ASIC and FCA licensed Retail FX broker AETOS Capital Group have provided their daily commentary on traditional markets for June 18, 2019.

EURUSD

The euro strengthened on Monday, closing at 1.1222(+7 pips) against the greenback. The greenback started the week advancing against most major rivals, although its strength faded as the day went by, ending it in an uneven fashion against its major rivals. The EUR/USD pair surged to 1.1246, retreating from such a high ahead of the close. The greenback held near its recent highs, as the latest US consumer-related data suggested that the economy remains resilient, generating doubts about how dovish the Fed could be when policymakers meet this week.

Across the Atlantic, ECB´s Benoit Coeure warned of “bleak” indicators about the health of the global economy, and that risks could materialize in the next few meetings. On the economic calendar, the EU published Q1 Labour Cost, which rose by less-than-anticipated, up by 2.4% vs. the 2.6% forecasted. In the US, the NY Empire State Manufacturing Index for June, disappointed with -8.6 in June vs. the previous 17.8 and the expected 10.0, while the NAHB Housing Market Index for the same month resulted at 64 vs. the expected 67.

Dismal US data prevented the greenback from appreciating alongside uncertainty about the Fed’s stance. This Tuesday, the macroeconomic calendar will include a speech from ECB’s Draghi, the German ZEW survey for June and EU’s final May inflation. The US, on the other hand, will release May Housing Starts and Building Permits.

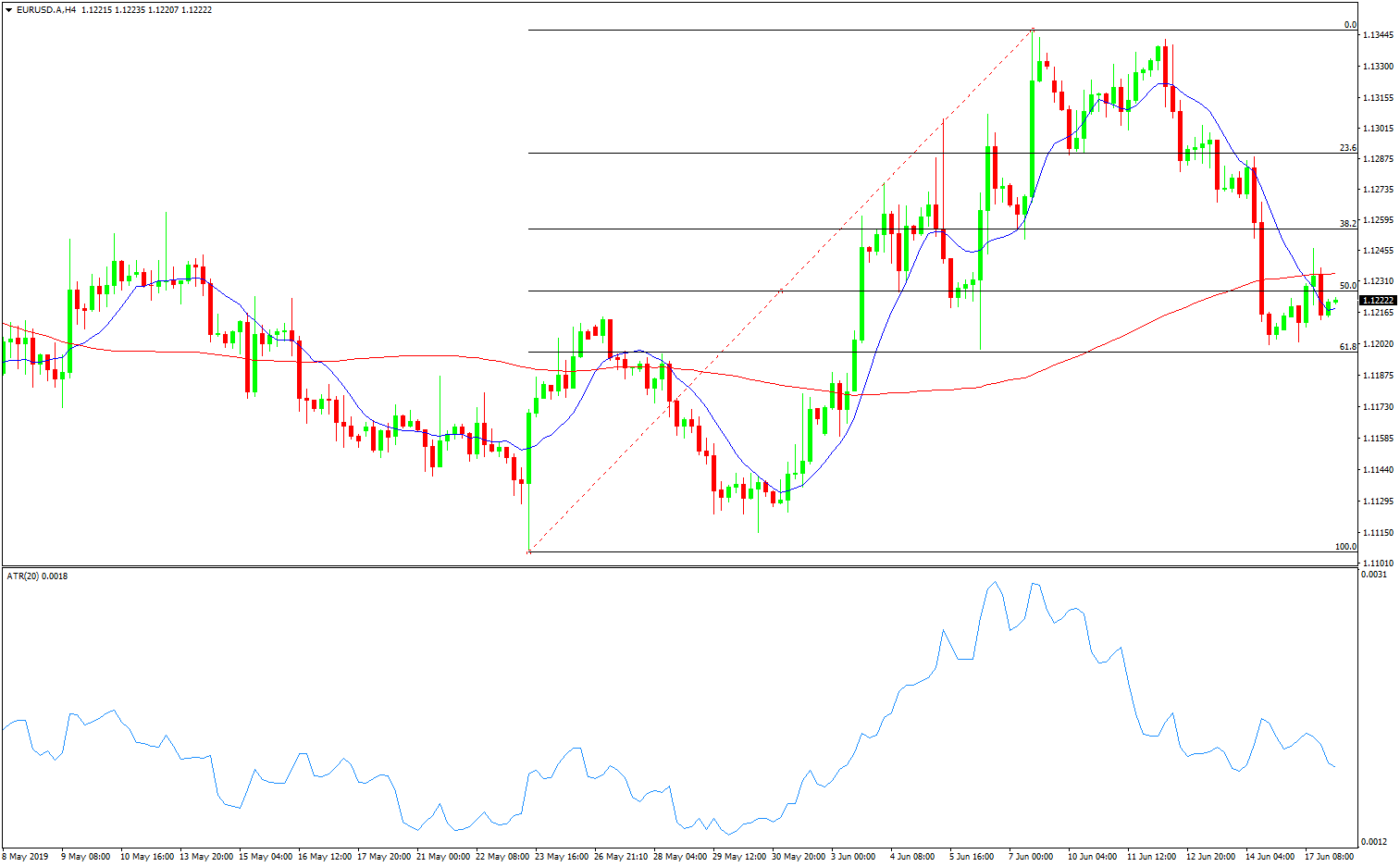

EURUSD 4 Hour Chart

From a technical point of view, the EUR/USD pair is still at risk of falling, as it trimmed intraday gains ahead of the close, now trying to stabilize at around 1.1200. In the 4 hours chart, the pair is trading between the 61.8% and the 50% retracements of its latest daily advance, with the most relevant being at 1.1200, providing a strong static support. Technical indicators in the mentioned chart have moved away from there lows, but remain well into negative ground, keeping the risk skewed to the downside.

GBPUSD

The cable pair came down on Monday, closing at 1.2540(-53 pips) against the greenback. Despite US data fell short of the market’s expectations, preventing the greenback from extending its gains against other rivals, Sterling self-weakness weighed more.

The UK’s political uncertainty was the main reason behind the decline as, Jeremy Hunt, one of the candidates for Tories’ leadership, was on the wires saying that is possible to renegotiate the Brexit deal, even despite EU authorities denied such option multiple times. Six out of the seven remaining candidates participated in a live televised debate, with the favorite, Boris Johnson, being the absent one. Conservative MPs will have another ballot this Tuesday, and the list will be reduced by at least one, with those with less than 32 votes also being removed from the next round of voting.

There are no macroeconomic releases scheduled in the UK, although BOE’s Governor Carney is set to participate in a panel discussion at the ECB Forum on Central Banking.

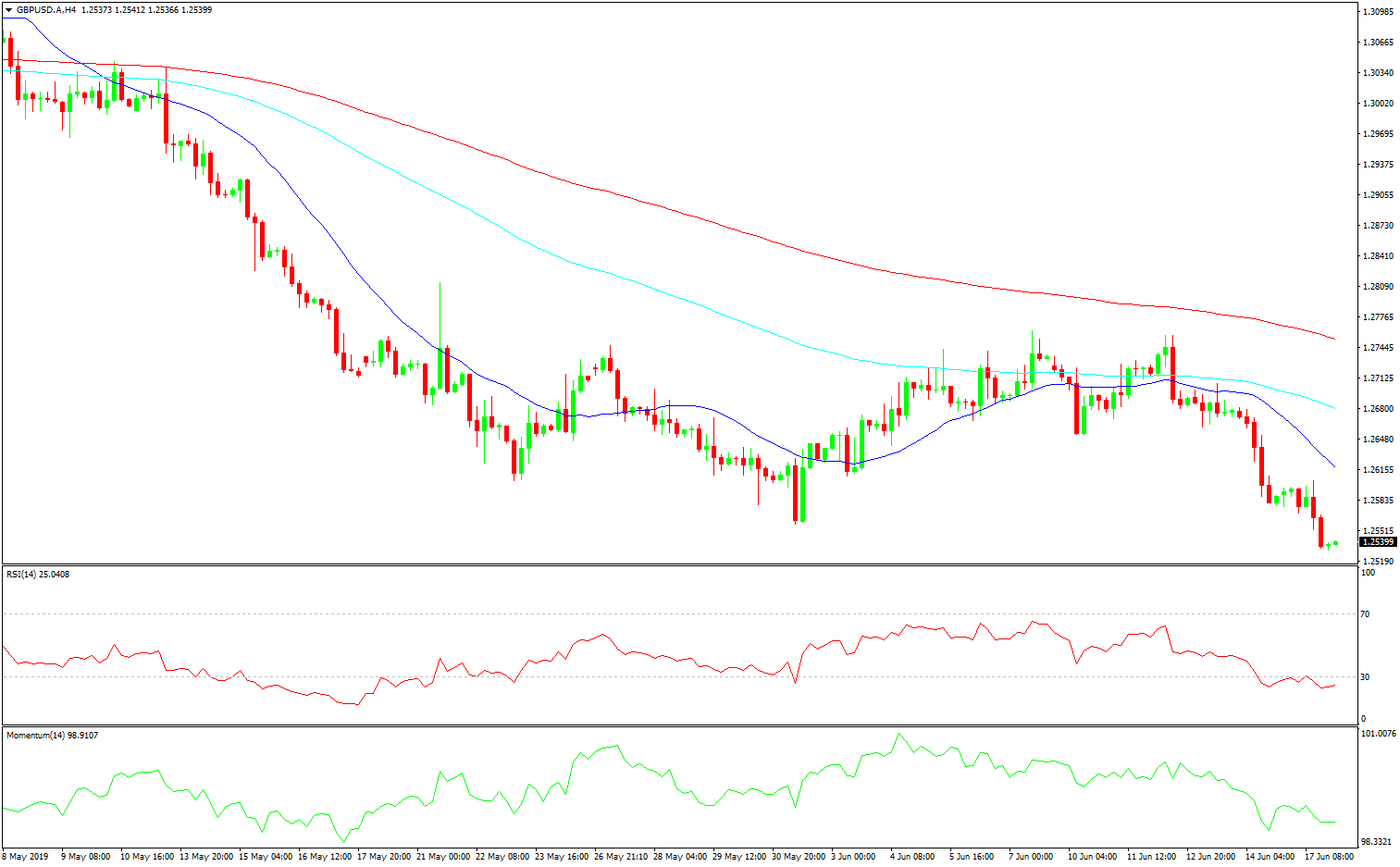

GBPUSD 4 Hour Chart

The GBP/USD pair posted a lower low and a lower high for a third consecutive day, a sign that bears retain control on the pair. Now hovering around its May low, the short-term picture is bearish, as, in the 4 hours chart, the 20 SMA(Dark Blue Line) has crossed below the 100 SMA(Aqua), gaining bearish strength, while technical indicators resumed their declines well into negative ground after correcting oversold conditions reached earlier in the day.

The RSI is back into oversold territory, with no signs of changing course while the Momentum holds far from its daily low, both in line with more slides coming.

Risk Disclaimer

The information above is of general nature only and does not take into consideration your objectives, financial situation or investment needs. The products and services provided are issued by AETOS Capital Group Pty. Ltd. (AFSL: 313016, ACN: 125113117). Trading Forex margin and CFDs carries a high level of risk, and losses can exceed your deposits. You are strongly recommended to seek independent financial advice before you make an investment decision. Please refer to our Product Disclosure Statement which you can obtain from our website for more details. AETOS has the ownership of the contents of this FX commentary. Copying, reprinting or publishing to a third party is not permitted.