The following article was exclusively prepared for LeapRate by the AMarkets team.

Despite the highs and lows of the international cryptocurrency market over the last few years, most novice traders choose crypto trading instead of traditional financial markets – Forex, stock, and gold. However, old-school markets can still provide various profit-making opportunities for newcomers.

How is crypto trading different from stock trading?

Cryptocurrencies come and go, though some digital coins have managed to find their place in the sun, stock trading can be a smart addition to financial trading. When we think about a trader per se, the restless mind draws the picture of a suited man who trades stocks in a crowded room.

Nowadays, with the appearance of trading software and new technologies, traders can trade both cryptocurrencies and stocks right from their home wearing their nightgowns and sitting in front of six monitors. This is the next generation of traders that we should get used to. And this next generation opts for stocks and cryptocurrencies as their trading instruments.

Which asset is more preferable?

Source: pbs.twimg.com

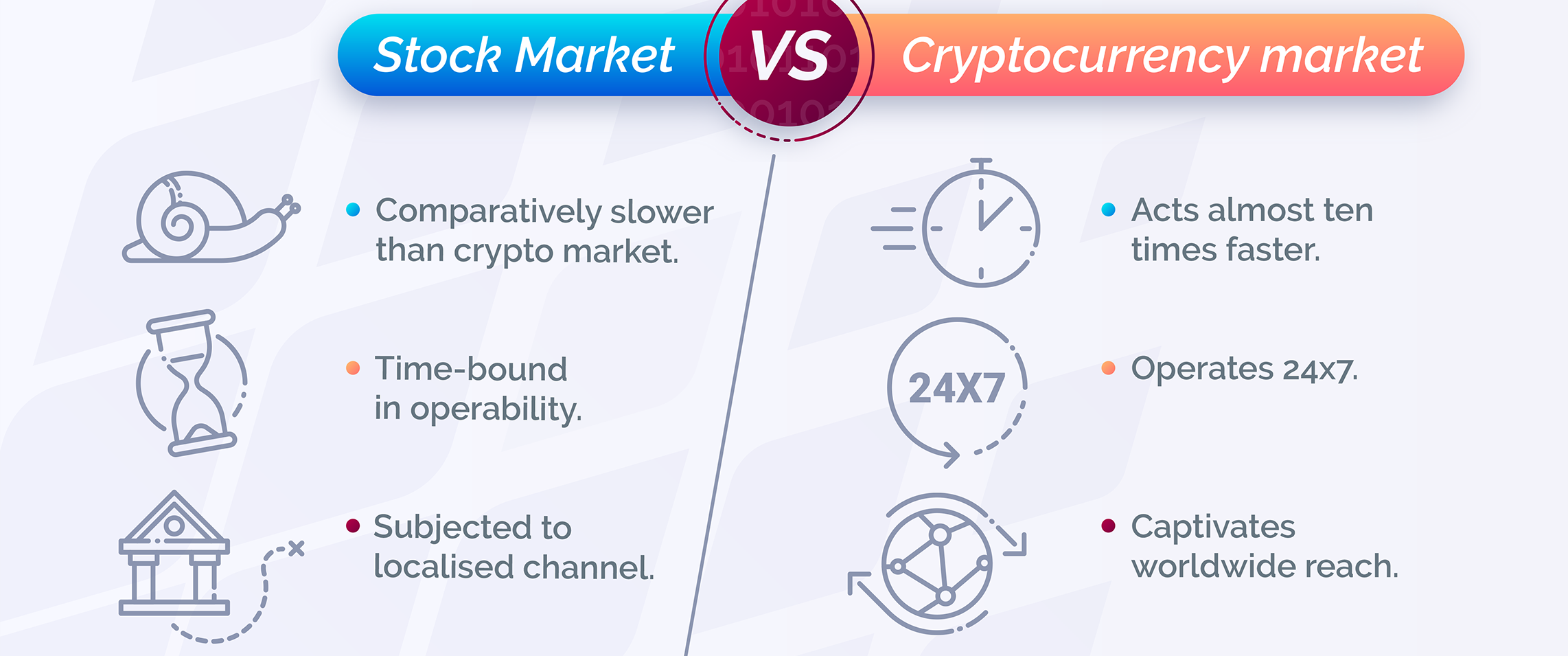

3 key differences between crypto trading and trading in stock markets:

- Trading sessions. You can trade stocks with traditional exchange services, characterized by limited-time trading sessions and occasional 24-hour windows. Transactions with traditional stocks have to be performed within certain timeframes, while crypto trading is available 24/7. Traders can instantly react to economic events and news, without any breaks and interruptions.

