Over the past two months while Bitcoin has been range bound, there have been a multitude of explanations for its sluggishness and inability to leap forward from its $10,000 perch. As for what could happen next, there are just as many predictions, primarily based on technical interpretations of the pricing “tealeaves”, but at times like these, Bitcoin tends to ignore what others might call a technical imperative. Suddenly, during late Wednesday trading, the world’s favorite digital asset fell $600, but why?

Confusion reigns at the moment in the analyst community. No one saw so sizable a dip on the horizon, but when does anyone accurately pick up on such a move until after the damage has been done. The forensic specialists typically follow, allowing everyone time to pore over the news and their charts to guess away at causes, until a broad consensus forms. For now, let’s start at the beginning – the fall from grace:

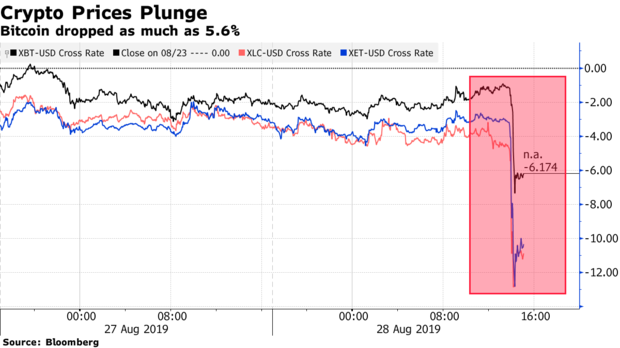

Source: Bloomberg

The above chart, courtesy of Bloomberg, is a snapshot of the percentage changes over time for Bitcoin, Litecoin, and Ethereum. As some investigators have noted, the major fall did not start with Bitcoin. Investors had already begun to shun other major cryptos, before the major damage was done across the board. From a valuation standpoint, BTC had been hovering around $10,100. It dipped to $9,340, but recovered to $9,500.

The race to determine reasons was then on. Bloomberg noted that Jeff Dorman, chief investment officer at Arca, believes the market is very sensitive at the moment:

It’s the week before Labor Day. Half of crypto is at Burning Man and the other half is sitting on their hands doing nothing. Volumes are low and it takes very little to move markets right now, and you have big futures/options expirations coming up at the end of the week. The only definitive thing I can point to is that the move was led by declines in EOS, ETH, XRP, BCH, LTC and other large-cap tokens that have been out of favor for months. I just don’t think there are a lot of investors willing to defend price right now.

The reference to the futures market then drew this comment from Dave Balter, chief executive of Flipside Crypto Inc. in Boston. He spends his time tracking transaction flows for speculators and other large trading action:

From our end, it looks like it was a sell-off to cash settle futures that are coming due on Friday for BTC.

There has been a great deal of talk about filling an existing “gap” in CME futures contracts, which had the potential of driving prices down to the $8,500 level, but the above suggestions pertain to current contracts that could expire at prices below the prevailing market. The suggestion is that someone on the wrong side of those deals could be selling large today to drive prices lower and push his contracts into the money, as it is called.

Lastly, a few analysts are also hinting that China could be the “smoking gun”. Chinese officials have been pushing hard to launch a national digital asset, which would imply a major crackdown on all remaining vestiges of Bitcoin and any other crypto still traded on the mainland. Such a strict ban might block the continuing flood of Chinese capital seeking a “safe haven” in Bitcoin, or so this theory goes. The issue here, however, is that this is not “new news”, nor is the long-term impact on Bitcoin and other cryptos.

For the time being, Bitcoin is slowly recovering higher, now over $9,525 and climbing. The week still has a ways to go before weekend trading kicks in, but, as long as volumes remain low, we could easily see major swings in both directions, until this dust settles.

More recent bitcoin news can be seen below: