The following article was written by Quinn Perrott, General Manager of regulatory and compliance solutions provider TRAction Fintech.

Quinn Perrott, TRAction Fintech

Natural person identifiers are an important part of transaction reporting and contain some complexity in their application due to the variety of identifiers available.

It’s widely-known that corporate counterparties need to be identified by their legal entity identifier (“LEI”) in MiFIR transaction reports. The LEI requirements have received a lot of industry attention because the corporate client LEI is not just an identifier, but a pre-requisite to providing investment services to clients (though this is subject to temporary relief).

Many of the fields in MiFIR transaction reports require reporting of natural person information including identifiers, names and dates of birth. The identifiers are a combination of the nationality of the client and an identifier used by the country in question. Which identifier is used will depend on the priority given by the rules accompanying MiFIR.

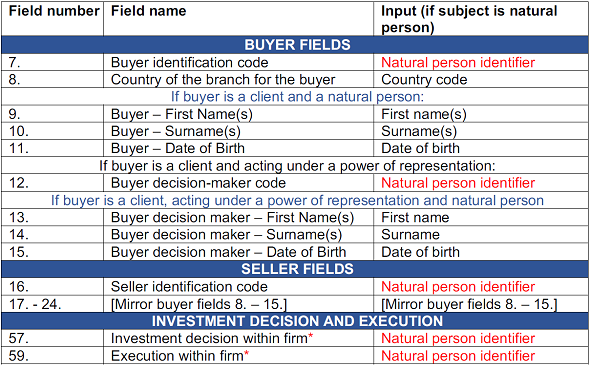

Fields which require population of a natural person or corporate identifier

The fields requiring inputs of natural person identifiers as provided in RTS 22 are summarised below.

N.B. There are some exceptions e.g. where the identity of a party is not disclosed.

* To learn how to populate these fields and the “trading capacity” field, see our page on MiFIR Reporting for STP Brokers.

Rules for use of natural person identifiers

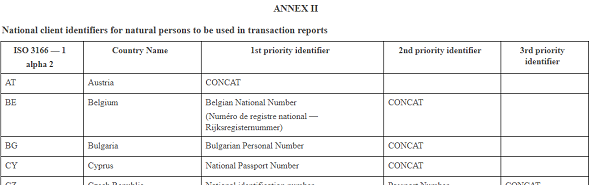

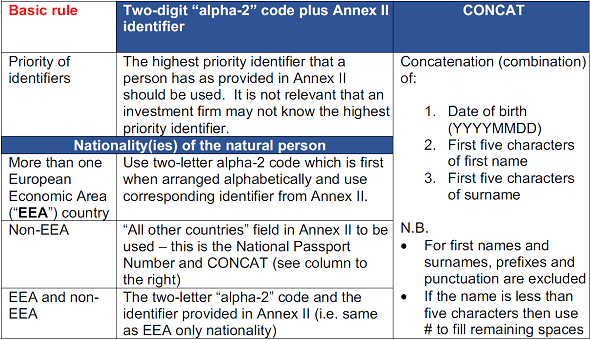

RTS 22 provides in clause 61 that a natural person should be identified by the two-letter country identifier provided by ISO 3166-1 as the “alpha-2” code and the identifier provided in Annex II of the RTS. Annex II lists various identifiers for each country code (up to three in order of priority), as depicted in the image extract below.

The identifier will typically be a passport number or a unique code specific to a country e.g. UK National Insurance Number. For citizens of some countries, or where the primary mode of identification is unavailable, a CONCAT code will be required to identify the natural person which is a concatenation of the name and date of birth (see right hand column of the table below).

The rules around use of natural person identifiers are provided in the other parts of Article 6 are as follows:

Firms need to make sure that this data is not only in their possession but that it is stored in such a way as to make it readily accessible for the purpose of generating and submitting daily transaction reports.

If you would like to discuss the natural person identifiers you are required to use in your transaction reports, please contact us on +44 20 8050 1317 in the UK or +357 25 123309 in Cyprus.