- Entry. Stock trading requires more preparation – get ready for some paperwork and associated costs before you will be able to make your first trade. To start trading crypto you don’t need to do any of this. Just register a trading account, put some funds into it, and you’re all set.

- Volatility. Cryptocurrency traders have to fight with volatility, which is higher than in any fiat exchange markets. Surely, volatility provides more investment opportunities but also involves an increased risk of losing money in mere seconds. New traders should stick to risk management tools offered by experienced brokers.

Source: www.pinterest.com

Stock trading encompasses less risk, but traders need to invest the price of a stock to start their investment portfolio. It is a trickier process which should be handled only by traders with profound knowledge and solid trading strategy.

“Digital Gold” Bitcoin vs Good Old Gold

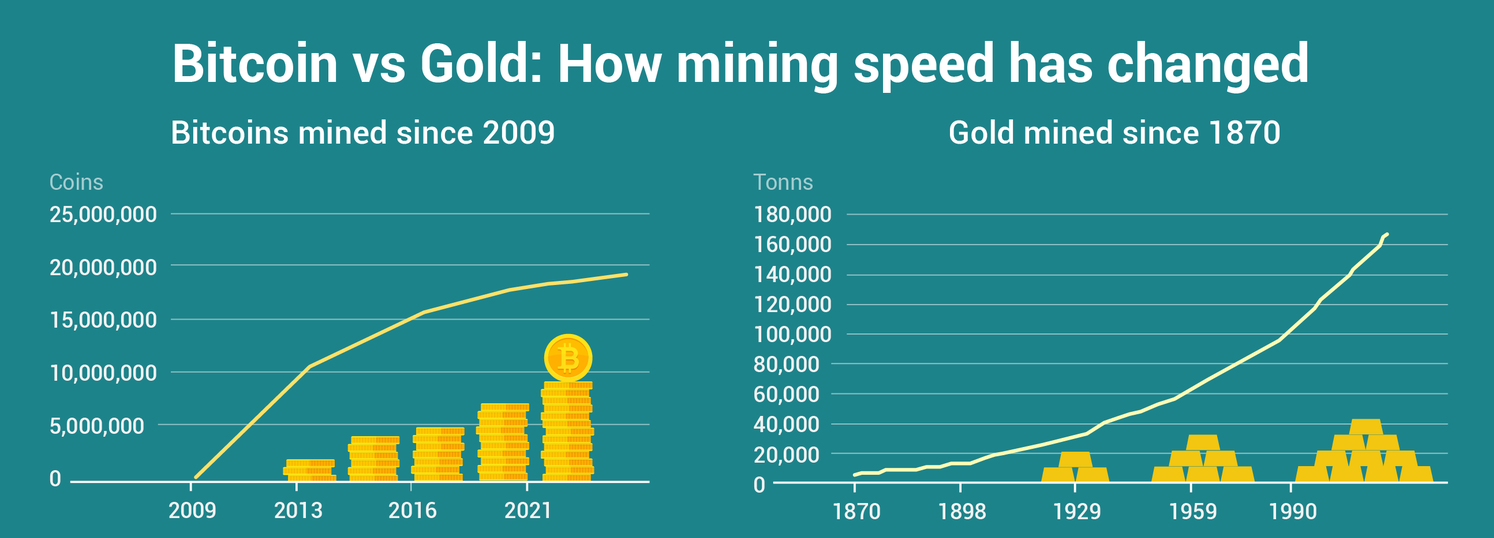

Experienced traders and authoritative financial media claim that gold is more stable than the emerging market of cryptocurrencies. Crypto-enthusiasts, on the contrary, believe that Bitcoin (the first and most reputable cryptocurrency) has long surpassed gold and transformed into “digital gold” or “gold 2.0” over the last few years.

