In its initial idealized beginnings, Bitcoin was intended to be another payment option at the point of sale, free from interference by bankers and a cheaper alternative for merchants. A few zealots actually predicted that Bitcoin would soon rival Visa and MasterCard at the point of sale, but that dream soon disappeared, as BTC became more of a speculative investment, rather than a popular retail medium of exchange.

Merchants had originally benefited from float holdings, while Bitcoin continued ramping up in value, but, when Crypto Winter arrived, an already declining retail usage payment volume fell even more. Over its first decade of experimentation, Bitcoin’s “Achilles heel”, so to speak, became readily apparent. A transaction might take a few seconds to originate, but another ten minutes to confirm on the blockchain, even more so, if the system was under stress due to higher through put.

The Visa network, by comparison, can process as many as 65,000 items in a second. The battle with the “Big Boys” was over before it ever got started, but crypto developers did not back away from the issue. The definition of the problem at hand was that the Bitcoin settlement network was not “scalable”. The supposed solution, the Lightning Network (LN) set of enhancements, was launched to much fanfare in January of 2018.

It is described as a “two-layer” payments solution. The technical explanation is far too complex to explain, but its essence is to create alternate payment channels on the network in order to allow payments to flow quickly, without the ongoing need to confirm the items on the blockchain. Once the payment is completed, the channels are closed, and the normal confirmation process on the ledger takes place.

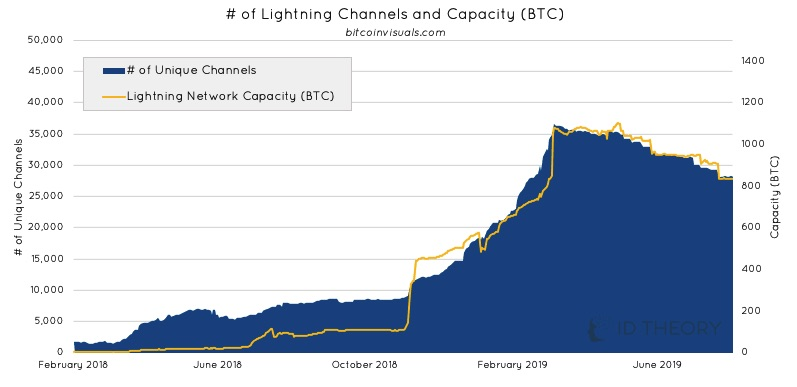

Source: bitcoinvisuals.com

Node operators immediately went to work, converting nodes to LN and building channel capacity. The number of unique channels climbed, as shown in the above chart from ID Theory, a crypto investment firm, from inception to a peak of 36,200 in Mid-March of this year. It has since tailed off, perhaps, as operators eliminated channels that do not produce acceptable income. In mid-March there were roughly 4,200 nodes, and this figure has not shown a pull back, but capacity correlates with channels, as depicted.

Lewis Harland, the ID Theory analyst who reported these results, spoke with staff at Crypto Briefing and shared his thoughts regarding the decline:

A lot of [existing] nodes are closing out their under-utilized channels. Opening and closing of channels require on-chain transactions and so it becomes expensive to use as a system if only single-transactions are made in LN channels simply because it’s capital intense, structurally.

There is another technical point to the LN solution that may be its downfall. An operator must tie up Bitcoin to be used as “float” until the transactions are confirmed. LNBIG, the largest node operator with 40% of the LN nodes has tied up $5 million worth of BTC in order to run its piece of the LN puzzle. Current fee revenues do not come close to providing even a reasonable return on this investment.

Early Bitcoin marketing materials professed that merchant fees, an historical source of irritation, would be much more economical than with payment giants like Visa and MasterCard, but here we are, one decade down the road, and it appears that the low fees must change if the LN network is to survive. Bitcoin’s point of sale narrative will continue to struggle, until the scalability and processing economics make sense.