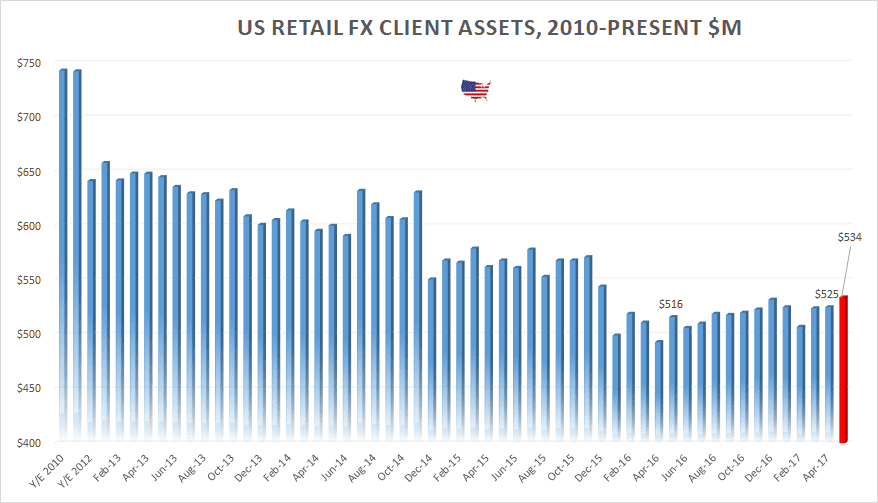

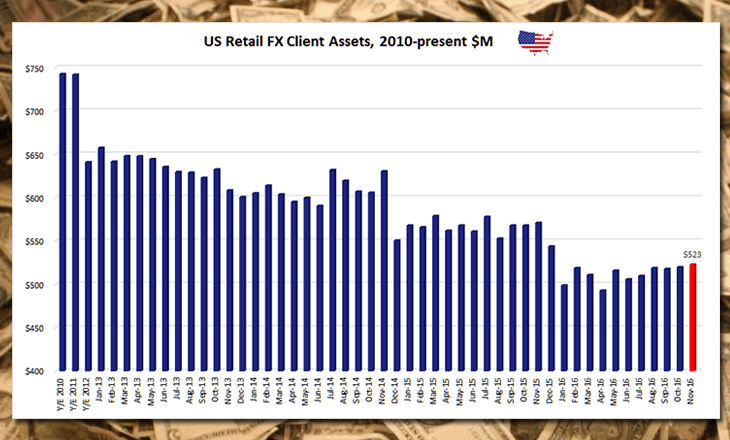

US Retail Forex client assets for May sees increase to $534 million

U.S. Retail Forex Broker client assets held showed a MoM uptick from reporting data filed with the CFTC as of May 31st. The report revealed a 1.74% increase in assets held by FCMs from April's $524,757,888 to $533,886,026 for May 2017. This is also $10 million more in assets from March’s $523,750,637. If the trend…

Read more