As copy trading becomes ever more popular, and novice traders continue to follow experienced trading strategies that suit their investment goals, FXTM’s Nikola Grozdanovic asks, what is copy trading all about?

Nikola Grozdanovic, FXTM

Copy trading provides people interested in investing in the financial markets (or ‘investors’) with an avenue to automatically copy forex traders whose strategies are more advanced. In essence, the traders getting copied are similar to ‘managers’ – as they manage both their own positions, and by default, all of the positions of investors following them. Without needing to flex any of their own trading muscles, an investor signs up for a copy trading program and the suitable manager they choose to copy, acts as a kind of proxy in the markets for them. All positions opened and managed by the more experienced trader, are automatically copied for the investor.

Those of you familiar with the term ‘mirror trading’ might be wondering what the difference between copy trading and mirror trading is. In fact, the idea behind the two concepts is virtually identical – mirror trading also allows forex traders to automatically copy specific strategies – but copy trading is a much more simplified version. With mirror trading, investors are typically copying large volumes of trades, whereas with copy trading the investor chooses to follow specific managers.

The exact process of what accounts are involved and the specifications of what gets copied varies from broker to broker. In general, the manager’s opening and closing positions, as well as the allocation of Stop Loss and Take Profit orders in his strategies, is directly reflected in the investor’s account. The manager assigns a certain percentage as a commission fee that gets taken from any earning he makes from the trade.

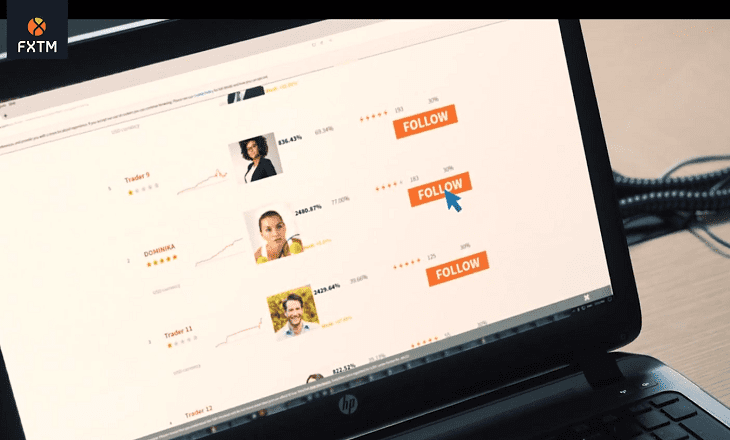

FXTM’s copy trading programme, FXTM Invest, has quickly become one of our most popular offerings. The feature is built completely in-house, with the intention of maximising the value traders get from copy trading without making it arduous, time-consuming or expensive. There is a choice of over 1800 managers (called Strategy Managers) who can be followed assuming that they are suitable for the investor– their trading strategies displayed in public on their own designated pages, where investors can analyse their trading history, statistics and drawdown rates, even calculate the profit they would have made if they followed them from the day they became Strategy Managers. On the flipside, managers get to set their own commission (Performance Fees) in percentages – up to 50%, so the earning possibilities for both parties is quite high.

Thanks to the proliferation of copy trading in forex, those traders who either feel they’re not experienced enough to confront the markets, or simply do not have the hours necessary to prepare, train and trade themselves, now have a way of building their own investment portfolio. Rather than investing directly in standard financial instruments, these types of investors are actually investing in other traders and their strategies.

Of course, as with everything related to the forex market, it’s important to understand the risks involved. Even if they’re not doing any actual trading themselves, investors automatically copy all trading from their chosen managers – including the trades that end up in losses. Even if a manager has a near-perfect past record, that record does not guarantee that future results will be profitable – the forex market is an untameable beast whose actions and movements are difficult to predict with any real certainty.

Managers whose trades are copied are usually well aware of this, and they implement their own risk management techniques to safeguard themselves from unpredictable and negative shifts in the market. Regardless of the copy trading programme the investor chooses, be it FXTM Invest or any other, as long as they sign up with a thorough understanding of all the risks involved, there is the potential to make profit as well as a loss.

Those looking for their perfect forex partner can visit the FXTM Invest page for more details on the benefits and how to sign up.

Disclaimer: This article comprises of personal opinions and ideas. It should not be construed as containing investment advice and/or solicitation for any transactions in financial instruments and/or a guarantee or prediction of future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available, and assume no liability as to any loss arising from any investment based on the same. Past performance does not guarantee future returns.

Risk Warning: Trading Forex and CFDs involves significant risk and can result in the loss of your invested capital. You should not trade unless you fully understand the true extent of your exposure to the risk of loss. When trading, you must always take into consideration your level of experience. If the risks involved seem unclear to you, please seek independent financial advice. Please read FXTM’s full Risk Disclosure.

NOTES TO EDITORS

FXTM brand is authorised and regulated in various jurisdictions. ForexTime Limited is regulated by CySEC (185/12), licensed by FSB of South Africa (FSP No. 46614) and registered with FCA of UK (600475). FT Global Limited is regulated by the IFSC of Belize (IFSC/60/345/TS and IFSC/60/345/APM).

For more information about FXTM, please visit www.forextime.com.