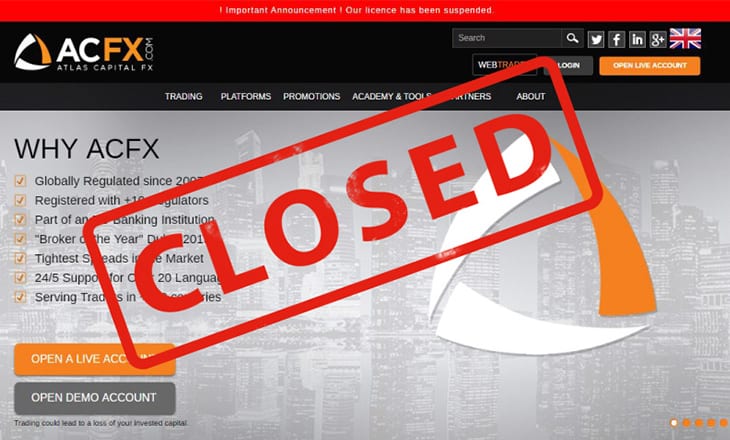

The Cyprus Securities and Exchange Commission (CySEC) announced that, on its meeting of 13th February 2017, has decided to wholly withdraw the Cyprus Investment Firm authorization with number CIF 085/07 of Atlas Capital Financial Services Ltd. (ACFX).

The company is operating at https://www.acfs.eu and https://www.acfx.com.

ACFX basically shut down its operations, with several million dollars of missing client funds still not accounted for.

The complete CySEC announcement can be seen below:

ACFX’s CIF authorization has been withdrawn due to the Company’s non compliance with:

1.Section 28(1) of the Law, as it fail to comply with the authorization and operating conditions of:

1.1 section 18(2)(a) of the Law and paragraph 13, sub paragraphs (2) and (9), of Directive DI144-2007-01 of 2012 for the Authorisation and Operating Conditions of the Cyprus Securities and Exchange Commission of the Cyprus Investment Firms (‘the Directive’), as the Company had not establish, implement and maintain effective procedures for the reasonable and prompt handling of complaints received from its clients and for their full investigation.

1.2. section 18(2)(c) of the Law as, due to the Company’s failure to submit evidence for actions taken, CySEC is not in a position to establish whether the Company has taken all measures necessary to ensure continued and regular performance of its services.

1.3. section 18(2)(f) of the Law as, due to the Company’s failure to submit evidence for actions taken, CySEC is not in a position to establish whether the Company has effective procedures for identifying, managing, monitoring and reporting of the risks.

1.4 section 18(2)(j) of the Law and paragraph 18(1)(f) of the Directive as, due to the Company’s failure to submit evidence for actions taken, CySEC is not in a position to establish whether the Company has taken all necessary measures and adequate arrangements to safeguard its clients’ assets.

2 Sections 68 and 70 of the Law as, due to the Company’s lack of depositing into the clients’ accounts the amount as indicated by CySEC, the Company’s capital is not consider adequate to cover future risks to which might be exposed.

The Company should cease to provide investment and ancillary services and settle, within a period of three (3) months, its obligations arising from the services that are no longer allowed to provide or perform.