PrimeXM released its April monthly metrics and reported weaker trading volumes in April, compared to March. In line with the other institutional and retail platform, the technology provider registered significant decrease for this month after the unprecedented volatility last month due to the coronavirus pandemic.

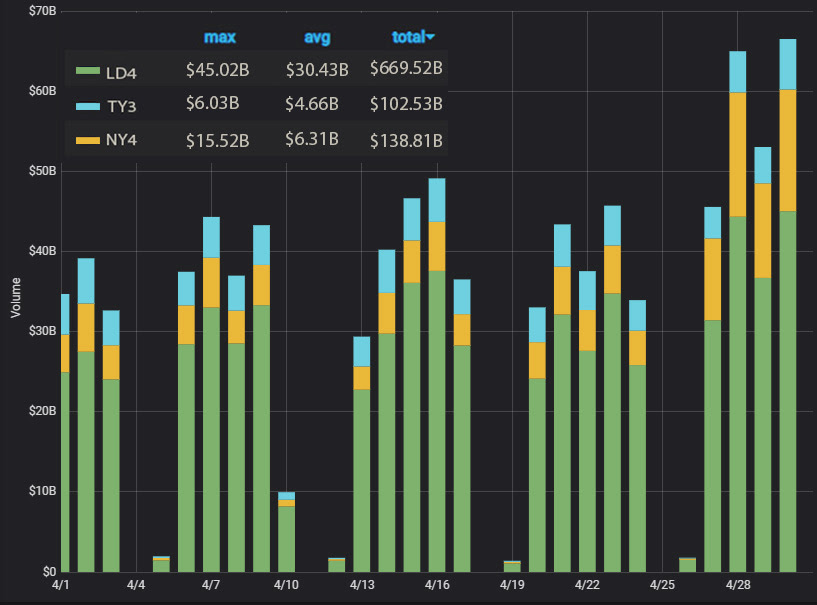

PrimeXM reported trading volume of $910.86 billion for the month of April across the 3 major data centres (LD4, NY4 and TY3), registering 20.8% decreased since last month. The Average Daily Volume was $41.40 billion, a 14.14% MoM decline compared $48,22 billion in March.

The London Data Centre (LD4) took the lead with 73% of the traded volume. New York (NY4) took over TY3 on ADV with $6.31 billion, up by 1.86% MoM, despite an overall decline in ADV figures in the other 2 data centres.