ASIC and FCA licensed Retail FX broker AETOS Capital Group have provided their daily commentary on traditional markets for June 6, 2019.

EURUSD

The euro weakened on Wednesday, closing at 1.1229(-23 pips) against the greenback. Greenback remained weak throughout the first half of the day, with the shared currency underpinned by upward revisions in Markit Services PMI. The German index showed that the service sector grew at a solid pace, printing 55.4. For the whole EU, the Services PMI resulted at 52.9, while the Composite PMI came in at 51.8, better than April’s 51.5, indicating expansion of the EU private sector, albeit at a modest pace. The EU also released April Retail Sales, which resulted as expected at -0.4% MoM. News that the EU Commission decided to launch a disciplinary procedure against Italy amid the country´s growing debt, put the pair under temporal pressure, later bouncing after the US ADP survey showed that the private sector added just 27K new jobs in May, way below the 180K expected, the catalyst that sent the pair to the mentioned high. The dollar turned north after the release of the ISM Non-Manufacturing PMI, which rose in May to 56.9, much better than the 55.5 expected. Furthermore, US Senate Finance Committee Chairman Grassley predicted the US will not impose sanctions on Mexico and said that he thinks an announcement could be made on Thursday night about a possible tariff deal. President Trump, however, later said that if Mexico doesn’t control migrants the tariffs will take place.

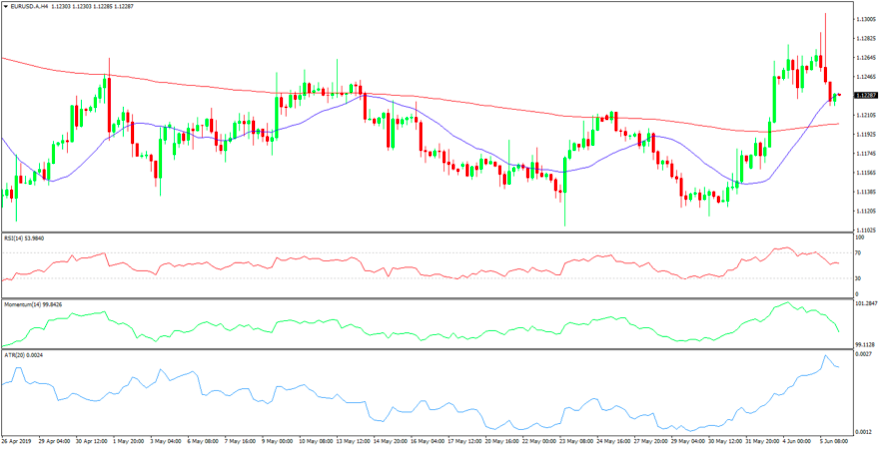

EURUSD 4 Hour Chart

The EUR/USD pair trades near its daily low ahead of the Asian opening, a sign that the market is not ready to go long in the EUR, moreover considering the ECB will announce its monetary policy decision this Thursday. The Union will also release a revision of Q1 GDP, seen unchanged at 0.4%. The decline remains corrective short-term, as, in the 4 hours chart, the pair holds above a bullish 20 SMA(Blue Line), which maintains its bullish slope after crossing above the larger ones, while technical indicators turned sharply lower, heading south almost vertically, but coming from extreme overbought readings and still holding above their midlines.

GBPUSD

The cable pair closed lower on Wednesday, closing at 1.2687(-15 pips) against the greenback.Sterling initially received a boost from the UK Markit Services PMI, advancing against the greenback to 1.2743, a fresh June high. The services sector in the kingdom expanded at a faster-than-expected pace in May, according to Markit, with the index printing 51.0, beating the market’s forecast of 50.6, also above April reading of 50.4. A weak dollar added to the bullish case of the pair, alongside the lack of fresh Brexit-related headlines. Political jitters will come back early next week, as PM May will resign as leader of the Conservative party this Friday, to pave the way for a contest to decide her replacement. She will remain as PM until the ends of July. This Thursday, BOE’s Governor Carney is due to speak at the Institute of International Finance Spring Meeting, in Tokyo, with little chances of surprise comments related to monetary policy. There are no other macroeconomic releases scheduled in the UK.

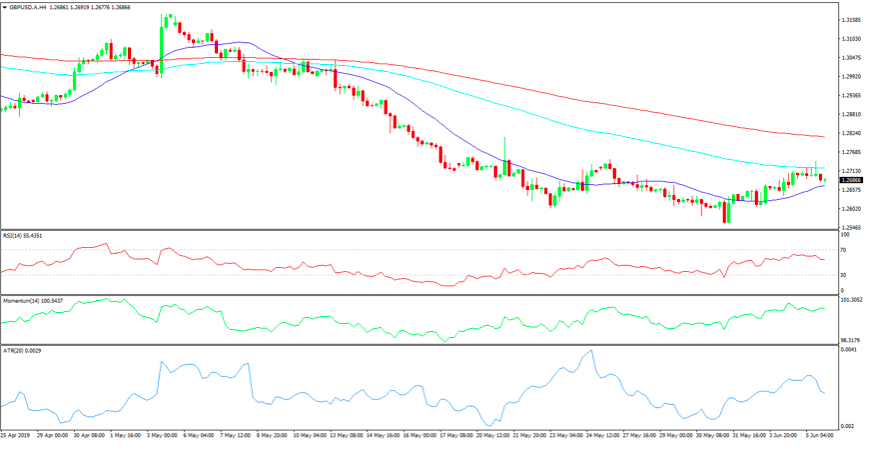

GBPUSD 4 Hour Chart

The technical point of view, the pair is losing the short-term bullish stance that led the way since late last week, as its breaking below a daily ascendant trend line coming from May’s low at 1.2558. In the 4 hours chart, the pair failed to sustain gains beyond a bearish 100 SMA, but holds above a bullish 20 SMA, while technical indicators retreated from overbought readings, consolidating within positive levels. The risk of a bearish extension will increase on a break below the 1.2660/70 price zone, where the pair has several intraday highs and lows from these last few days.

Risk Disclaimer

The information above is of general nature only and does not take into consideration your objectives, financial situation or investment needs. The products and services provided are issued by AETOS Capital Group Pty. Ltd. (AFSL: 313016, ACN: 125113117). Trading Forex margin and CFDs carries a high level of risk, and losses can exceed your deposits. You are strongly recommended to seek independent financial advice before you make an investment decision. Please refer to our Product Disclosure Statement which you can obtain from our website for more details. AETOS has the ownership of the contents of this FX commentary. Copying, reprinting or publishing to a third party is not permitted.