UK financial regulator Financial Conduct Authority (FCA) has published its Authorisations Quarterly Key Performance Indicators (KPIs) as at September quarter. These indicators provide key metrics on the performance of the FCA’s Authorisations Division, including authorisations, cancellations, variations of permission, change in control, and passporting.

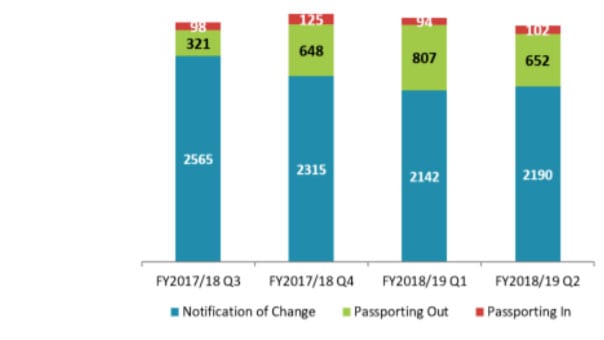

The latter seems to be of most interest these days due to the continuous movements around Brexit. The chart below shows a slight difference between “passporting in” and “passporting out” cases. As per FY2018/19 Q2, the “passporting in” was 102, while the “out” number was 652.

Source: FCA

Note that the chart has not been affected by FCA’s latest announcement.

The FCA has published two consultation papers back in October, setting out its proposals in the event the UK leaves the European Union on March 29, 2019 without an implementation period – i.e., a so-called ‘Hard Brexit’. It also set out its approach to the regulation of Credit Ratings Agencies, Trade Repositories and Data Reporting Services Providers.

The FCA had earlier stated that its Hard-Brexit plan was going to revolve around temporary passports and cliff edge risks. But while the FCA has clearly indicated its openness to allowing EU licensed firms (like Forex brokers) to continue doing business with UK clients post-Brexit via a temporary passport regime, so far its EU counterpart ESMA has towed a much harsher line, indicating that a Hard Brexit means no more access for UK-FCA licensed firms into continental Europe.