LeapRate Exclusive… LeapRate has learned via regulatory filings that Hong Kong based Retail FX broker KVB Kunlun Financial Group Ltd (HKG:6877) is set to announce the raising of a HK$200 million (USD $26 million) investment, to be led by Chinese insurance and investment giant Ping An Insurance (Grp) Co of China Ltd (SHA:601318).

We expect the company to make a formal announcement shortly.

This isn’t Ping An’s first venture into the Retail FX business. LeapRate readers will recall that Ping An led a similar sized investment, alongside Russia’s Sberbank, into Israel based Retail FX broker eToro in late 2014.

As noted above, the investment is being made as a convertible bond offering, with a two year maturity. The bonds will carry a 7.5% interest rate. However, since the conversion price is being priced “at the money”, i.e. at KVB’s current share price of HK$0.613 per share, it is effectively an equity investment. The new investors, once they convert, will own 16% of the company. KVB’s largest and controlling shareholder, China’s CITIC Securities Company Limited (SHA:600030), will see its holding diluted from 59% to just under 51%.

The bondholders will also be granted one seat on KVB’s board of directors.

According to the filings, KVB will use the new funds for general purposes. However, we believe that the fundraising is part of a larger plan by CITIC and KVB management to position the company to acquire and grow, in particular in China. KVB recently moved its share listing from the HKEX’s Growth Enterprise Market (or GEM), Hong Kong’s version of the LSE’s AIM market, to the HKEX Main Board. The purpose of the move was increase the company’s visibility, and to make the company’s shares more attractive to investors.

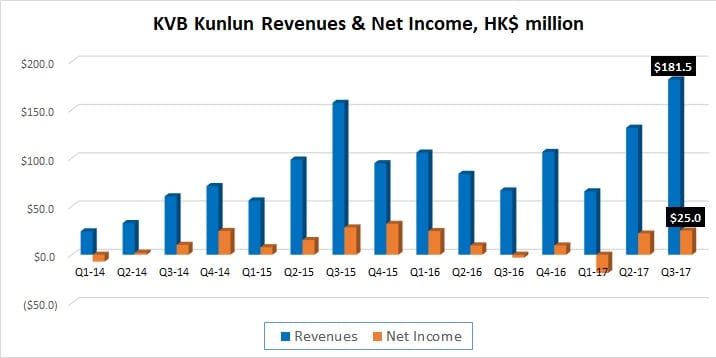

KVB has seen very up-and-down results over the past two years, although the company’s latest reported quarter, Q3-2017, saw the company report record Revenues and near-record profits.

The regulatory filing indicates the following terms for the convertible bonds:

Principal terms of the Bonds

The terms of the Bonds have been negotiated on an arm’s length basis and the principal terms of which are summarised below:

Principal amount:

Subscriber I (BC Global Fund SPC) – HK$111 million

Subscriber II (Ping An) – HK$89 million

Interest:

7.5% per annum (or 12% per annum where the Maturity Date is extended pursuant to the Bond Conditions) payable by the Company on the last business day before expiry of every six months since the Issue Date and thereafter and on the Maturity Date.

Maturity Date:

The second anniversary of the Issue Date. The Company may extend the Maturity Date for a further term of one year from the initial Maturity Date by giving notice in writing to all of the Bondholder(s) on or before the Maturity Date and with the prior written consent from Bondholder(s) of not less than 50% of the aggregate principal amount of Bonds outstanding.

Conversion Right and Conversion Period:

The Bonds are convertible into new Shares:

(i) in whole or in integral multiples of HK$5 million of the principal amount of the Bonds at any time from the day following one year from the Issue Date up to the fifth business day immediately before the Maturity Date at the Conversion Price; or

(ii) in whole (but not part only) of the outstanding principal amount of the Bonds into Shares within 60 days following (a) the cessation to act of any executive Director or Senior Management; or (b) any partial or complete suspension of the executive or managerial responsibilities of any executive Director or Senior Management; or (c) an announcement made by the Company in relation to (a) or (b) above (regardless of the actual or prospective date of such cessation or suspension)) ((a), (b), and/or (c) is individually or collectively referred to as the “Change of Management”);

subject to and upon compliance with, the provisions of the Bond Conditions. Except where the exercise of Conversion Right shall be made in respect of the whole (but not part only) of the outstanding principal amount of the Bonds in accordance with the Bond Conditions, any conversion shall be made in amounts of not less than a whole multiple of HK$5 million. No fraction of a Share shall be issued on conversion.

Conversion Price:

The initial Conversion Price of HK$0.613 per Share (subject to adjustment for Change of Management and anti-dilution events as mentioned below), at which each Conversion Share shall be issued upon exercise of the Conversion Right, was arrived at after arm’s length negotiations between the relevant parties and with reference to the market price of the Shares. The initial Conversion Price represents:

(a) a premium of approximately 5.7% over the closing price of HK$0.58 per Share as quoted on the Stock Exchange on 24 January 2018, being the Last Trading Day; and

(b) a premium of approximately 5.0% over the average closing price of the Shares of HK$0.584 per Share for the five trading days immediately before the date of the Subscription Agreements.

Under the Bond Conditions, the Conversion Price will be adjusted in the event of an alteration of the capital restructure of the Company or upon the occurrence of certain adjustment events. These adjustment events include, among others, consolidation, sub-division or reclassification, bonus issue, Capital Distribution, rights issue of Shares or options over Shares, rights issue of other securities, issue at less than the then current market price, other issue at less than the then current market price, modification of right of conversion, other offer to shareholders, Change of Management and other events. Where any such event occurs, the Conversion Price may be subject to the adjustment in accordance with the Bond Conditions, with a key objective that any dilution effect on the value of the Bonds arising from such events will be neutralized. If the Conversion Price pursuant to any adjustment is below the par value of each Share, the Conversion Price shall be adjusted to an amount equal to the par value of one Share instead.

If the Company or the Bondholder(s) determine that an adjustment should be made to the Conversion Price as a result of one or more events or circumstances set out in the Bond Conditions, or that an adjustment should not be made despite the events or circumstances, or that the effective date for the relevant adjustment should be a date other than that specified in the Bond Conditions, the Company or such Bondholder(s) may, at the expense of the Company, request either the Company’s auditors or an independent firm of merchant banks of international repute to be selected and appointed by the Company whose determination shall, save for manifest error, be final and conclusive.

Conversion Shares:

Up to 326,264,273 Conversion Shares (which are fully-paid ordinary Shares upon issue) will be issuable by the Company upon the exercise of the conversion rights attached to the Convertible Bonds in full at the Conversion Price of HK$0.613 per Conversion Share.

The 326,264,273 Conversion Shares, which, having an aggregate nominal value of HK$3,262,642.73, represent (i) approximately 16.05% of the issued share capital of the Company as at the date of this announcement; and (ii) approximately 13.83% of the issued share capital of the Company as enlarged by the issue and allotment of the Conversion Shares (assuming that there will not be any changes in the issued share capital of the Company save for the allotment and issue of the Conversion Shares). The net price of each Conversion Share to the Company, based on the estimated net proceeds of approximately HK$199.28 million and 326,264,273 Conversion Shares, is estimated to be approximately HK$0.61.

Redemption:

Redemption at maturity

Unless previously redeemed or converted or purchased and cancelled as provided in the Bond Conditions, on the Maturity Date, the Company shall redeem 100% of the outstanding principal amount of the Bonds together with an internal rate of return of 7.5% per annum from and including the Issue Date but excluding the actual date of redemption, inclusive of any coupon paid or payable on the relevant portion of the Bonds.

Where the Maturity Date is extended pursuant to the Bond Conditions, the Company shall redeem 100% of the outstanding principal amount of the Bonds together with an internal rate of return of 12% per annum from and including the Issue Date but excluding the actual date of redemption, inclusive of any coupon paid or payable on the relevant portion of the Bonds.

Early redemption

The Bondholders may give not less than five days’ written notice to the Company for redemption of the whole but not part of the outstanding Bonds at 100% of the outstanding principal amount together with an internal rate of return of 7.5% per annum (or 12% where Maturity Date is extended pursuant to the Board Conditions) from and including the Issue Date but excluding the actual date of redemption, inclusive of any coupon paid or payable on the relevant portion of the Bonds if any of the following occurs:

(a) occurrence of an event of default as defined in the Bond Conditions, including, among others, material breach of the Bond Conditions, dissolution of the Company and Company’s disposal of all or substantially all of its assets, encumbrances over the property, assets or undertaking of the Group, distress against a material part of the property of the Company, cessation or material change of business of the Group, suspension of trading in the Shares on the Stock Exchange for over 10 consecutive trading days or delisting of the Shares on the Stock Exchange, change of control (i.e. the acquisition of more than 50% of the voting rights of the issued share capital of the Company or the right to appoint and/or remove all or the majority of members of the Board) of the Company or announcement by the Company of such possible change, average of closing price of Shares for any 10 consecutive trading days being below 80% of the then applicable Conversion Price for so long as the Bonds remain outstanding, operating loss of the Company for three consecutive quarters starting from the year ending 31 December 2018, issue of new Shares resulting in the total equity interest of the Bondholder(s) in the Company (on a fully diluted and as-converted basis) falling below 12%, winding-up, liquidation, receivership or other analogous events of the Group, and the net asset value of the Group being less than HK$300 million by reference to the Company latest audited account;

(b) Change of Management; or

(c) exercise of option by the Bondholder(s) to request the Company for early redemption commencing from the day falling one year from the Issue Date.

Transferability of the Bonds:

The Bonds may be transferred in whole or in part (in multiples of HK$5 million) by the Bondholder to any person or company, provided that where such transfer is made to a connected person of the Company, such transfer shall be made in compliance of the requirements (if any) of the Listing Rules.

Transferability of the Conversion Shares:

Save that any Conversion Share shall not be transferred at any time from the date of exercise of the Conversion Right in respect of such Conversion Share and ending on the date which is three months therefrom, the Conversion Shares are freely transferrable.

Ranking of the Bonds:

The Bonds constitute direct, unconditional, unsubordinated and unsecured obligations of the Company and rank pari passu and without preference among themselves and shall, unless otherwise required under the applicable laws, rank at least pari passu with the other present and future unsecured and unsubordinated obligations and/or indebtedness of the Company.

Ranking of the Conversion Shares:

The Conversion Shares, when allotted and issued, shall rank pari passu in all respects with the then existing Shares in issue on the date when the Bondholder(s) exercising the Conversion Right is/are registered in the Company’s register of members together with all rights to dividends and other distributions declared, made or paid on or after the date of such registration.

Voting:

The Bondholder shall not be entitled to receive notice of, attend or vote at any general meeting of the Company by reason only of his/her/its being a Bondholder.

Nomination of Director:

Following completion of the Subscription Agreements, the Bondholder(s) of not less than 50% of the aggregate principal amount of the Bonds outstanding as a whole may nominate one candidate as non-executive director to the Board once only, provided that such right shall automatically lapse if no Bond is outstanding.

Undertaking:

The Company undertakes that at any time when the net asset value of the Group is less than HK$300 million, it will not take any corporate action without the prior written consent from Bondholder(s) of not less than 50% of the aggregate principal amount of the Bonds outstanding.

Conditions precedent to completion of the Subscription Agreements

Completion of each of the Subscription Agreements is conditional upon the following Closing Conditions being satisfied (or, where applicable, waived (to the extent waivable)):

(a) the Board’s approval for the transactions contemplated under the relevant Subscription Agreement having been obtained;

(b) all requisite consents or confirmations of no objection (if necessary) or filings at, any governmental or competent authorities for the transactions contemplated under the relevant Subscription Agreement having been obtained by the Company from any third parties or effected by the Company;

(c) the Listing Committee of the Stock Exchange having granted listing of and permission to deal in the Conversion Shares and such approval remaining valid and effective;

(d) each of the warranties given by the Company in the relevant Subscription Agreement remaining true and accurate and not misleading; and

(e) since the date of the relevant Subscription Agreement, there shall not have occurred any material adverse change.

Under each of the Subscription Agreements, Closing Conditions (d) and (e) above may be waived by the relevant Subscriber.

If any of the Closing Conditions is not satisfied or waived (to the extent waivable) by the Subscriber on the Long Stop Date or such other date as the Company and the Subscriber shall agree in writing, the relevant Subscription Agreement shall terminate.

The Subscription Agreements are inter-conditional on each other and completion of both agreements must take place simultaneously.

As the issue of the Bonds is subject to the fulfillment of certain conditions precedent and may or may not proceed, Shareholders and potential investors should exercise caution when dealing in the securities of the Company.

Completion of the Subscription Agreements

Completion of the Subscription Agreements will take place on the fifth business day after the last of the Closing Conditions is fulfilled or (as the case may be) waived or such other date as shall be agreed between the Company and the Subscribers in writing. The Subscribers shall settle the consideration payable for the Subscription by payment of the principal amount to the Company on the Completion Date. Upon the Completion, the Company shall issue the Bonds.