ActivTrades’ Market Analysts have provided their daily commentary on traditional markets for April 30, 2019.

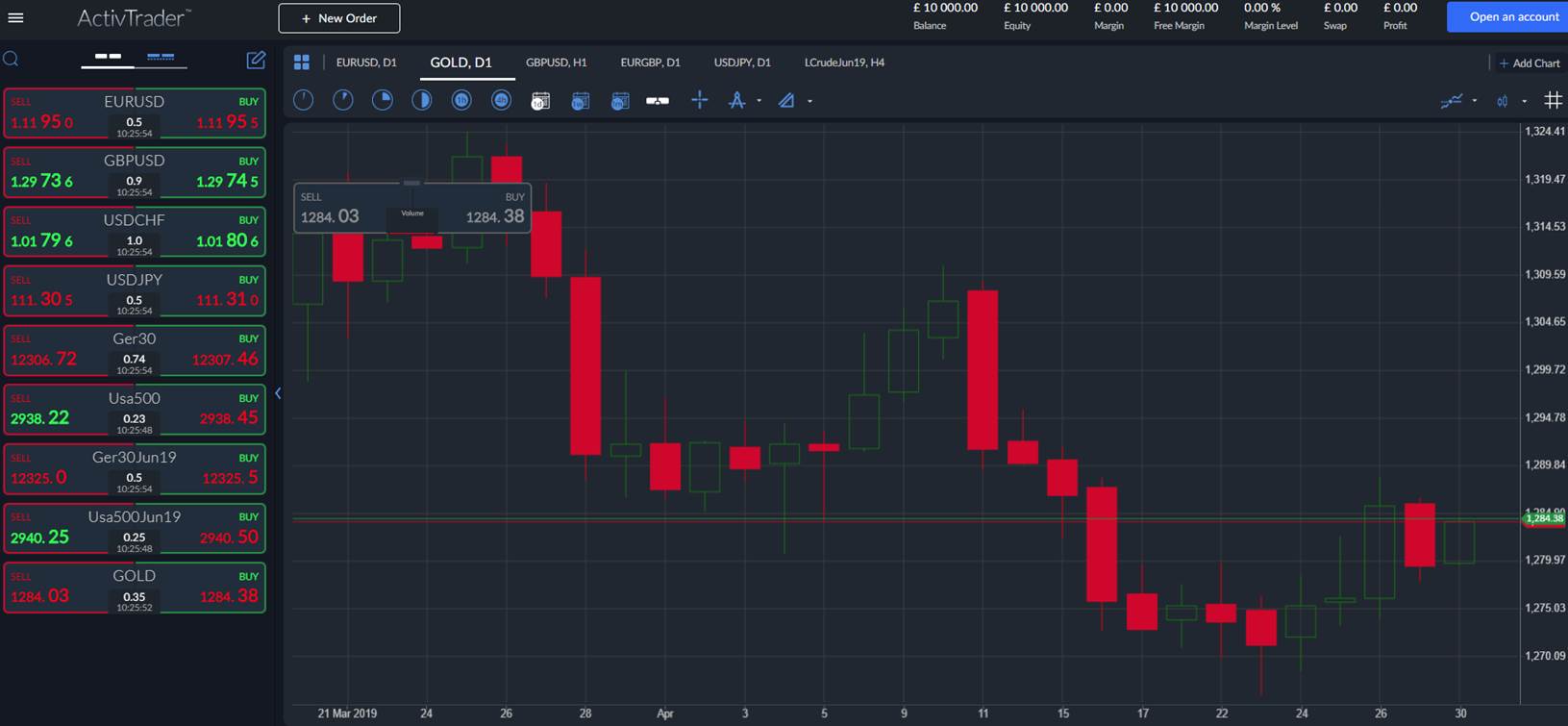

Gold

Weak Chinese PMI data is a supportive element for gold today, even if the price is struggling to find strength to attack the resistance area placed at $1,300. We have seen a first positive signal with the rebound registered on the support placed at $1,280, as investors are waiting for further input from the macroeconomic side, in a week that will end with the all-important US non-farm-payrolls data.

Carlo Alberto De Casa – Chief Analyst, ActivTrades

Oil

Oil is trying to regain momentum after the collapse seen in the final part of last week, with prices now rebounding on the support level of $62. The main scenario remains positive, even if the space for further rallies is reducing. We would have a positive signal if prices broke through the resistance placed at $64.5, with space in this case for another test to the recent peak.

Carlo Alberto De Casa – Chief Analyst, ActivTrades

European shares

A the new trading day begins uncertainty remains on the stock market. European shares are trading mostly lower after most Asian benchmarks dropped overnight amid low trading volumes due to a bank holiday in Japan.

Investors were disappointed by earning reports by Samsung and Alphabet released after the closing bell on Monday, which raised further worries about the state of the US economy ahead of tomorrow’s FED decision on rates.

Investors are now awaiting more clues on the strength of the global economy from data this week, with today’s German CPI and Eurozone GDP release in sight. Technically speaking, the STOXX-50 index still trades sideways, stuck between 3,445.0pts and 3,415.0pts.

Prices are currently attempting to close today’s opening bearish gap by challenging the 3,440.0pts level. The market could however quickly join back the 3,425.0ts / 3,420.0pts zone if prices break the 3,432.0pts price level.

Pierre Veyret– Technical analyst, ActivTrades