Similarities of gold and Bitcoin

Both assets can boast monetary origins, taking into account gold’s history and Bitcoin’s background.

Wall Street experts categorize gold and Bitcoin as “alternative investment options” which at some point make them equal. Both assets have a supply, limited by the process of “mining”.

Source: ihodl.com

Comparison of key features:

1. Safety and transparency

It is incredibly complicated to counterfeit or steal gold, unlike cryptocurrencies. Crypto traders always need to protect their digital wallets because even huge exchange services can be hacked. Bitcoin is less protected than gold or any other financial asset. However, when it comes to transparency, Bitcoin wins over gold because all transactions with this cryptocurrency are public and stored in a shared public ledger.

2. Liquidity

It is easier to exchange gold for cash than to get physical notes for cryptocurrencies like Bitcoin. BTC has daily withdrawal limits so this cryptocurrency is less liquid than gold.

For now, gold is positioned as a more reliable asset for long-term investment. It remains a smart addition to any trading portfolio. Modern traders should diversify their portfolio, keeping it smart. If the initial investment amount is limited, it is better to invest a small amount of both assets – cryptocurrency and gold. Bitcoin can increase in its value, but no one can beat the most reliable financial asset – gold.

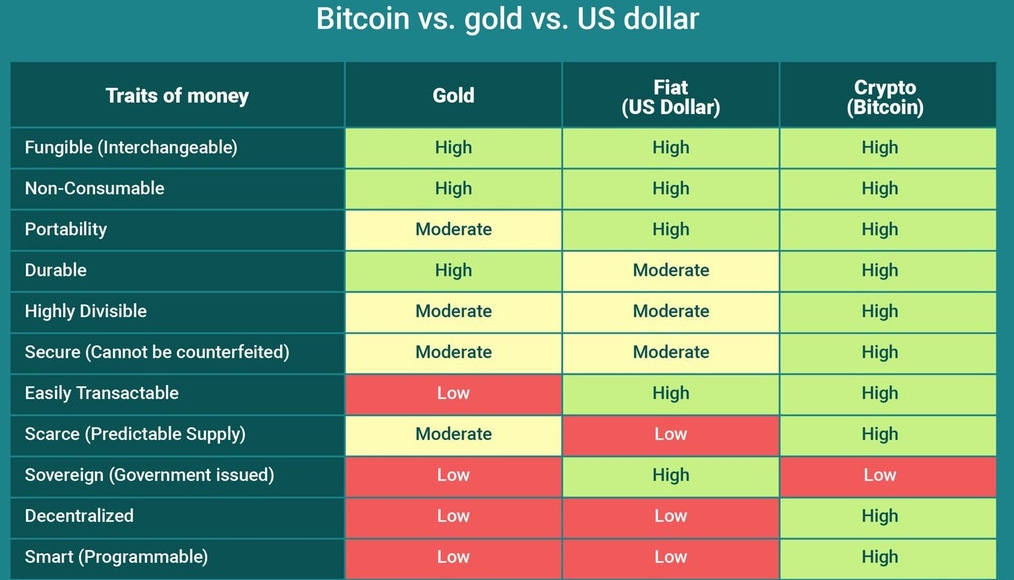

Fiat trading vs crypto trading: the battle of Bitcoin and U.S. dollar

Due to the common belief, the U.S. dollar is considered the most popular fiat currency in the world. Bitcoin, on the contrary, like all cryptocurrencies, exists only in the virtual world. However, despite the apparent adversarial relationship between the two assets, they have many common features. Both currencies are portable, durable, recognizable and divisible. There are many ways to invest in U.S. dollars or Bitcoin: Forex brokers like AMarkets, hedge funding, ETFs. But traders have to take into account a few drastic differences between these two assets.

Differences between the U.S. dollar and Bitcoin:

1. The dollar is centrally supported and regulated by the U.S. government. This fiat currency is available all over the world and is widely used by the entire banking network. Also, U.S. dollars are easier to store, withdraw and transfer. They can be quickly converted into physical notes. U.S. dollar’s price depends directly on inflation/deflation in one country. It is less volatile than most fiat currencies, and more stable compared to Bitcoin.

