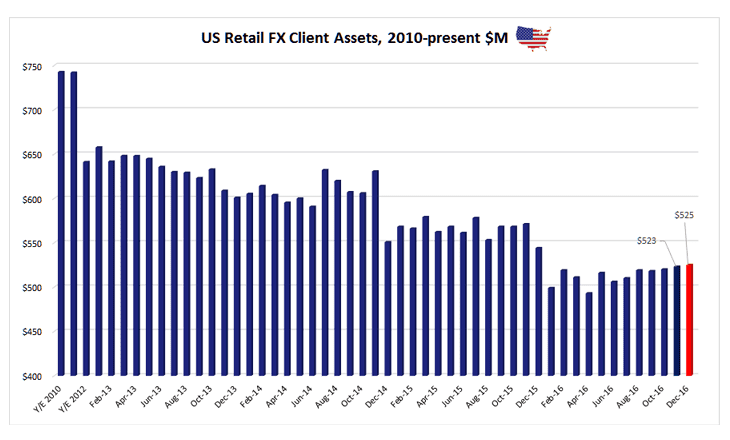

The latest CFTC data from US retail forex brokers is out for December 2016 from reports filed by January 26th, 2017. The data showed a minor rise in assets held by US retail forex traders to $525 million, a 0.3% rise from November’s $523 million (see chart above).

Continuing to lead the way in December was FXCM Inc (NASDAQ: FXCM), holding $178.9 million of client assets but as reported earlier today on LeapRate in some major developments, FXCM will be exiting the US market after violations. Oanda, holds the #2 position in the USA with $134.5 million, ahead of #3 Gain Capital Holdings Inc (NYSE: GCAP) and its Forex.com brand sitting at $128.5 million.

However, even though FXCM will be exiting the market as noted above, OANDA will still most likely remain #2 in the US, as it was also reported on LeapRate today that FXCM sold its client list to GAIN Capital. Should most clients stick with GAIN Capital, it would create a massive client value in assets at around $300 million.

Interactive Brokers still holds $33 million of retail client funds, but they should also soon disappear from the retail FCM list, as they discontinued the US-based retail service last summer. Rounding out the list is TD Ameritrade Futures and Forex which holds $50 million of client funds.

Future reports should now only see just 3 brokers operating for retail forex trading clients in the US, including Gain Capital, OANDA, and TD Ameritrade Futures & Forex.