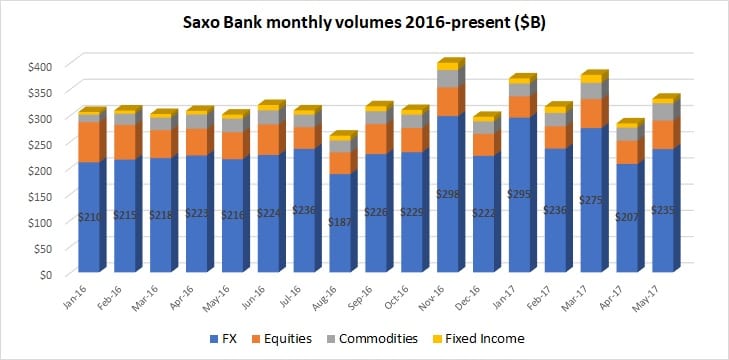

After a fairly slow April, Copenhagen based multi-asset broker Saxo Bank has reported that it saw an overall 17% MoM increase in trading volumes during May, including a 14% rise in FX trading volumes.

FX volumes came in at $235 billion for May, with total multi-asset volumes (including also Equities, Commodities and Fixed Income) totaling $331 billion for the month.

The figures at Saxo Bank are fairly much in line with what we have seen for May from other leading retail and institutional eFX venues. After a fairly robust start to the year in currency trading throughout most of Q1, the sector took something of a break in April as currency volatility waned, with volumes picking up again in May.

FX represented 71% of overall trading volume at Saxo Bank in May, down from 73%-75% the past few months as other areas, in particular Equities (up 22% MoM) and Commodities (up 32%), continue to see strong growth. Saxo Bank has been making a big push both internationally and in diversifying away from “just FX”, with the latest example being its recent agreement with OpenMarkets, one of Australia’s leading online cash equities brokers, which was exclusively reported by LeapRate.

Also on the international front, Saxo Bank recently welcomed a new largest shareholder, with China’s Geely Group acquiring a 30% stake in Saxo Bank from co-founder Lars Seier Christensen.