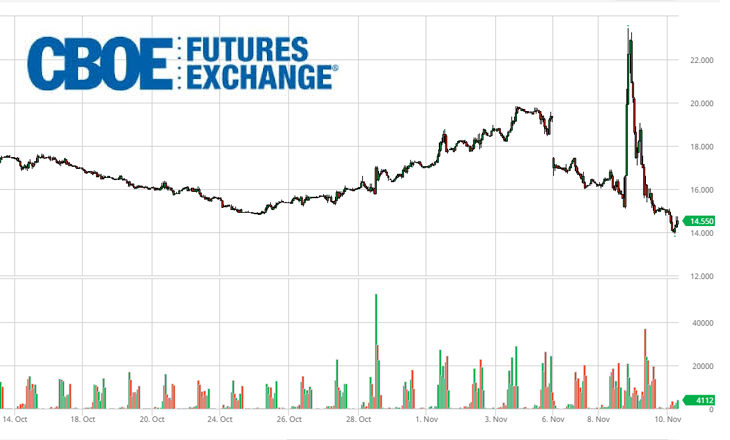

Chicago Board Options Exchange (CBOE) Futures Exchange has announced on the day after the U.S. election on Wednesday, November 9th that record volume was set in futures contracts on the CBOE Volatility Index (VIX Index) traded in non-U.S. trading hours with an estimated 263,663 contracts changing hands.

This record surpasses the previous single-day record of 235,141 contracts set during the overnight session on June 24, 2016, when U.K. voters decided that Britain should leave the European Union, an event also known as “Brexit.”

The daily jump in overnight trading volume followed a drop in global market prices after the results of the U.S. Presidential Election began to favor a Donald Trump victory over an expected win by Hillary Clinton.

VIX options and futures enable investors to trade volatility independent from the direction or the level of stock prices. Whether an investor’s market outlook is bullish, bearish or in between — VIX options and futures offer the ability to diversify a portfolio or hedge, mitigate or capitalize on broad market volatility.

For more information on the CBOE Volatility Index click here.