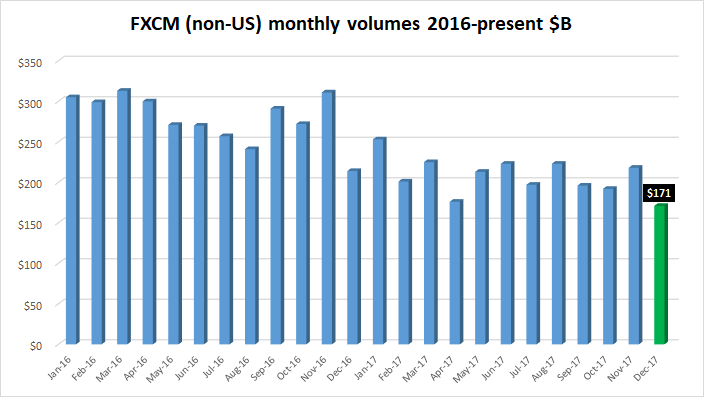

After seeing a healthy comeback in trading volumes during November, Retail FX broker FXCM Group has reported that December activity dipped by 22% to $171 billion – the company’s slowest month since at least 2015.

Average customer trading volume per day came in at $8.6 billion in December 2017, 13% lower than November 2017 (with less trading days, the % decline in ADV wasn’t as sharp as for total volumes), and 16% lower than December 2016.

An average of 299,332 client trades per day were made at FXCM in December 2017, 11% lower than November 2017 and 30% lower

than December 2016.

FXCM reported active accounts of 116,262 as of December 31, 2017, a decrease of 2,187, or 2%, from November 30, 2017, and a decrease of 16,262, or 12%, from December 31, 2016. Tradeable accounts were 95,939 as of December 31, 2017, a decrease of 611, or 0.6%, from November 30, 2017, and a decrease of 9,643, or 9%, from December 31, 2016.

Customer trading volume for the fourth quarter 2017 as a whole was $581 billion, 6% lower than the third quarter 2017, and 27% lower than the fourth quarter 2016.

Volume from indirect sources was 33% of total trading volume in the fourth quarter 2017.