Mati Greenspan, Senior Market Analyst at FX broker eToro, has provided his daily commentary on traditional and crypto markets for April 29, 2019. The text below is an excerpt and does not contain the full analysis.

Highlights include:

- NY AG Pursues Bitfinex & Tether: The crypto market dipped on the news that the New York Attorney General has publicly accused Bitfinex and Tether of spending $850 million in Tether reserves. Tether’s Dollar peg has held up, but a price gap has emerged between exchanges that use Tether and those that don’t.

- Fed to Tighten Rates? Pressure is now back on the Fed as it will be difficult for them to justify a policy of patience with GDP growth numbers smashing expectations.

- Crypto Back in Investors’ Sights: IOTA’s partnership with Jaguar Land Rover and Andressen Horowitz’s new crypto fund are signs that investor interest in crypto is back in the spotlight.

- Volatility Low as FAANG Earnings Hold Strong: Markets are relatively low as earnings from Alphabet and Apple will be announced today and tomorrow. Facebook, Amazon, and Netflix all smashed their respective first-quarter earnings.

Today’s Highlights

Asian markets rose this morning, presumably on trade optimism as US-China talks resume in Beijing this week.

The European session is not going quite as swimmingly today. Very possibly due to the results of Spain’s elections, which saw a surprise victory for the socialist party.

All things considered though, markets are still pretty calm and volatility remains low as we await earnings reports from Alphabet this evening and Apple tomorrow. Facebook, Amazon, and Netflix all smashed their respective first-quarter earnings, so things are looking pretty good for the FAANG group so far.

Smashed Growth

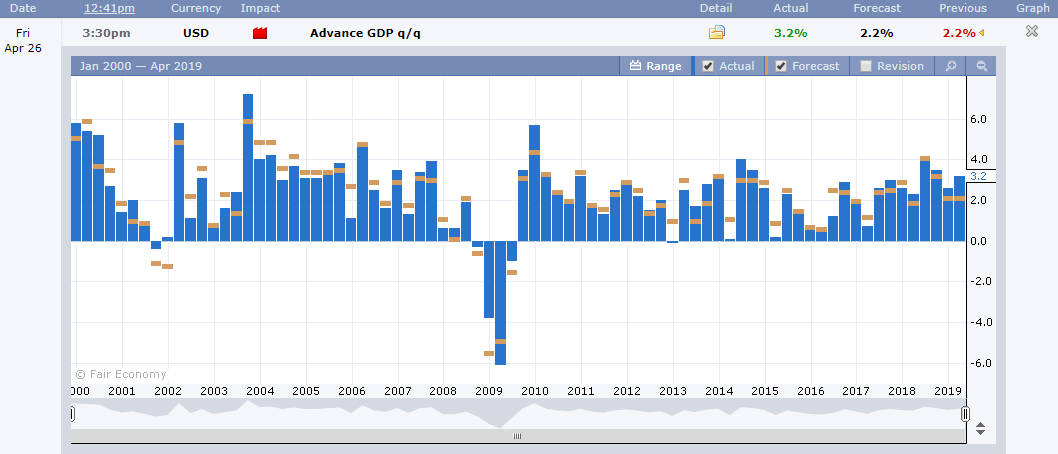

On Friday, the United States reported its biggest growth beat since 2010. Analysts were expecting to see GDP growth figures chug in at 2.2% but instead, the numbers surprised to by a full percentage point higher at 3.2%.

This graph shows the Advance GDP in blue and the analyst forecast in gold.

This is the latest sign that the US economy is doing really great at the moment, at least from a macro perspective. Pressure is now back on the Fed as it will be difficult for them to justify a policy of patience with figures looking this good. They may soon be forced into further monetary tightening, especially since stock markets are once again breaking new record highs.

Crypto Winter is Over

Investor interest has been picking up again in the crypto market in a big way.

There have been some phenomenal gains in many crypto assets since the market lows of mid-December, but that’s not specifically what I’m talking about right now.

During an interview, I once heard Jeff Bezos responding to Amazon’s price crash when the tech bubble popped. Amazon shares went from triple digits to single digits in a matter of months but Jeff was unfazed. He says, and I’m paraphrasing, the stock price crashing only affects companies that are trying to raise capital but we already had all the money we needed. In the meantime, all of our metrics including userbase and sales were growing at a rapid rate.

Sometimes we need to look beyond the price. In this case, we can already see signs that investor confidence in the crypto industry is rising rapidly.

