Shares of Australia based currency transfer provider OFX Group Ltd (ASX:OFX) popped today, up 17% after the company reported Full Year 2017 results. OFX Group, formerly known as OzForex, has a March 31 fiscal year end.

OFX Group’s results reflected growth in active clients and transaction volumes with good momentum in the US, but lower Average Transaction Values (ATVs) from individual customer transactions, especially in the UK.

The company saw a slight and unexpected improvement from its first half results, which disappointed investors and hit OFX shares hard back in November.

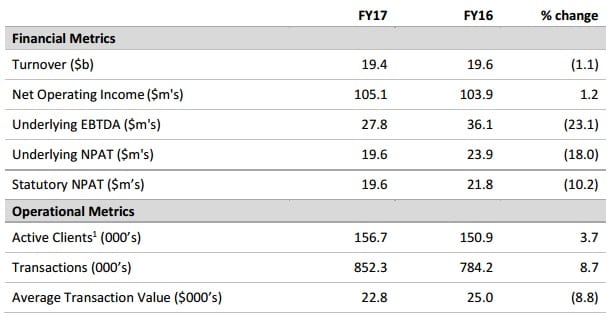

Highlights of Fiscal 2016 at OFX Group include:

- Turnover of $19.4b, in line with FY16, driven by:

- Active clients up 3.7 %to 157k, of which the corporate segment grew by 6.7%;

- Transaction volumes up 8.7% to 852k, up 10.5% in H2 FY17 against H2 FY16; and

- ATVs down 8.8% to $22,800.

- Fee and trading income of $114.1m, up 2.5% on FY16, with 13.6% growth in North America;

- Net Operating Income of $105.1m, up 1.2% on FY16 ($103.9m)

- Underlying EBTDA of $27.8m and underlying NPAT of $19.6m in line with guidance;

- Global rebrand completed in key US and UK markets: remaining geographies in FY18;

- Investment in people and technology to drive productivity and enhanced customer experience; and

- Final dividend of 2.9 cents per share fully franked.

OFX’s Chief Executive Officer and Managing Director, Skander Malcolm, said:

It is good to be able to deliver the 2017 annual result in line with previous guidance. Operating conditions have been challenging, with revenue affected by lower ATVs in the wake global economic and political uncertainty. Despite this, the fundamentals of the business are strong, with overall transaction numbers and our active client base growing, whist maintaining our margins. We have also diversified our revenues with good growth in North America and our Corporate segment, to help offset lower individual transaction numbers and ATVs, especially from the UK due to the decline in GBP.

Our current earnings reflect continued investment in people and technology to take advantage of the enormous growth opportunity we see across our markets. Our technology investment is already paying off, with hosting costs continuing to decline each quarter, security enhanced, and improved search engine optimisation due to faster load times.

The execution of the rebrand in Australia is complete, and the !earnings applied from that drove the successful rebrand in the UK and the US, restoring search rankings in under 8 weeks.

Our teams have worked incredibly hard all over the world, and it’s a credit to them that we have operated well throughout the significant changes we are implementing.

OFX’s balance sheet remains strong with a pre-dividend cash position net of customer liabilities of $42.6m (before regulatory requirements) as at 31 March 2017 and no debt.

The company’s shares, which closed Tuesday at AUD $1.54, are still well down from the $2.00-$2.50 range they traded in a year ago.

OFX Group one year share price graph. Source: Google Finance.