The price chart of Bitcoin now resembles a “hockey stick”. A constantly increasing price with time, with only small corrections here and there. Bitcoin is now trading at around the $7,300 level, hitting new all-time highs almost every week for the past month. With 889% growth this year, according to Coinbase, Bitcoin has helped the market capitalization of the entire digital currency market to reach $200 billion.

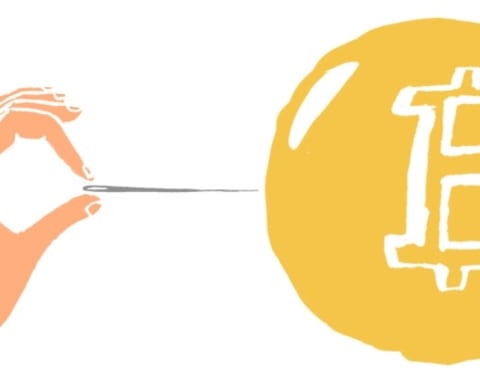

According to an article published by Forbes, investment advisors are now relating bitcoin to previous bubbles that essentially crashed the world economy like the housing bubble of 2007 and the 1929 stock market crash.

Ku Trang Ho reported the opinion of the CEO of Black Dog Venture Partners, Scott Kelly:

“A month before the 1987 crash, my cab driver said he started day trading. A month before the real estate crash in 2007 in Arizona, my cab driver said he was getting into flipping real estate. Last week, my Uber driver said he just started trading Bitcoin.”

Jamie Dimon of JP Morgan Chase, Ray Dalio of Bridgewater Associates and Warren Buffet have all in one way or the other, called the “people’s currency” a “fraud”.

There are several factors that come into play when such great financiers think of bitcoin as a bubble and a fraud. First, bitcoin was slammed as the currency of “crime”, one that can be used by terrorists and criminals. Second, the tremendous hype and growth bitcoin has seen in just one year is off the charts. Such rapid growth and “popularity” often makes even the greatest bulls of the market bears. The limited supply of bitcoin also contributes to the sense that everything may be just one big bubble, resembling the housing crash of 2007-2008. People are confident in the value of bitcoin, as the currency gained approval in countries such as Russia, Ukraine and even Iran. Most of all, financial institutions seem to fear the wide spread of bitcoin, since the currency is not regulated and the elimination of financial intermediaries may prove troublesome in the future.

On the other hand, the one thing that separates bitcoin from potentially turning out to be a bubble is the blockchain technology on which it is built. Blockchain has now entered and disrupted a series of industries. What is more, blockchain is no longer connected to finance only, but also to AI, healthcare, edtech, and many more.

At the end, many say that bitcoin is a bubble because of numerous factors. However, with the solid blockchain technology behind it and the rapid spread of the digital currency around the world, bitcoin is here to stay.