U.S. dollars are easier to store – in a regular wallet if we are talking about cash, or in a bank account. Dollars can be stolen or lost, but the level of security is still very high. With the 200-year history, the U.S. dollar has reasonably good prospects and a stable future.

2. Bitcoin easily wins over all the U.S. dollar’s advantages when it comes to inflation due to the in-built scarcity. Bitcoin doesn’t depend on any economic system and is not regulated by any government. While U.S. dollars are printed daily which inevitably creates inflation, Bitcoin (like most cryptocurrencies) is not inflationary because only a finite amount of coins can be mined and when the last coin is mined in 100 years, it will be impossible to mine more. Due to the limited supply, the Bitcoin’s price strives to be stable. Though, high volatility is the biggest drawback of Bitcoin trading.

Unlike U.S transfers, all Bitcoin transactions are completely transparent due to the public ledger (blockchain). The whole process of transaction is fully automatic and instantaneous. You can transfer Bitcoins within a few seconds – so much faster than U.S. dollars.

Source: steemit.com

So, what is better for a new trader? U.S. dollars remain the dominant fiat currency in the world. All people understand its value. Bitcoin is a 10-year digital currency that hasn’t been accepted in every country so far. U.S. dollars are more stable while Bitcoin’s price can increase drastically (or fall) in the next few years.

Don’t miss out the latest news, subscribe to LeapRate’s newsletter

Cryptocurrency markets vs Forex markets: comparison of key features

Trading Forex online trading is very popular nowadays, just like trading the cryptocurrency market. Forex traders speculate on the changes in exchange rates of fiat currencies and crypto traders trade on live cryptocurrency prices through CFDs (contracts for difference). Basically, a CFD is a contract between a client (buyer) and a broker to pay the difference between the current price of an asset and the final price when the contract expires. Another similarity is that anyone can become a Forex or cryptocurrency trader. All you need is a mobile or PC device and a stable Internet connection.

Source: www.eventbrite.com

Key options for cryptocurrency and Forex traders:

| Cryptocurrency trading | Forex trading |

| Limited supply. Each cryptocurrency asset is limited to create the demand. There is a cap of the amount of created cryptocurrencies. In such a way, their value can rise. This works with Bitcoin. | Unlimited supply. Forex traders can trade the international currency market which offers an unlimited supply of currencies for exchange. |

| Quick and irreversible transactions. Crypto traders pay lower transaction fees because there are no third-party vendors or banks involved. | Leverage. Forex traders can trade using the leverage of 50:1, it means that for every $1 you invest, you can purchase up to $50 worth of currencies. However, while your profit can be 50 times bigger, your risk increases proportionally, so the losses can be devastating. |

| Massive potential profits for all investors. If you had invested $1,000 in Bitcoin back in 2013, in 2019 your gains would have increased by 10 times (despite all volatility and price drops). Something to think about, huh? | Liquidity is huge. Forex markets are overcrowded, it is easy to trade any currency or commodity, without any limitations. A single investor can’t affect the Forex market, like with the stock market, for instance. |

| Low entry barrier. Everyone can start trading crypto. Although, FX accepts everyone as well. | Fundamental analysis is very strong. New traders can find plenty of financial strategies based on economic events, news, statistical data, etc. |

| Commission is charged every time whenever a cryptocurrency transaction occurs. They may vary drastically due to the exchange service. | Commission fees for FX traders depend on the price for services set by each particular broker. Consider choosing FX broker with the lowest commission rates. |

| Risk management is very complicated if you are a cryptotrader because the market is very volatile. Substantial profits can easily turn into massive losses within a few minutes and vice versa. | FX traders have a better chance at predicting and minimizing risks. The average volatility rate in the FX market is no more than 1% compared to 15% volatility in cryptocurrency market. |

If you can’t choose between Forex trading and cryptocurrency trading, don’t worry. Most reputable Forex brokers offer both. AMarkets international brokerage company, for example, has diversified its portfolio offering a broad selection of trading instruments for both novice and experienced clients.

The best advice for novice traders who want to manage their risks and limit their losses is to diversify. Break down your trading portfolio into different assets classes and backtest your trading strategies prior to investing any serious capital.