ASIC and FCA licensed Retail FX broker AETOS Capital Group have provided their daily commentary on traditional markets for May 17, 2019.

EURUSD

The Euro slumped against the greenbacks on Thursday, and reached a weekly low at 1.1165, although it has attempted a recovery earlier this week. The tension around trade war between China and US continue. US President Trump declared a national emergency over threats against American technology, which ended up with the US Department of Commerce adding Huawei Technologies and its affiliates to the BIS Entity List, making it harder for the company to do business with US companies. The spokesman from Ministry of Foreign Affairs of China, said if US doesn’t have the sincerity to come up with a trade agreement, it doesn’t matter if the US trade talk team come to China for the next round of discussion.

The positive economic data was backed by US data, which beat the market’s expectations. According to the official releases, stronger Housing Starts and Building Permits supports the housing market, while 212K unemployment claims for the week ended May 10, better than the 220K expected. Also, the Philadelphia Fed Manufacturing Survey came in at 16.6, much better than the previous 8.5 and above the forecasted 9.0.

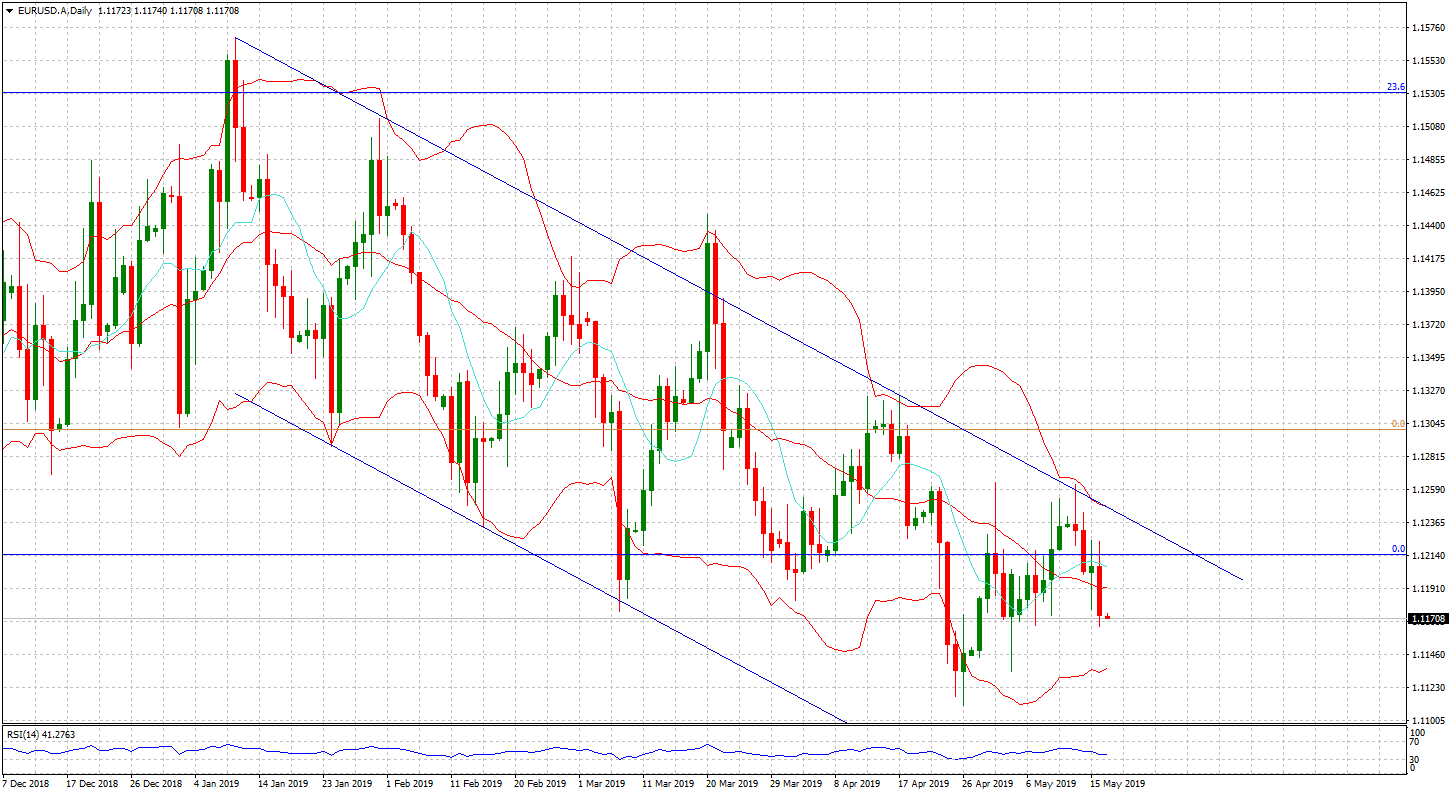

EUR/USD Daily Chart

Euro depreciated against USD by 33 pips, dropped down below the 20-day moving average. Euro is traded within the downward channel since 10th low and tried to break the up bound channel. As the channel, Bollinger Bands, and moving average all trending downward, the euro will experience a further movement toward 1.1110.

AUDUSD

The Aussie kept dropping against the greenbacks on Thursday, as the Australian employment data put further pressure onto RBA to cut rates. The country added 28.4K new jobs in April, although it lost 6.3K fulltime positions, with part-time jobs up by 34.7K. The unemployment rate ticked up to 5.2% (consensus was 5.1%), while the participation rate surged to 65.8%.

While the economic data does not support the Aussie whatsoever, the Aussie dropped down below the crucial 0.6900 level. The pressure and anticipation on RBA rate cut, add further pressure onto the Aussie. The fundamental situation of the Aussie is very weak, and the market could not find any evidence supporting the pair, especially the Federal Election is commencing this Saturday.

