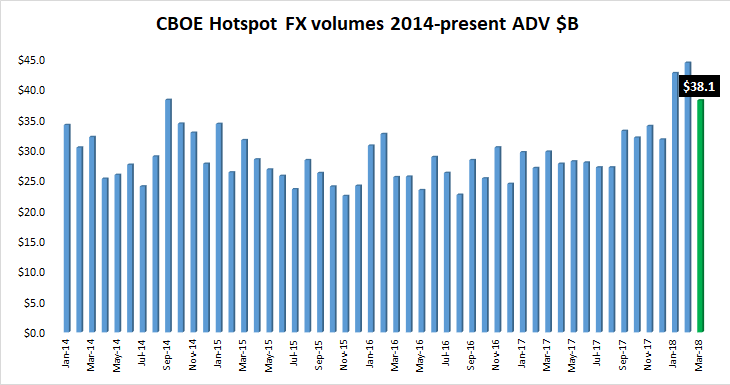

After setting two consecutive trading volume records in January and February, data from institutional Forex ECN Cboe FX Markets – formerly known as Hotspot FX – indicates that the company saw a marked decline in activity during March.

After reporting daily average trading volumes of $44.3 billion in February 2018 and $42.6 billion ADV in January to start off the year, Cboe FX reported a more modest $38.1 billion ADV of activity during March.

Still, a good result capping an excellent Q1 at Cboe FX – before entering 2018, the company’s previous best-ever month was September 2014 at $38.2 billion. For the full year 2017 Cboe FX averaged $29.6 billion daily.

It has been just over a year since Hotspot FX began operating under the corporate umbrella of its new owner, CBOE Holdings Inc. (NASDAQ:CBOE). CBOE acquired control of Hotspot FX via its $3.2 billion takeover of Bats Global Markets Inc at the end of February 2017. CBOE initially rebranded its Forex ECN unit as: Hotspot – a CBOE company. And now, as noted above, it has been re-rebranded as Cboe FX Markets, with the ‘Hotspot’ brand being phased out.