Payments services and technologies provider SafeCharge International Group Ltd (LON:SCH) has announced its financial results for the first six months of 2017, which were a period of solid performance and delivery for the group.

Transaction volumes continue to grow with very strong growth in the value of transactions processed through SafeCharge Acquiring. During the period, the group successfully launched a fully serviced global payment solution to Tier 1 customers and it has a strong sales pipeline, although the revenue growth to maturity from these long-term Tier 1 clients is taking slightly longer than anticipated. The company continues to generate significant free cash flow, which is being returned to shareholders through the company’s dividend.

As far as outlook goes, SafeCharge stated that it has enjoyed a strong start to the second half of 2017 benefiting from the launch of new clients, many of whom had started processing on the company’s global acquiring platform by the end of the first half of the year. The Board remains confident that the outcome for the year will be broadly in line with market expectations, and the Directors look forward with confidence to the rest of 2017 and beyond.

Financial highlights

The first half of 2017 included:

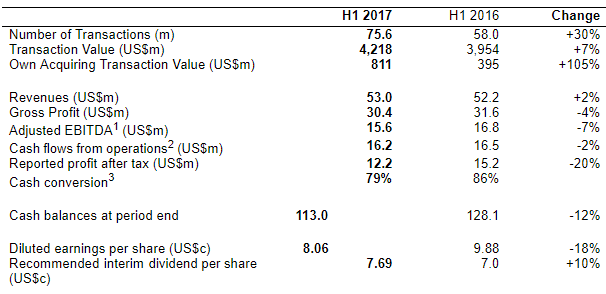

- Increase in transaction value by 7% to US$4.2 billion

- Continued revenue growth after the reshaping of the existing customer base undertaken during 2016 to upgrade the quality of revenues which contributed US$4.6 million to the comparative period

- An impressive cash conversion, and strong balance sheet with US$113 million of cash balances and no debt

- Increase of interim dividend by 10%

Operational highlights

- Successful launch of a fully serviced global payment solution to Tier 1 customers, including 888 and Plus500

- A strong pipeline of customers, including Bet365, Paddy Power, EuroBet and car rental company Share’ngo, will be launched during the second half of 2017 and 2018

- Continued growth in the overall value of transactions processed through SafeCharge and very strong growth in value of transactions processed through SafeCharge Acquiring

- Strong growth in number of card present transactions processed through SafeCharge Acquiring platform

- Airline certification by card schemes completed

- Global expansion continues with successful launch of WeChat Pay and integration to Chase in the United States, and opening of new offices in Singapore, United States and Netherlands

- Rebranding of the Group completed

- Continued investment in infrastructure & technologies to support future growth

David Avgi, SafeCharge

David Avgi, CEO of SafeCharge, said:

I am pleased to report a solid set of results. The Company has performed well and made positive progress with the implementation of its organic growth strategy and focus on delivering high quality revenue. We continue to invest in our payment and risk platform to drive future growth and are delighted that our customers recognise the benefits that SafeCharge’s payments solutions bring to them.

Whilst we continue to advance in our core verticals, the Group has made exciting progress in entering our new target sectors and geographies. Over the coming months we will continue to focus and invest further to build our sales teams to accelerate a successful entry into these markets.

The Group has enjoyed a strong start to the second half of 2017 benefiting from the launch of new clients, many of whom had started processing on the Company’s global acquiring platform by the end of the first half of the year. The Group is confident that its focus on higher quality earnings driven by its healthy pipeline will yield revenue growth in 2017 and build even stronger profitable momentum in 2018 and beyond.

SafeCharge’s full 1H 2017 report can be seen here.