FOREX

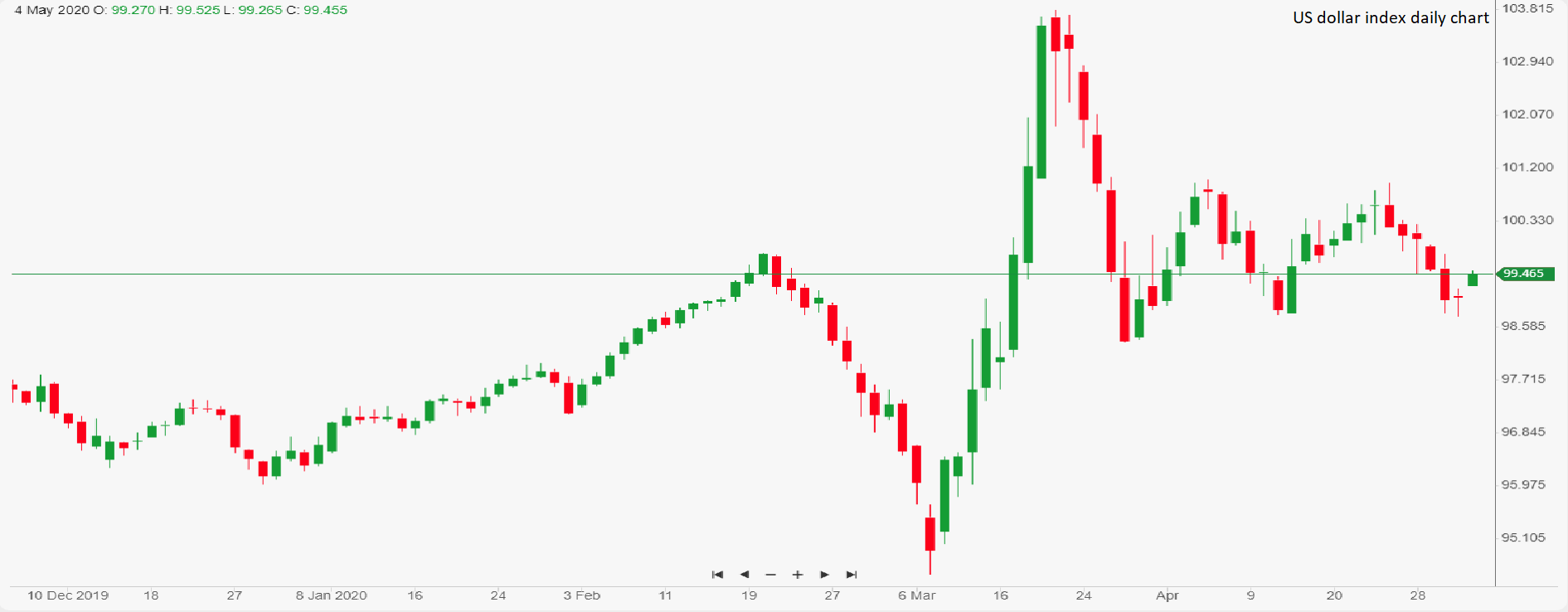

The dollar is in demand at the start of Monday’s European session with investors looking for a safe haven amidst an escalation in tensions between the US and China. The greenback’s gains result from market anxiety that the trade conflict between the world’s two largest economies may once again take over the international agenda, following allegations from American officials, including the President and Secretary of Defence, that the coronavirus comes from a lab in Wuhan.

Donald Trump went as far as to threaten China with retaliatory tariffs, which could trigger a renewing of last year’s trade tensions, compounding the fears of many investors, who are already shell-shocked by the economic impact of the coronavirus, and driving the appetite for refuge assets.

Ricardo Evangelista – Senior Analyst, ActivTrades

GOLD

Gold’s price activity on Friday could have offered an important signal to markets. Investors once again confirmed that they are buying every single dip of bullion as the general uncertainty continues to offer a bullish scenario for gold price. The support placed at $1,670 is now even stronger with the price continuing its slow dance just above the psychological threshold of $1,700. We would have another bullish signal if the price managed to clear the recent highs at $1,730-$1,735. Overall gold is clearly performing its safe haven asset role in a market where volatility remains high and the next bear movement for stocks could be just around the corner if the virus comes back with a second wave.

Carlo Alberto De Casa – Chief analyst, ActivTrades