The following market analysis was prepared by Ramy Abouzaid, ATFX (AE) Head of Market Research.

Following the outbreak of the coronavirus and the uncertainty in the markets, the eurozone economic sentiment – especially in its biggest economic countries – wasn’t really optimistic. And it is not like, they were that optimistic before – many long hours of monetary policy discussions and debates couldn’t deliver a clear vision on how to get through the slow growth the Eurozone has witnessed over the past year.

It seems like all applied strategies are just trying to push things a little further, but not radically change the economic vision or monetary policies. One might argue that the main challenge to the Eurozone if not a recession or growth battle, but a battle against a great stagnation.

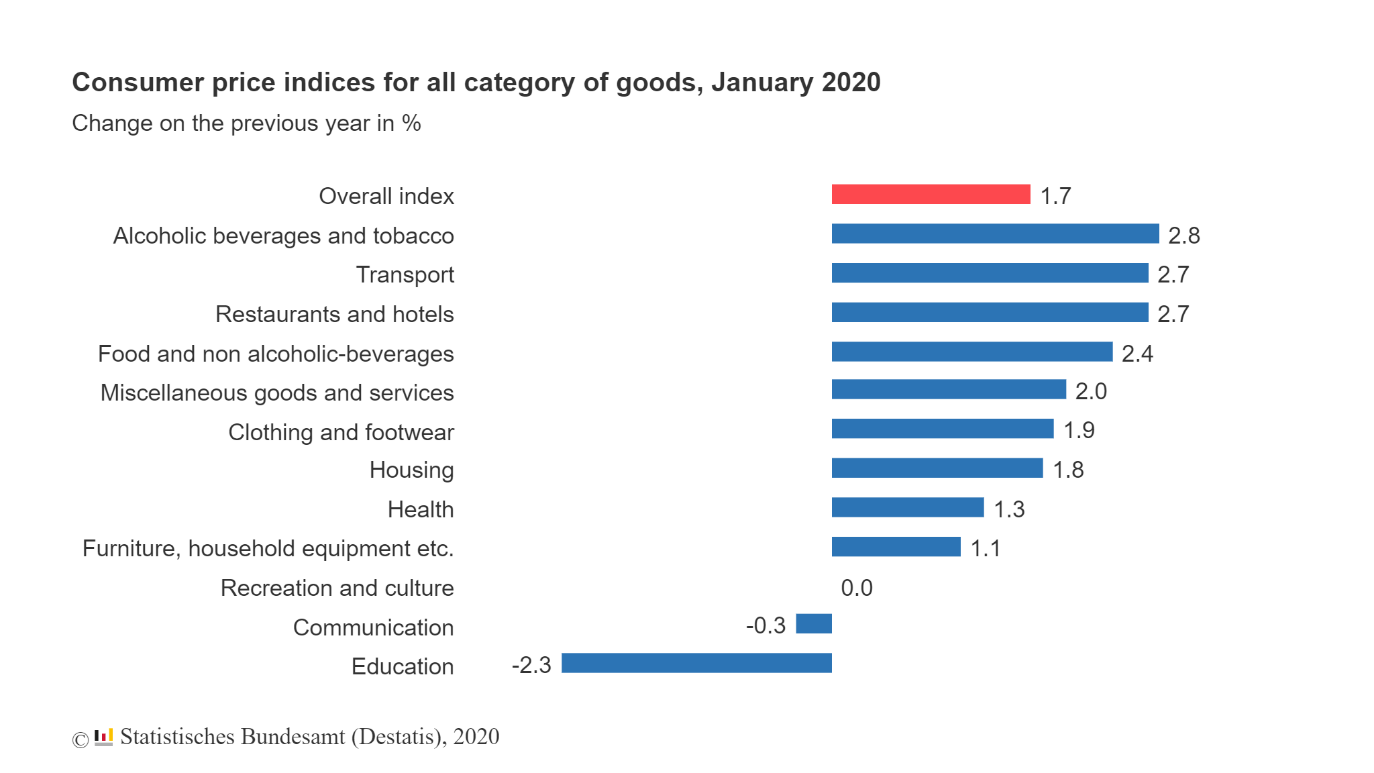

In its attempt to fight this prolonged stagnation, Germany’s consumer price index (CPI) showed a glimpse of positivity for the month of January, as it climbed to 1.7% – overpassing July 2019 highest level – and scoring 0.2% above its previous month percentage of 1.5%. We’re focusing now on Germany’s data since it is Europe’s biggest economy and since the Euro area, annual inflation data is yet to be published, with an expected rate of 1.4% for January. If the forecasts are right it would be a 0.1% increase from the previous month of December 2019 which witnessed an inflation rate of 1.3%.

Even if the forecasts came up better than expected, many indicators and updates predict a worse upcoming month for the euro area that still falls short – even without the approaching bad news effect – of an inflation rate close to 2%, the target of Europe Central Bank.

What to expect next?

As of Monday, the 9th of March, the European stocks closed lower as a direct reflection of coronavirus outbreak and the clear sell off oil prices, the European Stoxx600 plunged 7% lower the heavy energy shares witnessed a hard fall as the Europe’s oil & gas index SXEP crashed by 13%, and it seems like the ball has just started rolling.

A damaging impact on the energy sector is expected for the upcoming month, a direct reaction by the major drop witnessed in crude oil prices. Yet, in the current scenario, the fall of oil prices won’t just affect the energy sector. Usually, a fall in oil prices might have its beneficial aspects on private consumption and investment, but that won’t be the case in the upcoming month, again backed by the of coronavirus outbreak. With all the pressure on the Eurozone, it seems like the markets are betting on a proper monetary policy and measures to overcome the worst.

So far, the markets seem to have no confidence that the soft monetary policy of central banks will protect the economy from the massive downturn, despite an estimated € 20 billion increase in the bond purchase program to reach € 40 billion per month.

So, do we still hope for a recovery in Q1 or Q2?

We think, because of the spread of the coronavirus that is out of control, we will not see any growth next month in euro area GDP. But perhaps we can see a decline in CPI due to the decline of energy prices.