A few projects that are seeing a rush of investor interest these days, but what really caught my attention is this…

The VC firm Andreessen Horowitz has been responsible for funding some of the biggest tech startups in the world and the fact that they’re going big on crypto inspires me with great confidence.

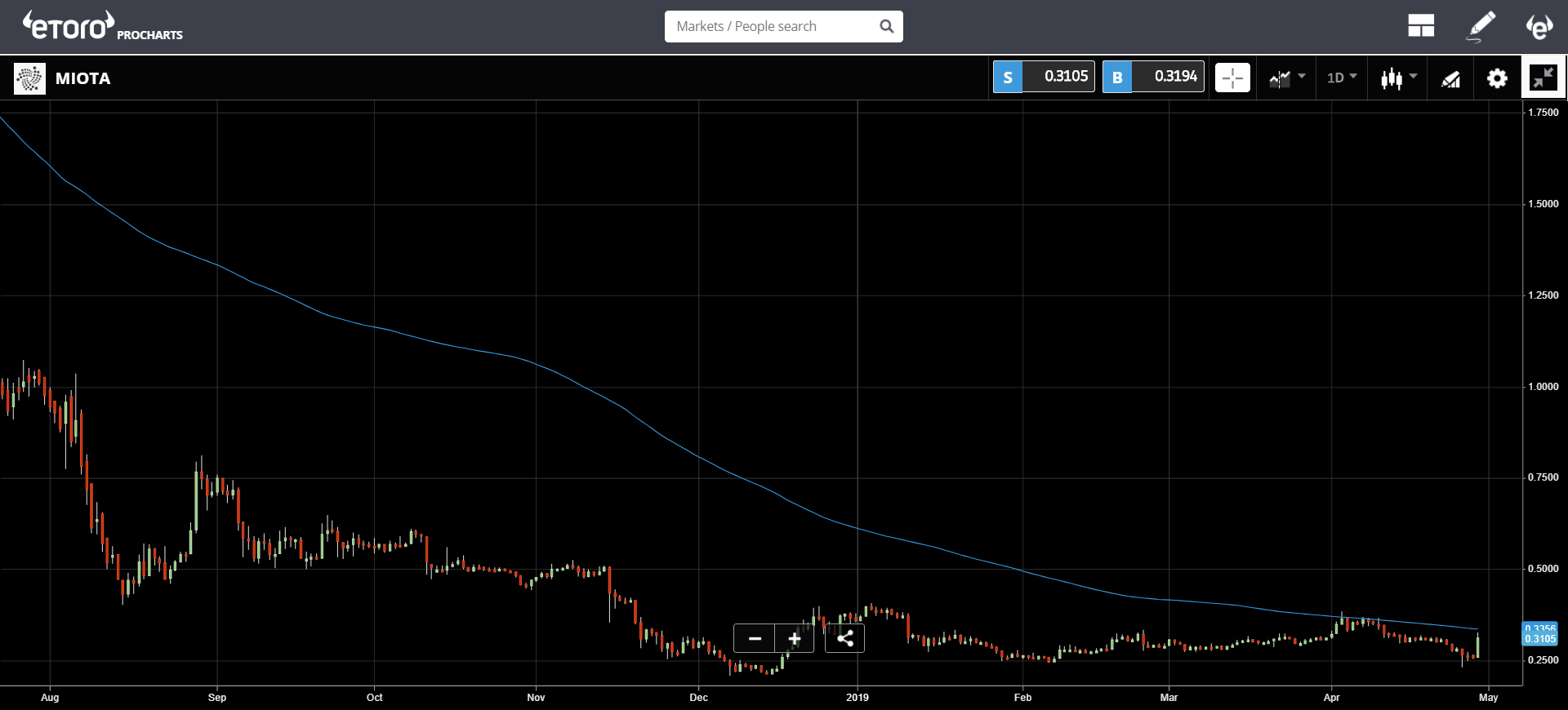

Outperforming today has been IOTA, who just announced an interesting partnership with Jaguar Land Rover.

Now, we have heard a few of these type of announcements before that turned out to be fake news but this one appears to be genuine. Here is a blog post on Jaguarlandrover.com that explains the pilot they’re doing and how they want to use machine to machine microtransactions on IOTA’s tangle to improve the motorist experience.

Needless to say, IOTA is up more than 20% today, which comes at an ideal time as the token was showing signs of trouble in the price action over the last few weeks. Declining despite optimism in the rest of the crypto market. Now we can see it giving a serious test to the 200-day moving average (blue).

Let’s have a fantastic day!

Mati Greenspan can be found on LinkedIn, Twitter, or etoro.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.