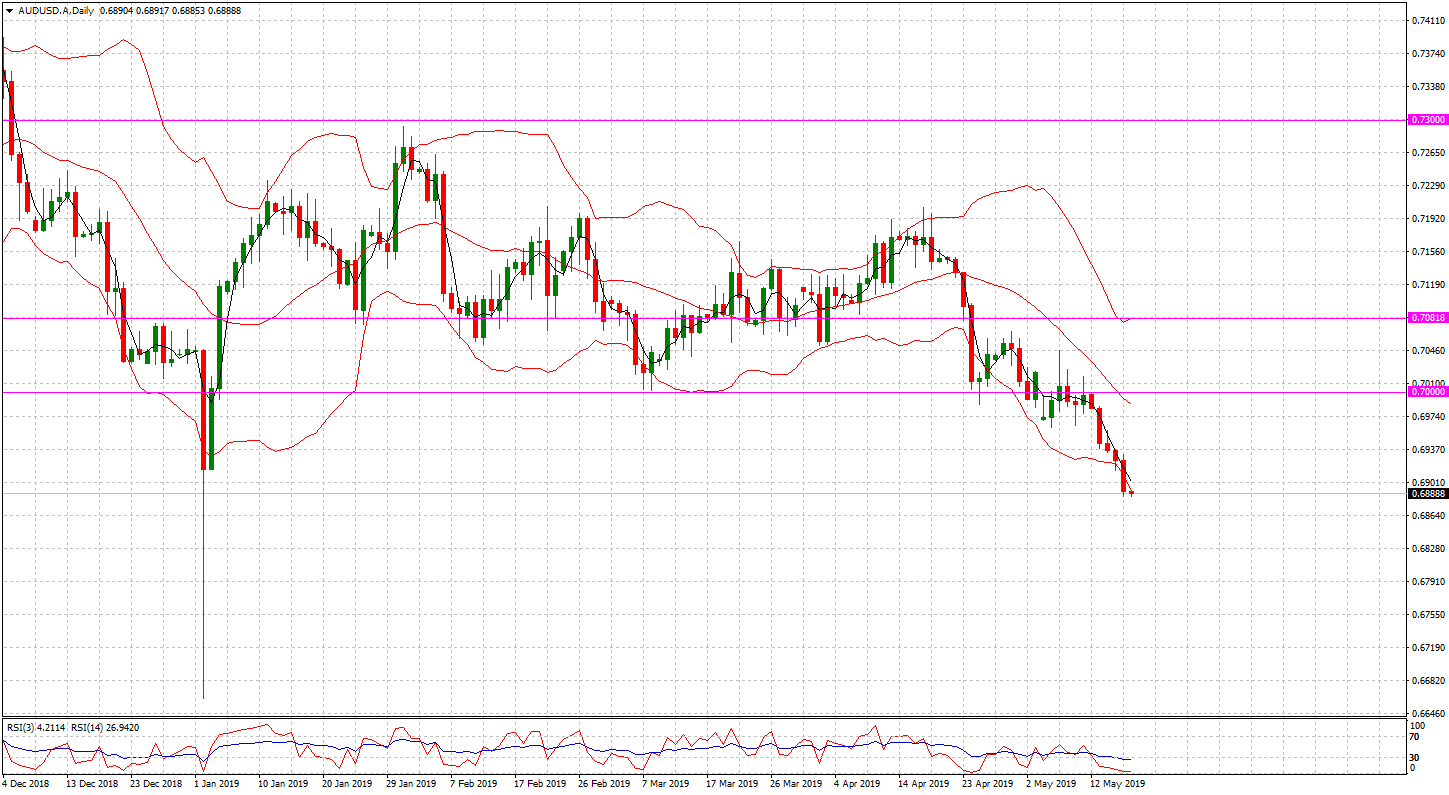

AUD/USD Daily Chart

The Aussie fell another 34 pips on Thursday, the pair has experienced lower close price four days in a row, for a total 106 pips since this Monday. The market did not expect the Aussie to fell this much before the Federal Election, however, the weak economic condition drove the pair down regardless of the extreme indicators. The 3-period RSI is sitting at 4.2 and may indicate a correction, therefore, it is not a perfect time to keep shorting the Aussie at this given price level, although the pair has a pretty clear downward trend.

Major Economic Events happening this week (AEDT Time Zone)

| Economic Event (Date) | Previous | Forecasted | Actual |

| AU – NAB Business Confidence (14 May) | 0 | 1 | 0 |

| DE – Inflation Rate YY Final (14 May) | 1.3% | 2% | 2% |

| GB – Claimant Count Change (14 May) | 28.3K | 24.2K | 24.7K |

| DE – ZEW Economic Sentiment Index (14 May) | 3.1 | 5 | -2.1 |

| AU – Westpac Consumer Confidence Index (15 May) | 100.7 | 100.4 | 101.3 |

| DE – GDP Growth Rate QQ Flash (15 May) | 0% | 0.4% | 0.4% |

| CA – Inflation Rate YY (15 May) | 1.9% | 2% | 2% |

| US – Retail Sales MM (15 May) | 1.6% | 0.3% | -0.2% |

| AU – Unemployment Rate (16 May) | 5% | 5.1% | 5.2% |

| US – Michigan Consumer Sentiment (18 May) | 97.2 | 97.5 | – |

Risk Disclaimer

The information above is of general nature only and does not take into consideration your objectives, financial situation or investment needs. The products and services provided are issued by AETOS Capital Group Pty. Ltd. (AFSL: 313016, ACN: 125113117). Trading Forex margin and CFDs carries a high level of risk, and losses can exceed your deposits. You are strongly recommended to seek independent financial advice before you make an investment decision. Please refer to our Product Disclosure Statement which you can obtain from our website for more details. AETOS has the ownership of the contents of this FX commentary. Copying, reprinting or publishing to a third party is not permitted.