The following post is courtesy of fractalerts, a division of fractal SA, Switzerland, a trading alert service based on unique algorithms that intuitively predict patterns in the market. Each market forecast is systematic, unemotional and data-driven – resulting in specific entry and exit points and historically astounding gains across 34 different markets.

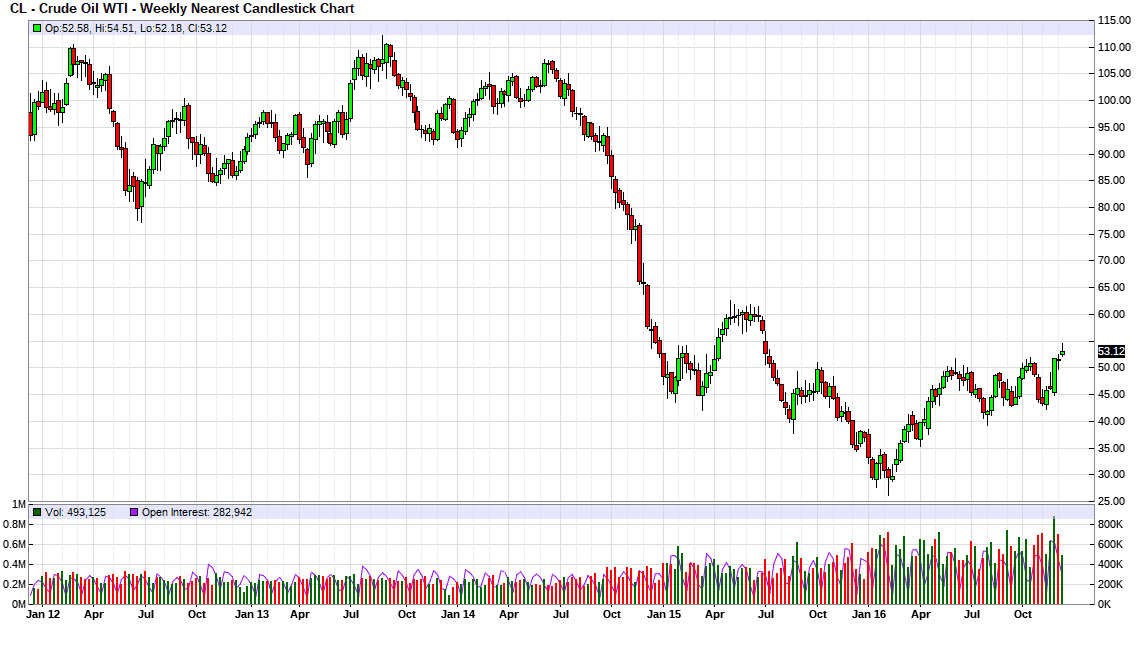

The price of oil has been languishing for some time, and we all know why. A global supply glut and a record high for production meant that we were oversupplied. In simple terms, nothing was going to get that supply down unless market conditions changed. We could have seen a sudden growth in global demand, but that was highly unlikely given that the largest consumers of oil (China and the US) were continuing to cut their demand. That meant that in reality the only way we could see a lift in the price of oil was if OPEC came together and agreed to stop pumping so vigorously… less oil would, by default, lift the price of the black stuff.

But we’ve been watching continued meetings between the OPEC member states, and nothing has changed. Back in July there was a chance of a decision, but that was never agreed upon. Saudi Arabia and Iran seemed at logger heads, with the former desperate to retain market share and the latter enjoying the benefits which came with the lifting their international sanctions.

But, with that said, one last push was made to see if the organization could come to an agreement about production. And on the eve of the 30th November a final call was made between Saudi Arabian Energy Minister Khalid Al-Falih and his Russian counterpart Alexander Novak.

Novak agreed that Russia would not freeze production, but they would be willing to contribute to cutting half of the amount that OPEC were hoping to reduce production by. The deal would only be made if Al-Falih could come back with concrete figures on how the OPEC states would meet the remaining amount.

Al-Falih was good to his word, and announced on the 30th November that OPEC would decrease output for the first time since 2008. That means that there will be 1.2million fewer barrels coming to market each day, with Russia contributing too.

Obviously, the price of oil skyrocketed, up more than 15% and above the $50 a barrel mark for the first time in more than a year. But what can this mean in the long-term? Is this a panacea, or are we not out of the woods yet?

Let’s be realistic, this could be great. But it is only going to work if the member states deliver on their promises. Saudi Arabia will reduce output by 486,000 barrels a day to just over 10million a day; Iraq will cut 210,000 barrels a day from their October levels; The United Arab Emirates will reduce by 139,000 barrels a day; Kuwait, by 131,000.

That is extremely bullish, and we expect that it will be enough to continue to keep oil prices around the $50 a barrel mark. But by January 2017 we’ll have a better indication of whether the member states are keeping to their promises. If they do, great. This cull will hopefully begin to eat into the global oil glut that has kept global prices stagnating. However, if one of the member states goes back on their promise, then it is likely that the others with renege too, in order to both save face and more importantly market share.

For now, let’s be positive. The market is up and that is going to do wonders for the indices and associated currencies. Only time will tell if this is a flash in the pan or not, but with all things considered, we could be a very different situation if there had been no agreement at all.