In 2016, Eurex, Europe’s largest derivatives exchange, saw increasing demand for its highly liquid benchmark product range as well as strong growth in a number of new product segments.

Exchange Traded Derivatives (ETD) are efficient hedging instruments, sharing the same benefits as OTC contracts and also the the advantages of deep liquidity and transparent trading on a regulated venue such as Eurex.

Further upcoming regulatory changes will continue to strengthen the benefits of the ETD market in 2017.

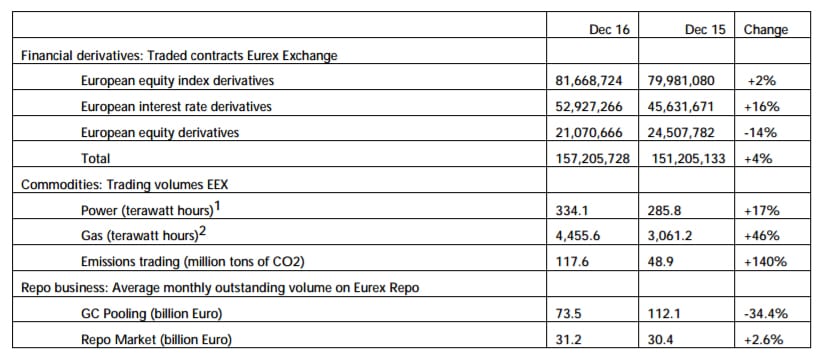

During 2016, a series of events provoked high volatility in underlying markets and spurred strong demand for Eurex products. Throughout the year, Eurex ensured efficient price discovery and hedging opportunities to help clients cope with market turbulence. Over the course of 2016, 1,727,891,584 contracts were traded, a plus of 3 percent compared to 2015.

Euro STOXX 50 Index Futures (374,452,071) experienced the highest turnover, followed by Euro STOXX 50 Index Options (286,250,191 contracts) and Euro-Bund Futures (130,699,951 contracts). The banking sector also experienced strong volumes. Market participants relied on EURO STOXX Banks Futures (42,645,554 contracts), to hedge their exposures.

2017 will be about supporting market participants to comply with new regulatory requirements.

The introduction of margin requirements for bilateral instruments will make ETDs more attractive”, said Thomas Book, CEO of Eurex and Head of Derivatives Markets Trading at Deutsche Börse Group.

We will further develop our range of standardised exchange traded and cleared products, addressing the needs of our clients and helping them cope with regulatory change.

The latest examples are Eurex Total Return Futures, launched in December 2016, which offer returns analogous to Equity Index Total Return Swaps, but with higher capital efficiency compared to current bilateral instruments.