ASIC and FCA licensed Retail FX broker AETOS Capital Group have provided their daily commentary on traditional markets for May 31, 2019.

EURUSD

The Euro closed lower on Thursday, closing at 1.1132(-4 pips) against the greenback. Most major European markets, excluding London, were off on holiday, limiting activity and the macroeconomic calendar, while risk aversion remained as the top market motor, with another batch of crossed fired between US and Chinese politicians. US data released Thursday failed to impress, as the first revision of Q1 GDP came in at 3.1% as expected, while initial jobless claims for the week ended May 24 resulted at 215K also matching the market’s forecast. Core quarterly PCE prices, on the other hand, were revised to 0.4% from the previous and the expected 0.6%, while Wholesale Inventories increased by 0.7% in March, much worse than the 0.2% expected. Finally, Pending Home Sales fell by 1.5% in April, vs. the expected 0.9% advance. The week will come to an end with the release of German Retail Sales, seen bouncing in April after falling in March, and preliminary estimates of May inflation, seen depressed yearly basis. As for the US, the country will release Personal Income and Spending data, including monthly PCE inflation, and the final version of May’s Michigan Consumer Sentiment, with the index seen revised to 101.5 from 102.4.

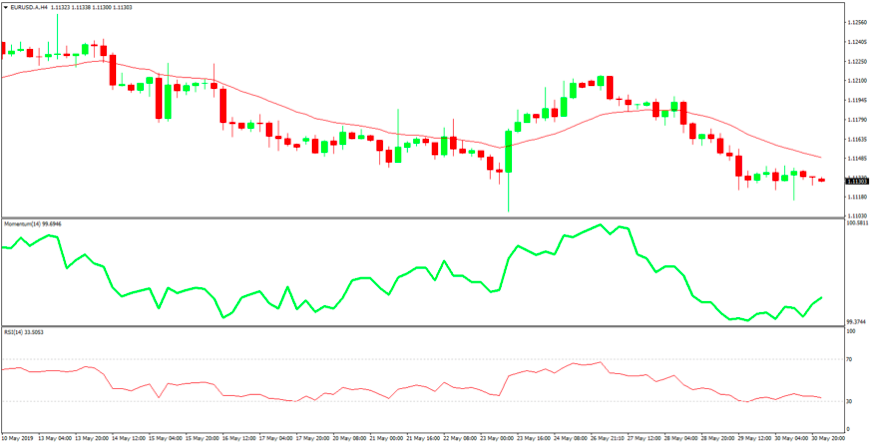

EURUSD 4 Hour Chart

Based on the chart above, the pair posted a lower high and a lower low for a third consecutive day. In the 4 hours chart, the 20 SMA heads sharply lower below the larger ones, making advances tougher. Technical indicators in the mentioned chart, remain near daily lows and oversold territory, lacking directional strength, yet keeping the risk skewed to the downside.

GBPUSD

The cable pair fell to 1.2608(-20 pips) against the greenback. The pair touched the critical support on the back of broad dollar’s strength, demanded amid prevalent risk aversion. The later bounce came as the dollar retreated, although the dominant bearish trend remains intact. In the Brexit front, Labour leader Corbyn said that his party would do ‘whatever is necessary’ to prevent a no-deal Brexit, including backing a second referendum. “Let the people decide the country’s future, either in a general election or through a public vote on any deal agreed by parliament,” Corbyn stated, adding that if he gets to lead the UK, he will go back to the EU and ask them to seriously consider a customs union. This Friday, the UK will only release minor housing and money data.

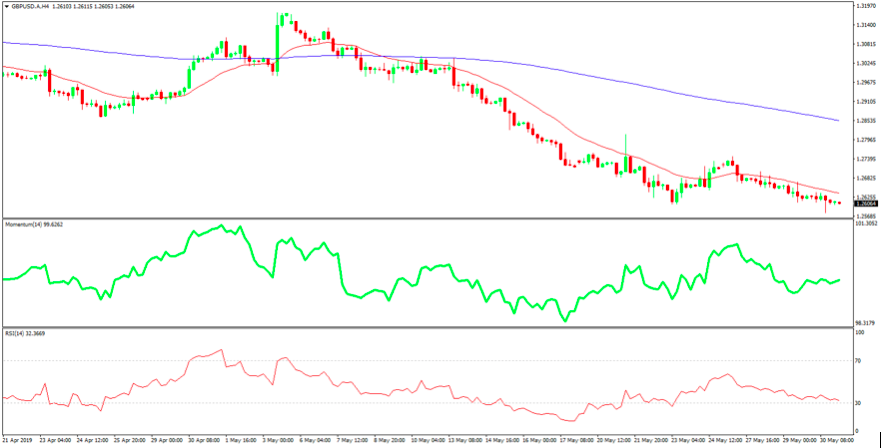

GBPUSD 4 Hour Chart

The cable pair maintains the technical bearish stance edging lower for a fourth consecutive day. In the short-term and according to the 4 hours chart, the pair is also poised to extend its decline, as it’s developing below a bearish 20 SMA, while developing over 200 pips below an also bearish 200 EMA. Technical indicators in the mentioned chart remain within negative levels, although lacking enough directional strength to confirm the next move. As mentioned on a previous update, the pair would need to break below the mentioned daily low, a strong static support level, to confirm a steeper decline ahead.

Risk Disclaimer

The information above is of general nature only and does not take into consideration your objectives, financial situation or investment needs. The products and services provided are issued by AETOS Capital Group Pty. Ltd. (AFSL: 313016, ACN: 125113117). Trading Forex margin and CFDs carries a high level of risk, and losses can exceed your deposits. You are strongly recommended to seek independent financial advice before you make an investment decision. Please refer to our Product Disclosure Statement which you can obtain from our website for more details. AETOS has the ownership of the contents of this FX commentary. Copying, reprinting or publishing to a third party is not permitted.