The following article was written by Quinn Perrott, General Manager of regulatory and compliance solutions provider TRAction Fintech.

Quinn Perrott, TRAction Fintech

Starting on 3 January 2018 are both MiFIR and MiFID II. MiFIR applies in all European Union states regardless of domestic implementation. However, as a directive of the European Commission, MiFID II requires enactment into the national laws of states in the European Union (EU). To date, MiFID II has only been implemented by eleven (11) European Union member states, leaving seventeen (17) states facing infringement proceedings from the European Commission.

What does implementation mean and which states have implemented MiFID II?

MiFID II, which takes the form of a directive, will apply only in states which have enacted the law domestically.

The European Commission maintains a list online of the member states which have communicated to it full transposition status, partial transposition status and those which have not communicated transposition measures.

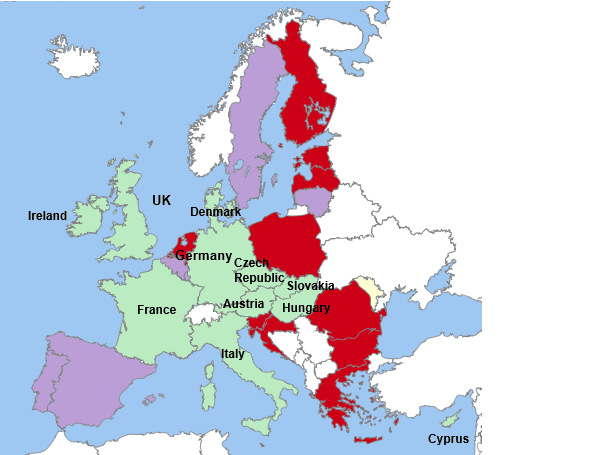

The list of members who have fully transposed MiFID II includes the UK, Cyprus, Germany and Italy, while those who have not communicated transposition status include Malta, the Netherlands and Bulgaria. The map below depicts the MiFID II transposition status of member states as shown on the European Commission website as at the date of publication of this article, naming those states which have fully transposed the directive.

If my regulator is in a country which hasn’t implemented MiFID II, does that mean I don’t have to do transaction reporting?

Transaction reporting requirements are contained in MiFIR, which is legislation that will become automatically binding on all EU states without the need for countries to incorporate its provisions into their national laws. Therefore, this obligation needs to be carried out regardless of your National Competent Authority (“NCA”) government’s implementation status.

MiFIR also contains obligations to:

- publicly disclose trade data for transparency purposes;

- undertake trades on a trading venue; and

- provide non-discriminatory clearing access; and

also contains rules around the supervisory powers of ESMA and rules for third country firms providing investment services. These obligations also apply across the EU irrespective of domestic implementations status.

How will MiFID II apply across the European Union?

Given that some states may transpose MiFID II after the 3 January 2018 implementation date, questions arise as to how firms operating across borders will be regulated. ESMA has answered some of these questions in its recent guidance to National Competent Authorities and in its market structure FAQs, in which it has said that the authorisations granted to operate a regulated market under MiFID I will remain effective and that regulated markets can operate in other countries, provided that certain conditions are met. It remains to be seen how ESMA will treat regulation of specific cross-border investment services.

If you would like to discuss this with us, please contact TRAction Fintech on +44 20 8050 1317.