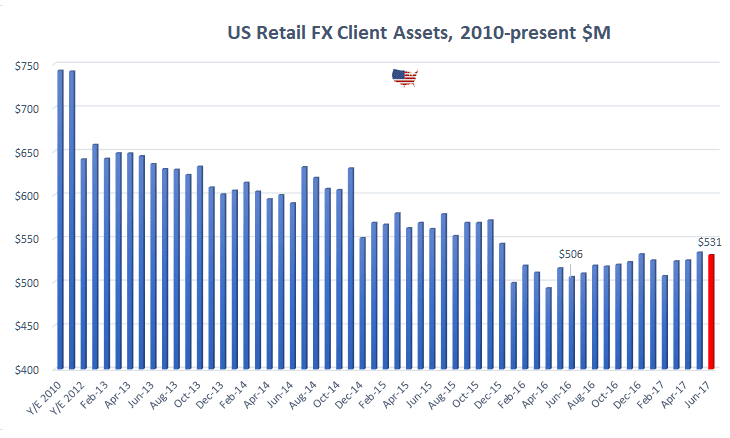

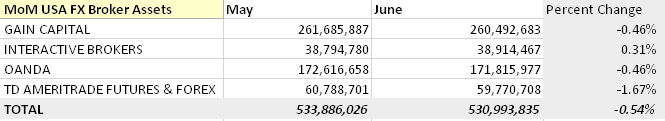

US retail forex broker client assets showed a slight MoM slippage according to data filed with the CFTC as of June 30th. The report revealed a 0.54% contraction in assets held by Retail Foreign Exchange Dealers (RFEDs) from May’s $533,886,026 to $530,993,835 for June 2017.

This is a very slight drop as most of the volume reports in the industry came in positive MoM for June 2017. GAIN Capital even reported a 10% increase in retail trading volumes during the month. May’s overall total showed a 1.74% increase from April, so we’ll see if next month’s July data will continue a modest positive trend building in US retail client forex assets.

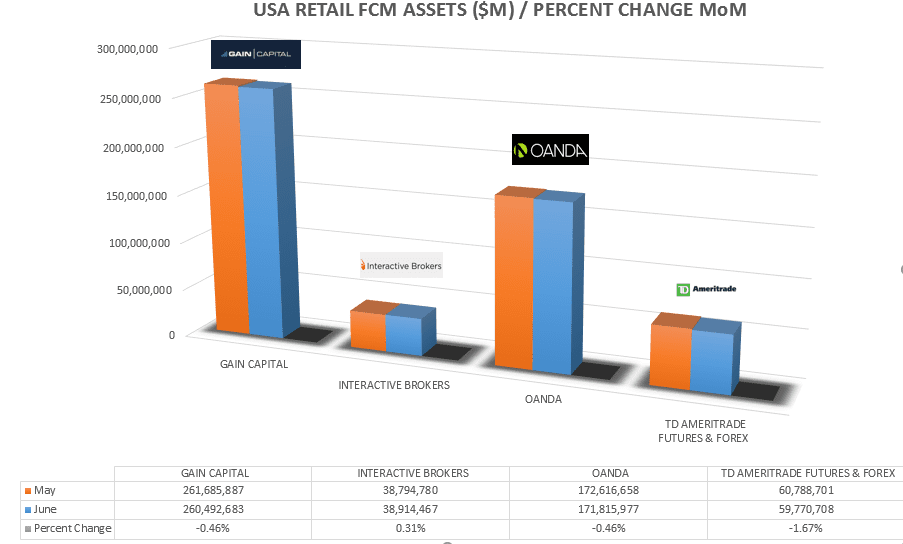

The winner for the month in percent gained was Interactive Brokers. Although, we are still anticipating their reports to be removed shortly, as the broker shut down its US retail Forex operations last summer.

Besides Interactive Brokers, all RFEDs saw a small drop in client assets. Gain Capital Holdings Inc (NYSE:GCAP) and OANDA, in that order, will continue to be the leaders of the pack for the foreseeable future. OANDA’s assets for June made up a little bit space in the gap between GAIN Capital, with the broker now sitting $88,676,706 behind in client funds.

The detailed monthly changes from May to June are in the following graphs (click to enlarge):