The following article was written by AMarkets, a St. Vicent & the Grenadines (FSA) regulated global forex broker established in 2007.

As the most liquid currency pair part of the Forex dashboard, the EURUSD is said to run the show in terms of market’s volatility. More precisely, when the pair doesn’t move, the entire dashboard lacks movement.

In a way, it is only reasonable. We talk about two of the most important currencies in the world: the U.S. Dollar and the Euro.

Together, they account for over eighty percent of the daily foreign exchange volume, which makes the EURUSD pair’s significance clearer.

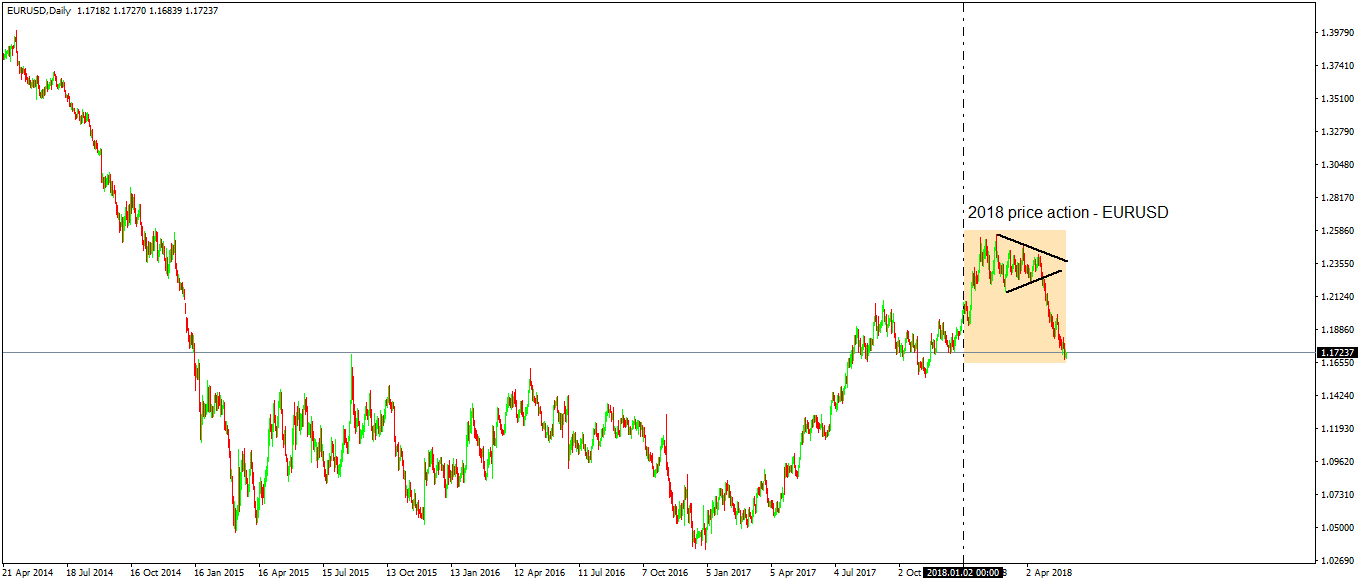

2018 so far brought a little something both for EURUSD bulls and bears. The pair started the year as it ended in 2017, in a strong bullish trend.

However, the first four months saw the pair consolidating between a two-hundred and fifty pips range. What for many looked like a triangle as a continuation pattern, in fact, it was one as a reversal pattern.

Now that we’re back to square one, at levels from 2018 start, what next for the EURUSD?

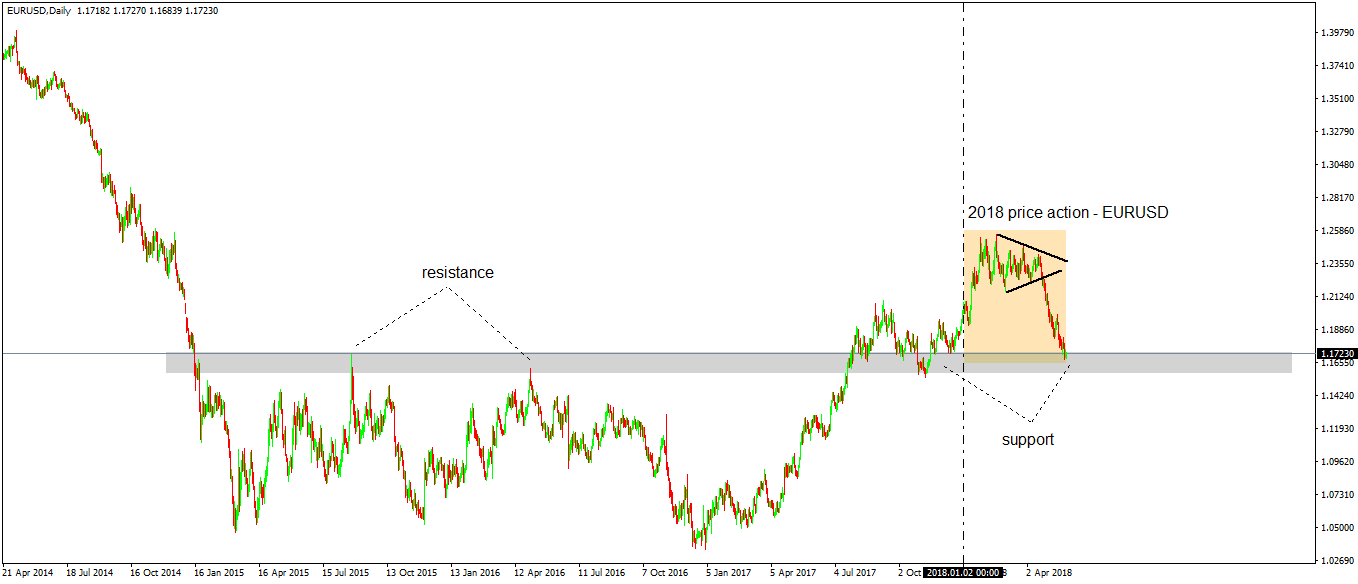

Major Support Might Hold

It so happens that the recent fall was so abrupt that the EURUSD bulls ran for the hills. However, when this happens, typically it is a sign of a temporary bottoming.

While the almost vertical drop scared bulls away, the pair currently sits at significant support. An area that provided resistance for over two and a half years now is tested for the second time as a support level.

Will it hold?

Since the European Central Bank (ECB) started to cut rates and engaged in unconventional monetary policy, the Euro fell across the board. In particular, the EURUSD dropped in an almost uncontrolled manner, from 1.40 to near parity.

For two and a half years it consolidated waited for essential events to pass: the Brexit vote in the United Kingdom and the U.S. Presidential election.

Even the in-house crisis wasn’t enough to push the pair below parity. Not to mention the interest rates differential between the Fed and the ECB, that grew bigger and bigger by the day.

In fact, this was the big unknown of the 2017 bullish rally on the pair: why it is rising when the ECB keeps the critical interest rate level below zero, while Fed engages in a tightening cycle?

Probably this is one of the mysteries of trading the currency market when the market stays irrational more than a trader remains solvent.

Conclusion

As 2018 proved to be pretty lame so far with EURUSD investors, neither bulls or bears made money. Swing traders and scalpers may have liked the price action, but from an investing point of view, the pair didn’t go anywhere.

Look for a bounce back above 1.20 if the current horizontal support holds. With the June European Summit knocking at the door and the potential June Fed rate hike on the table, the market has all the ingredients to experience volatility spikes.

On the other hand, a clear break below the pivotal support will transform it in a resistance level challenging to break.