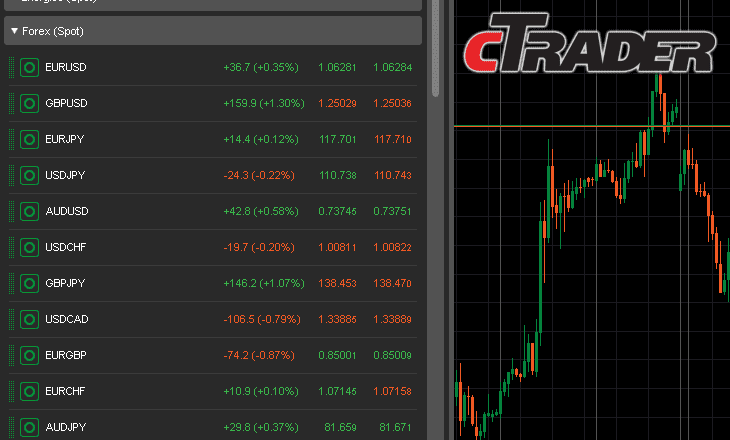

Spotware announces updates to cTrader including scaling stops and improved GUI

Forex platform developer and technology company Spotware Systems today officially announced updates to cTrader for Windows for November 2016. These updated features are now available in cTrader for Windows. The new features include the following: Smart Stop Out A new Stop Out logic has been introduced to cTrader. No longer are entire positions closed to help…

Read more