AMarkets comments on the Trump vs the Fed hot topic in a special guest post exclusive to LeapRate.

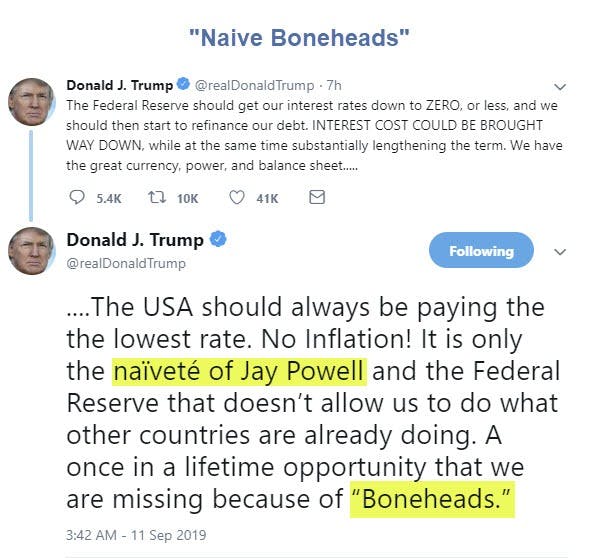

“Boneheads” is a new word we have learned thanks to Donald Trump. Once again, Mr. Trump confronted the Federal Reserve on the issue of not slashing the interest rates as he’d prefer. In short, he claims that zero-equivalent interest rates are capable to perform the mission of saving the U.S. governmental funds on huge debts.

Just a little reminder: A few European Central banks and the Bank of Japan initiated the policy of adverse interest rates to stimulate their economic situation. However, the decreased rates couldn’t exponentially boost inflation’s growth in these regions.

Back to Trump’s emotional tweet, the U.S. Federal Reserve should lower the rates down to 0 or even below 0 to refinance the governmental debt. Trump believes that “the great currency” and his power will assist the country to overcome inflation. He argues the current policy of the Federal Reserve and Jay Powell, in particular. The scandalous tweet was finished by naming Fed’s executives “the boneheads”.

