LeapRate Exclusive… It looks like social FX and CFD trading is still alive and well. At least in some circles.

LeapRate has learned that FCA regulated Tradeslide Trading Tech Ltd, which operates social trading broker and investment manager Darwinex, has continued to grow in 2017 with Revenues for the year ended June 30, 2017 more than doubling from the previous year.

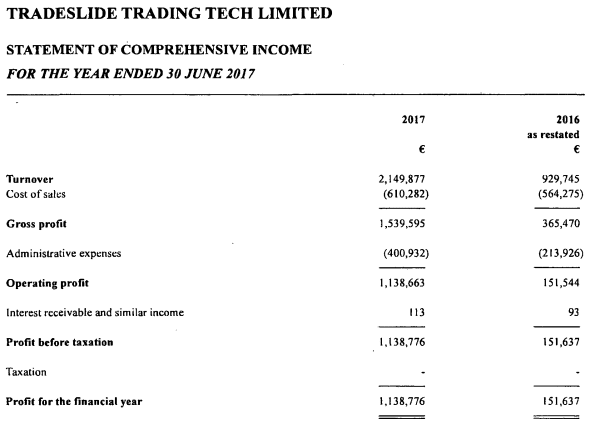

Darwinex indicated in regulatory filings that it brought in Revenues of €2.15 million for Fiscal 2017, up 131% from €930,000 in 2016, which was Darwinex’s first full year of operation. The company turned a Net Profit of €1.14 million for the year, versus €152,000 in 2016.

Darwinex reported that trading volumes were in the $15 billion per month range by mid-2017, about double the $8 billion we reported Darwinex was doing last year.

Darwinex’s success and growth marks something of a resurgence for the idea of social and copy trading among Retail FX traders. The idea has seen some ups and downs in the Retail FX world over the years which included some not-so-successful attempts at either in-house or pan-broker FX social networks. However Darwinex’s growth as well as impressive numbers reported recently by social trading focused CFD broker Ayondo certainly prove that the idea can be done profitably for both traders and brokers.

MT4 based Darwinex allows its trade leaders to earn a 20% success fee on profits they generate for third party investors, with no commissions charged to third party investors. A Darwinex asset is called a DARWIN. A DARWIN combines a trading strategy managed by a trader with Darwinex’s independent risk management engine. The risk management engine ensures the target volatility of each DARWIN is similar to that of a mid-cap equity. A DARWIN trades in real-time for the value of its underlying assets. DARWINs can trade long or short at any given time, meaning they are uncorrelated to traditional assets.

Darwinex analyses the 12 attributes that make up the DNA of a trading strategy, in a way analogous to that of fundamental analysis of a traditional share.

Darwinex employs about 30 people, in offices in London and Madrid. The company reports that 80% of new clients are referred by existing clients, and that it has paid out more than $1 million in performance fees to date.

Juan Colon, Darwinex

LeapRate spoke with Darwinex CEO Juan Colon, who had the following to say:

In 2017 we set the foundations to more growth. Our flagship Trader Exchange went fully operational – AuM grew 5x up to a total investment of EUR 50 MM in traders. We will bring our evolution full circle in 2018 by becoming the first multi-asset, multi-platform broker where traders make a legal independent livelihood. We believe that alignment can disrupt the retail trading sector for the better.

Tradeslide’s 2017 income statement follows: