ASIC and FCA licensed Retail FX broker AETOS Capital Group have provided their daily commentary on traditional markets for June 17, 2019.

EURUSD

The euro tumbled on Friday against the greenback. Closing at 1.1210(-69 pips) on Friday. The dollar recovered amid decreasing fears of an upcoming dovish Fed. The preliminary June Michigan Consumer Sentiment Index came in at 97.9, slightly below the 98.0 expected and the previous 100, while Industrial Production in May expanded by 0.4% following April’s 0.4% contraction, and Capacity Utilization expanded by more than anticipated in the same month, up to 78.1%.

The dollar also benefited from its safe-haven condition, as tensions between the US and Iran over the attack to oil tankers in the Gulf of Oman, spooking investors away from high yielding assets. This week will start with a light calendar, as there’re no relevant data scheduled in the EU, while the US will release the June NY Empire State Manufacturing Index, foreseen at 12.75 vs. the previous 17.80.

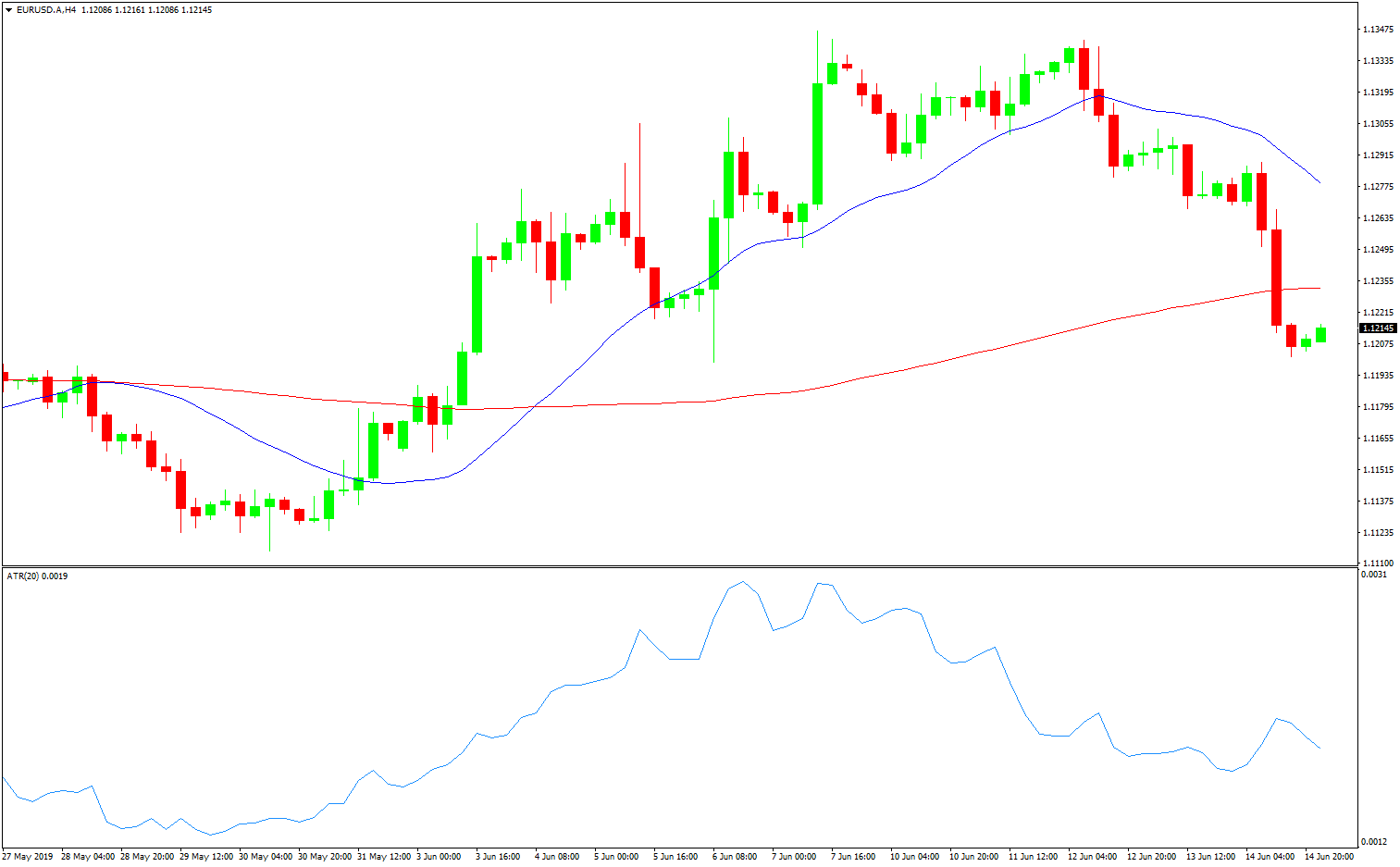

EURUSD 4 Hour Chart

From a the technical perspective, the decline in the EUR/USD pair was exacerbated after it broke back below the daily descendant trend line coming from September 2018 high, triggering stops and bearish momentum. The pair is now trading at around 1.1210, its lowest since June 6, when the ECB’s monetary policy announcement shook the shared currency. In the daily chart, the pair has settled just below a mild bullish 20 SMA(Blue Line), while the 100 SMA(Red Line) converges with the mentioned trend line at around 1.1265.

GBPUSD

The cable pair was down on Friday as well, closing at 1.2589(-89 pips) against the greenback. The dollar’s broad strength was partially responsible for the decline, but also the noise coming from Tories related to PM May’s succession as Tory leader. On Thursday, Conservative MPs had their first ballot, with Boris Johnson being the overall winner. Johnson has stated this past week that he will take the kingdom out of the EU by October 31, with or without a deal. He later poured some cold water on his comments, yet the damage was done.

Meanwhile, the EU believes that Johnson won’t risk a no-deal Brexit but rather ask for another extension. EU politicians keep repeating that the withdrawal deal is not open to renegotiating. On Friday, BOE’s Governor Carney delivered the central bank’s annual report and said that the upward pressure on prices is likely to build if the economy performs as the MPC expects, which means that policymakers will hike, although he repeated that it would happen at a gradual pace and to a limited extent. This Monday, the UK macroeconomic calendar will include the May Rightmove House Price Index and the Inflation Hearings report.

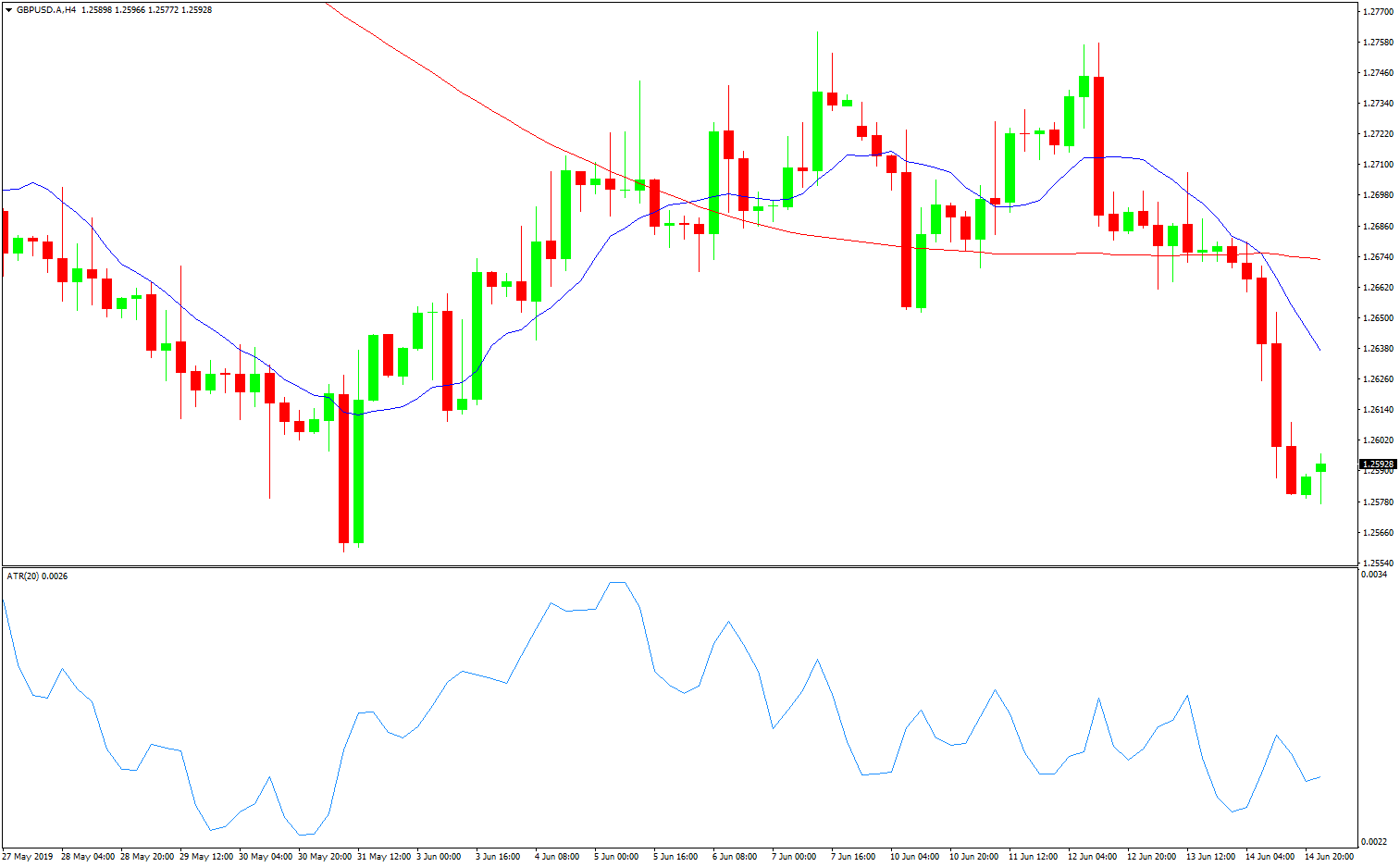

GBPUSD 4 Hour Chart

From a technical view, the daily chart for the GBP/USD pair shows that it collapsed Friday after spending the week around a firmly bearish 20 SMA, while technical indicators turned sharply lower, the Momentum barely entering negative ground and the RSI currently at 34, this last reflecting the strength of sellers.

Shorter term, and according to the 4 hours chart, the bearish case is also favored, as the pair is currently developing below all of its moving averages, with the 20 SMA about to cross below the 10 SMA(Blue Line), both in the 1.2670/80 price zone, while technical indicators stalled their declines, but were unable to bounce, now consolidating in oversold territory. May’s monthly low at 1.2558 is now the immediate support, with a break below it likely resulting in a steeper slide.

Risk Disclaimer

The information above is of general nature only and does not take into consideration your objectives, financial situation or investment needs. The products and services provided are issued by AETOS Capital Group Pty. Ltd. (AFSL: 313016, ACN: 125113117). Trading Forex margin and CFDs carries a high level of risk, and losses can exceed your deposits. You are strongly recommended to seek independent financial advice before you make an investment decision. Please refer to our Product Disclosure Statement which you can obtain from our website for more details. AETOS has the ownership of the contents of this FX commentary. Copying, reprinting or publishing to a third party is not permitted.