Deutsche Börse has announced that in May, Eurex‘ Italian BTP segment saw record volumes that were triggered by the forming of the new government.

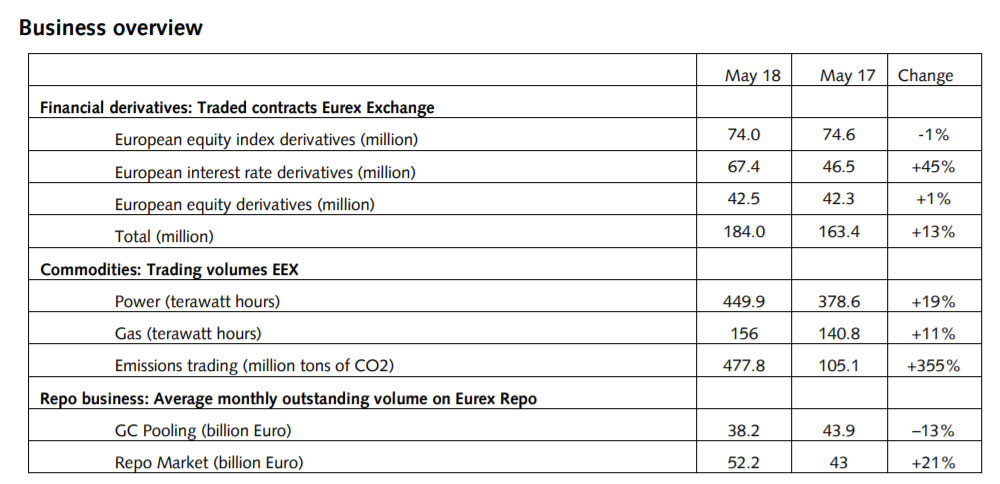

Traded volume more than doubled year-on-year reaching 7 million (+126 percent) while open interest stood at 0.7 million at month-end (+0.2 percent YoY). Overall, Eurex‘ interest rate segment grew by 45 percent (YoY).

Eurex offers the full suite of Exchange Traded Derivatives (ETD), both in futures and options, to hedge exposures in the Italian bond market. Furthermore, the instruments present an opportunity to trade the basis on Italian debt instruments, thus complementing the Italian cash market.

What is encouraging is the volume increase in BTP both in futures and options,” says Lee Bartholomew, Head of Fixed Income & FX Product Research and Development at Eurex. “Having this breadth of product coverage has allowed investors to hedge and position their portfolios accordingly. All this wouldn’t have been possible without the support of our members, who have provided liquidity in choppy markets.

Overall, Eurex trading volumes grew by 13 percent from 163.4 million traded contracts in May 2017 to 184.0 million in May 2018.