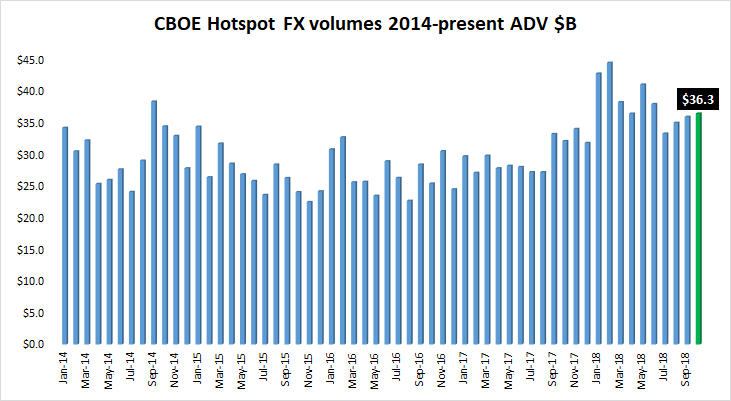

Data from institutional Forex ECN Cboe FX Markets – formerly known as Hotspot FX – indicates that the company saw average daily volumes climb modestly for the third month in a row, although activity remains well below where it was in the first few months of the year.

Cboe FX saw a 1.4% MoM increase in average daily volumes during October, $36.3 billion versus $35.8 billion the previous month.

As noted above, however, volumes remained well below where they were during the first half of the year at Cboe FX / Hotspot, at exactly $40.0 billion ADV.

It has been about a year and a half since Hotspot FX began operating under the corporate umbrella of its new owner, CBOE Holdings Inc. (NASDAQ:CBOE). CBOE acquired control of Hotspot FX via its $3.2 billion takeover of Bats Global Markets Inc at the end of February 2017. CBOE initially rebranded its Forex ECN unit as: Hotspot – a CBOE company. And now, as noted above, it has been re-rebranded as Cboe FX Markets, with the ‘Hotspot’ brand being phased out.