Source: imageproxy.themaven.net

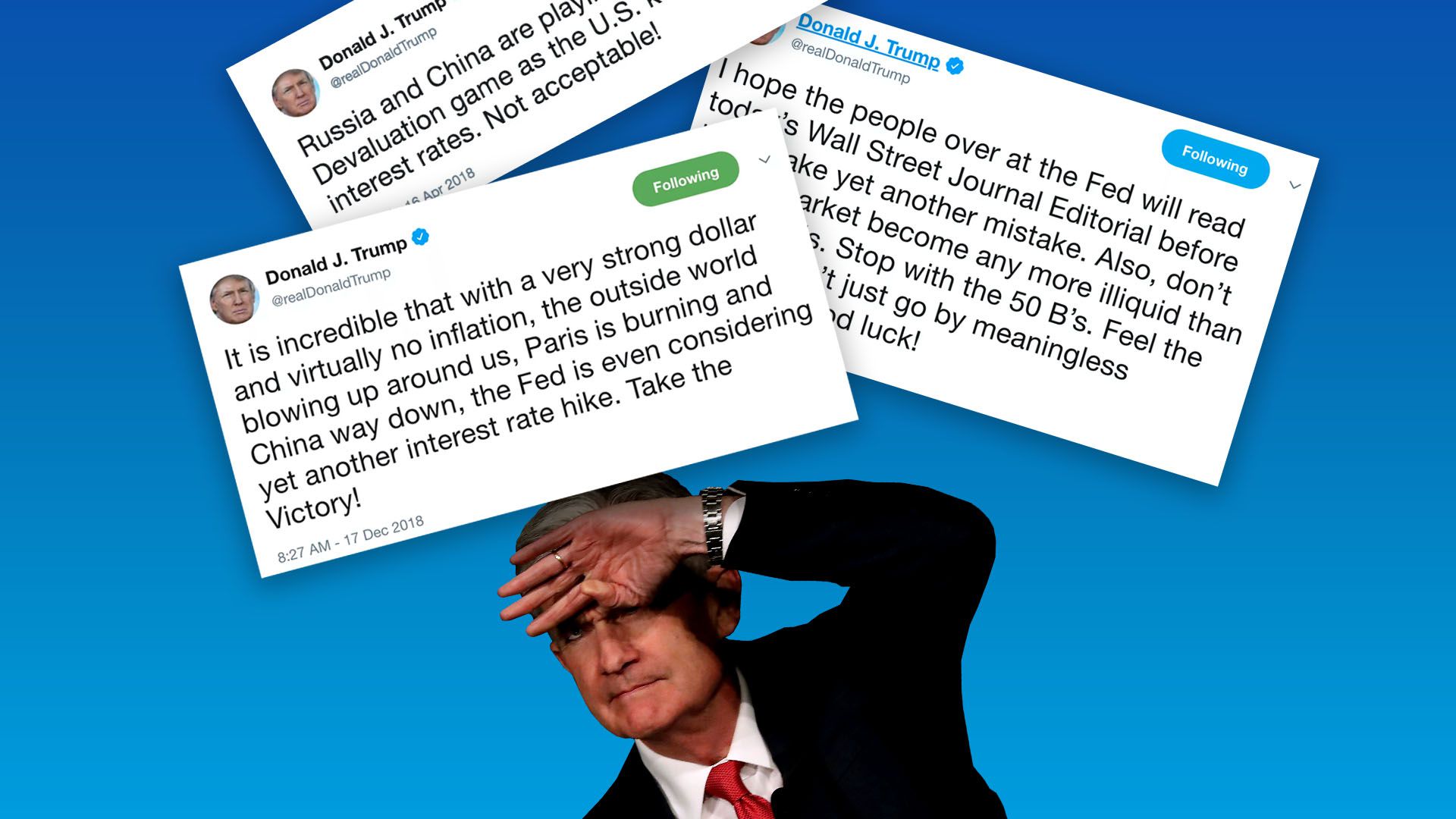

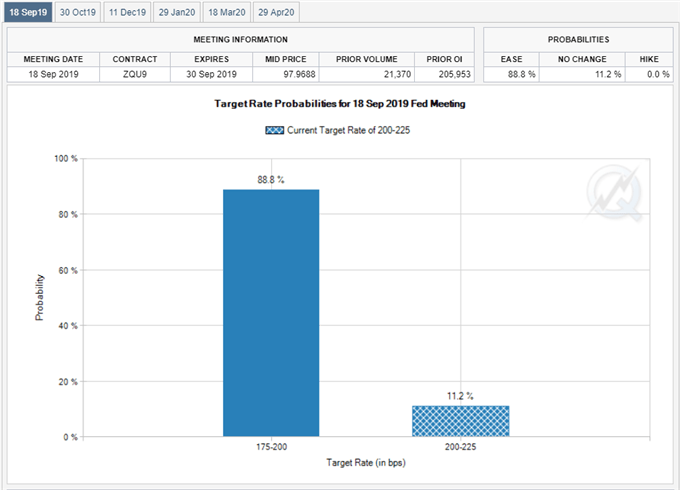

Powell reacted by saying the Feud will continue the U.S. economic progress, the political factors won’t affect the central bank’s function and decisions. The Federal Reserve had already dropped the interest rates in this July (for the first time in 10 years). The Wednesday meeting aimed to clarify the ongoing situation. The vast majority of analysts, including AMarkets, believed that the Fed will be forced to decrease the rates once again on September 18. And it happened again. So don’t miss an opportunity to earn, especially, having effective analytics and profitable trading conditions, as the broker offers.

Choose your side

As usual, Mr. Trump ignores the common knowledge that both fiscal and monetary policies are required for raising the living standards. The Fed is good only when it comes to monetary policy. Mitch McConnell should think about the fiscal side.

Also, the U.S. president prefers to ignore the fact that the lower rates will negatively affect millions of retired Americans who are living with a fixed income. Savers will also lose some of their savings due to the decreased interest rates. And even with interest rates decreased, banks won’t hurry to decrease the loan and credit card rates to compensate the losses in retirement accounts and deposits.

Steve Mnuchin, the current U.S. Treasury Secretary, hopes that Powell will keep his job despite the months of the confrontation with President Trump.

Source: images.axios.com

Keeping in mind the public fillings proved by the data from different financial experts, as an entrepreneur Mr. Trump could keep interest rates stable for a whole year by giving the loans on his business entities.

How will financial markets react to the Trump vs the Fed confrontation?

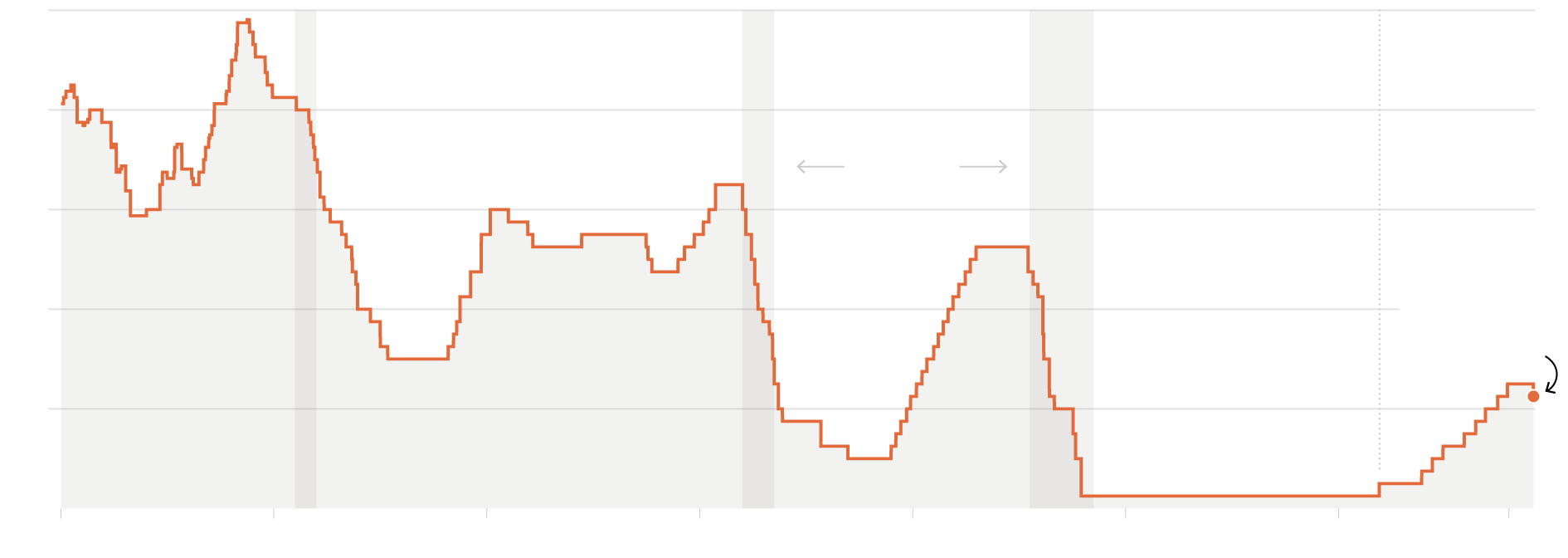

One of the leading AMarkets analysts Tim Deev claimed that a 25 bps rate cut was almost inevitable. The Federal Reserve had nothing else to do but stay away from political reconciliation.

Source: www.nytimes.com

With an inevitable cut of interest rates, the frail economic terms are expected. They will make the U.S. banks keep the reserve deposits with the Fed. Or the banks will raise the risks and put their money to other, more efficient niches. Savers will get fewer payments because the banks won’t be able to operate at a profit.

Lower profits of banks will also make the capitalization harder. And taking into account the external factors like a recession in most countries, the majority of banks will have to cut the losses by firing their employees. That is exactly what Americans “need” right now.

The previous week’s data flow suggests that stronger retail sales and higher core inflation may arise the “mid-cycle” adjustment.

As for the huge investors besides the bands like pension funds, investment entities, insurance and securities companies, they will have to take more risks as well by using more illiquid and complex instruments to motivate lenders to move on to riskier borrowers. The financial markets will definitely react to this news, so be prepared to check the external factors because they will determine the dollar’s driving force.

Source: a.c-dn.net

Surely, such a public feud of the most powerful people in the country can lead to an economic disaster. However, at the statement’s day the financial markets reacted by ignoring Trump’s tweet, for example, the USD index was last up 0,2%, at the mark of 98,52.