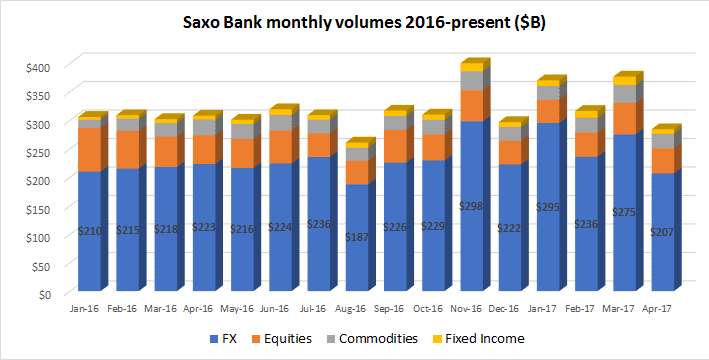

Copenhagen based multi-asset broker Saxo Bank has released its trading volume statistics for the month of April, indicating an overall 25% reduction in activity for the month.

The figures at Saxo Bank are fairly much in line with what we have seen for April from other leading retail and institutional eFX venues. After a fairly robust start to the year in currency trading throughout most of Q1, the sector took something of a break in April as currency volatility waned.

(We would note, however, that the trend has re-reversed so far in May, as both the Euro and the Pound have been on the move, as well as Tier 1B currencies such as the Canadian Dollar. Barring a slowdown in the last week of the month, May should be a good month for FX trading).

FX volumes were at their lowest level of the year at Saxo Bank, and slowest since last August, at $207 billion. Saxo also saw slight decreases in the trading levels of Equities, Commodities and Fixed Income products.

FX represented 73% of overall trading volume at Saxo Bank, about the same as last month.

As of earlier this month Saxo Bank has a new largest shareholder, with China’s Geely Group acquiring a 30% stake in Saxo Bank from co-founder Lars Seier Christensen.