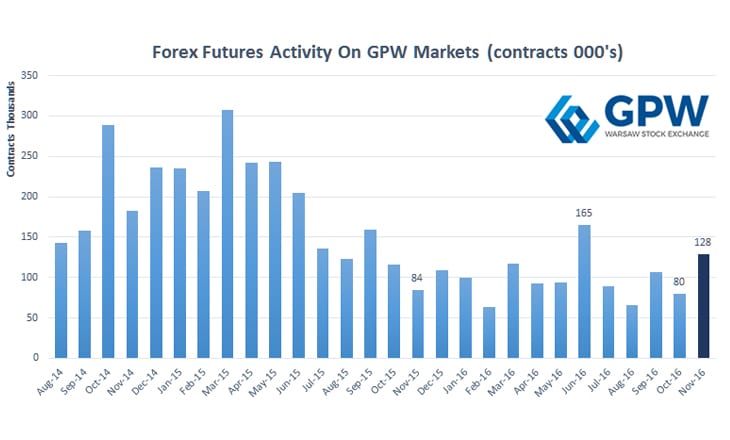

Warsaw Stock Exchange November Forex futures volume jumps 61% MoM

Today the Warsaw Stock Exchange (GPW), the biggest securities exchange in Central and Eastern Europe reported monthly metrics for November 2016…the currency segment recorded a nice rebound in volumes. The total volume of currency future transactions rose by 52.3% year on year to 128,445 contracts in November 2016 from November 2015’s 84,332; activity also rose heavily month on month by 61.4% from…

Read more