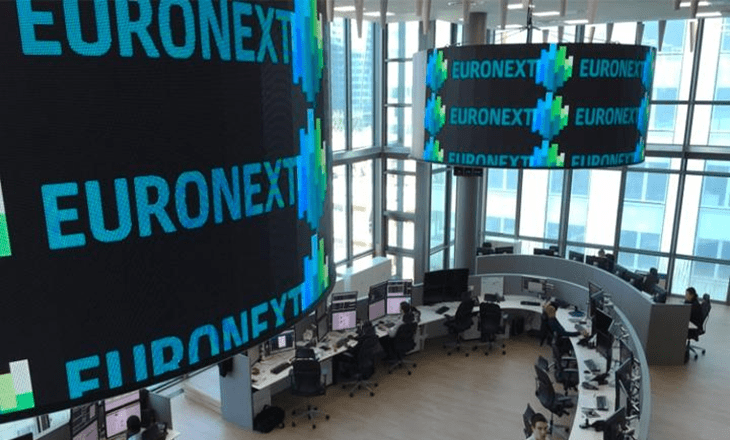

Euronext has announced the launch of a new Euronext Green Bonds offering across its six regulated markets. The initiative is operated out of Euronext Dublin, the group centre of excellence for Debt, Funds and ETFs, and is designed to encourage and promote more sustainable investment in Europe.

The Green Bonds offering goes live today with more than 50 participating issuers.

With more than 44,000 bonds, Euronext is with approximately €118bn worth of Green Bonds listed on Euronext markets, €40bn of which was raised in the last 12 months.

In order to be eligible for inclusion, Green Bonds must be listed on a Euronext market, be aligned with recognizable industry standards such as ICMA Green Bond Principles or the Climate Bond Initiative Taxonomy, and be accompanied by an appropriate external review performed by an independent third party.

In response to the launch, Ireland’s Minister for Finance, Paschal Donohoe said:

Sustainable Finance is already an important and growing sector in Ireland and it has the potential for further growth in both size and importance. Across Ireland there are already world leaders in sustainable finance in asset management, insurance, pension funds and professional service firms. Today’s announcement only adds to this emerging cluster of activity. I commend Euronext for their leadership in this important area. I look forward to seeing the growth of this segment in Dublin.

Welcoming today’s announcement, Ireland’s Minister of State with special responsibility for Financial Services and Insurance, Michael D’Arcy commented:

We are delighted to work with Euronext and support the launch of their new Green Bonds initiative. Sustainable Finance is an important and rapidly growing sector in Ireland and Europe, and is a key priority in the ‘Ireland for Finance’ 2025 strategy which I jointly launched earlier this year. Leading financial entities such as Euronext can play a leading role in unlocking the capital required to transition to a low-carbon economy and keep global warming below 2 °C, meanwhile supporting issuers connect with a new base of investors.

Euronext CEO, Stephane Boujnah added:

As a leading market infrastructure, accelerating the global transition to a low-carbon economy is one key element of Euronext’s new strategic plan, ‘Let’s Grow Together 2022’. The climate crisis affects us all, and we all, as citizens and corporations alike have a responsibility to support sustainable investment decisions. Today’s initiative is designed to promote and support green bonds and make it easier for investors to finance projects that will fundamentally change our economy and environment.

More recent news from Euronext can be found below: