The following article is based on research by Marshall Gittler, Head of Investment Research for FXPRIMUS.

FXPRIMUS Week in Focus for week beginning 21 Nov: UK Autumn Statement, Preliminary PMIs, US “Black Friday”

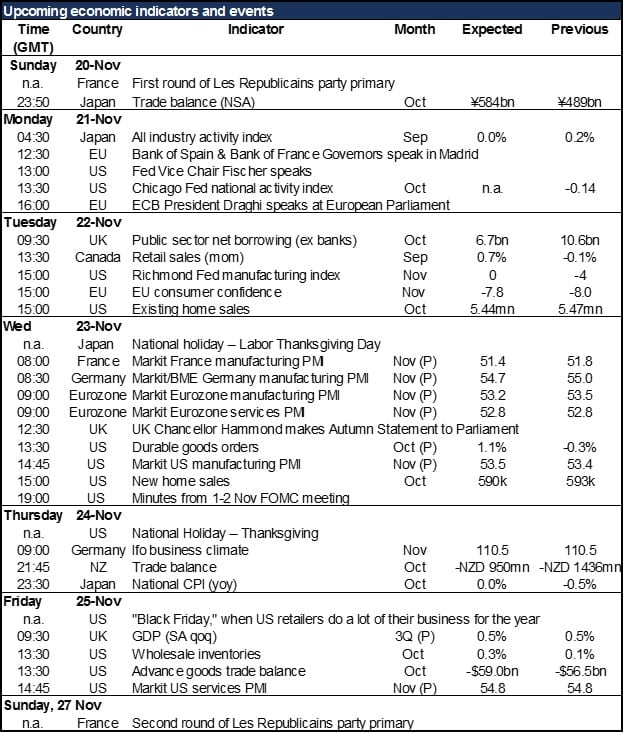

Traders exhausted by all the excitement of the last two weeks can relax a bit this week. With the US Thanksgiving holiday on Thursday, many US traders close up shop Wednesday at midday and take Friday off as well. Japan too will be closed for its Thanksgiving on Wednesday. Of course, that could just mean thinner, more volatile markets.

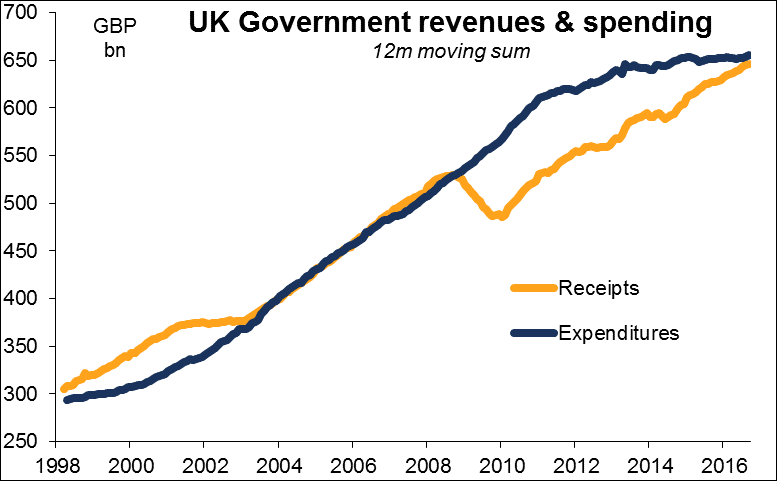

The UK Autumn Statement isn’t likely to shock the markets. In the wake of the Brexit vote, Chancellor Hammond may delay his predecessor’s plan to narrow the deficit, but he’s unlikely to abandon the overall direction of policy entirely. Nonetheless, with the economy receiving more support from the fiscal side, it shouldn’t need as much support from the monetary side. That means the statement could be bullish for the pound.

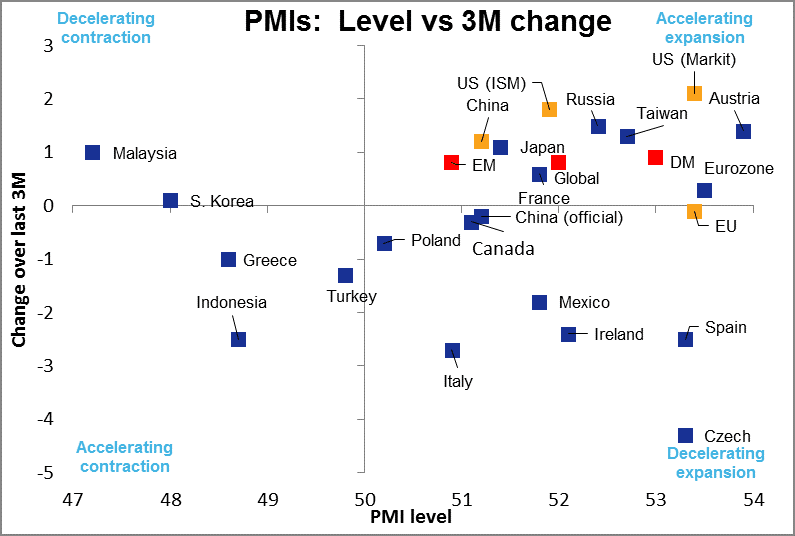

The same day, the major economies’ preliminary PMIs will be released. The PMIs suggest that the global economy is in relatively good shape, with many of the major countries in the “accelerating expansion” quadrant. The November Eurozone PMIs are expected to be a bit weaker, while the US manufacturing PMI is expected to be a bit stronger. That difference could reinforce the economic divergence theme and push EUR/USD even lower.

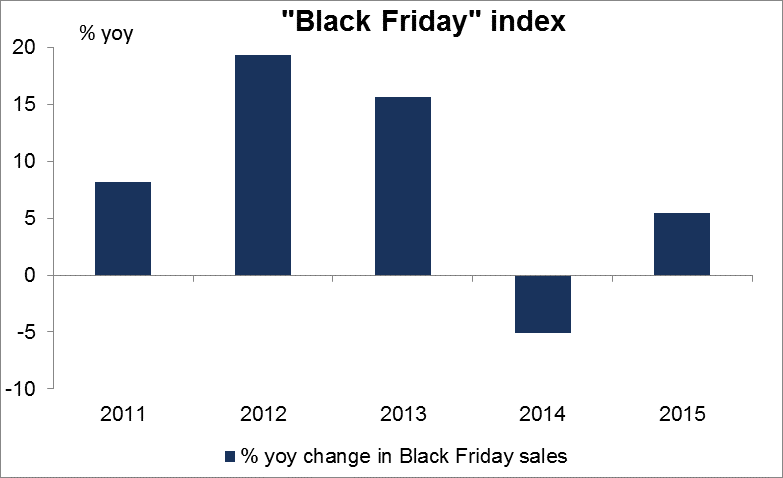

For the US, the other major indicators are durable goods and new home sales on Wednesday. But the big event is “Black Friday” on Friday. The day is referred to as “black” because supposedly retailers operate in the red for the whole year until that day, when Christmas shopping begins and they go into the black. Reports of how well the sales go that day are considered to be an early indication of how the Christmas shopping season will go and are therefore an important barometer of the health of the US consumer and the US economy. Since last year was nothing special, retailers may do better this year. That would probably boost the dollar when trading began again the following Monday.

Wednesday’s release of the minutes of the November FOMC meeting would normally be a big event, but with the market already seeing a 96% probability of a rate hike in December, it’s hard to see how the needle can move much further.

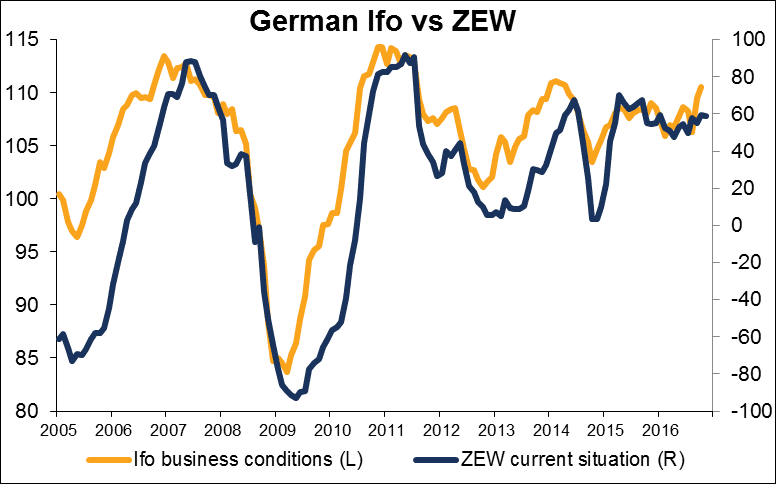

For the EU, the Ifo indices are expected to be unchanged. That would be an improvement from the ZEW index and would show sentiment at least holding up in the wake of the US Presidential election, which could be taken as positive for the euro.

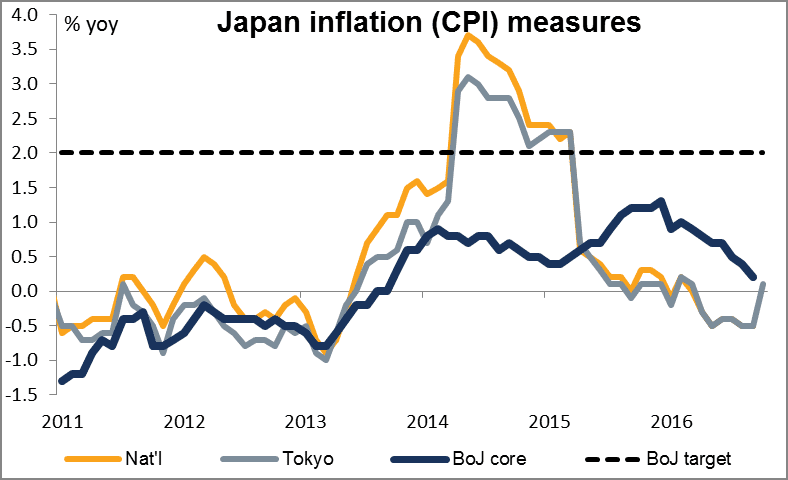

Finally, Japan announces its CPI on Thursday (Friday morning Tokyo time). The national CPI is expected to pop back into positive territory because of the rise in fresh food prices. Nonetheless, prices aren’t rising fast enough to change monetary policy for some time. Accordingly, US politics and global risk on/risk off are more likely to be the driver of JPY than domestic economics for now.

Speaking of politics, the French conservative party Sunday held the first round of its two-round process to select the party’s Presidential candidate. Former PMs François Fillon and Alain Juppé will face off in the second round next Sunday. Whoever wins is likely to go up against the National Front’s Marine le Pen in the final round of the Presidential election next May and should have a good chance of winning. Thus this election may decide the next President of France – one way or the other.