The following article is based on research by Marshall Gittler, Head of Investment Research for FXPRIMUS.

FXPRIMUS Week in Focus for the week beginning Oct. 24th: RBA, BoJ, BoE & FOMC meetings; US nonfarm payrolls

Meetings of three of the four major central banks plus Australia followed by the US nonfarm payrolls, the biggest indicator of the month – there’s a lot of important data on the schedule this week. Plus the widely watched US ISM index and the final PMIs from around the world. This is likely to be a volatile week for the FX markets.

None of the central banks meeting this week is expected to change its interest rate policies, but there will still be plenty to watch and debate. The key will be how they all see the future shaping up and what guidance, if any, they can give about their future intentions.

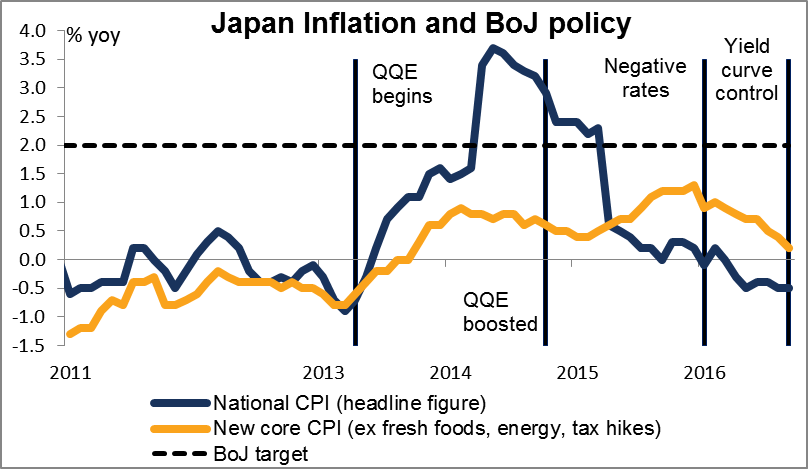

The Bank of Japan just changed its targets and methods at its last meeting on 21 Sep. They dropped the monetary base as a policy instrument and implemented “yield curve control” instead. It’s way too early for them to make any changes. I would expect them to evaluate the progress so far, but nothing more. Standing pat may cause some disappointment and cause the yen to strengthen somewhat.

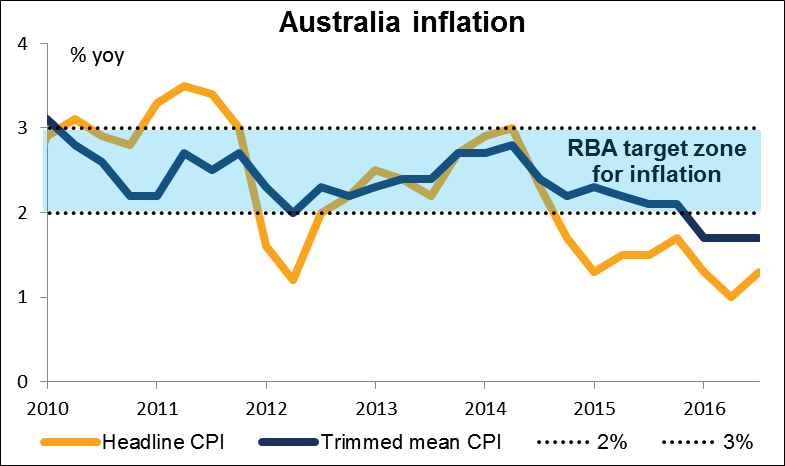

A few analysts expect the Reserve Bank of Australia (RBA) to ease at its meeting Tuesday, but I don’t look for any change. Australia’s recent Q3 headline CPI was higher than expected and the economy seems to be fairly healthy, with solid growth and falling unemployment. Add onto that the recent rises in iron ore & coal prices, and I look for a more optimistic statement that could boost the AUD.

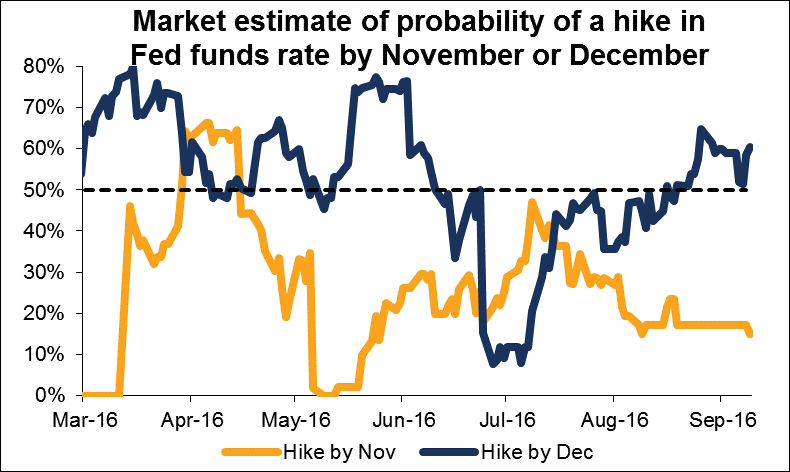

The FOMC decision Wednesday is more about preparing the market for what they’re likely to do in December than what they might do at this meeting. I would expect them just to tinker with the statement to give some reasons why the case for a hike has strengthened further. That would be a strong signal of an impending hike in December and would probably be USD-positive.

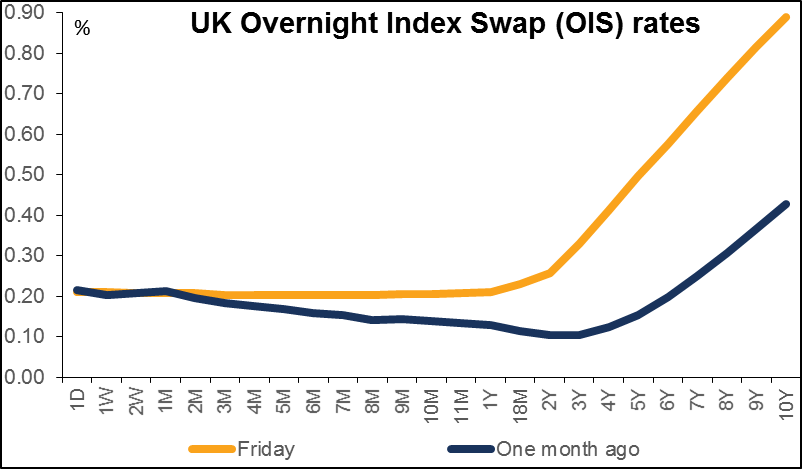

The minutes of the Bank of England’s September meeting said that if the economy develops as the Monetary Policy Committee (MPC) expected, a majority of members expect a further cut in Rates sometime this year. However, following the resilient PMIs and surprisingly strong Q3 GDP figure, plus the continued weakening of sterling, I would expect the MPC to remain on hold at this meeting. That could boost sterling somewhat, although as the graph shows, the market is no longer discounting any further rate cuts, so it shouldn’t come as a great surprise.

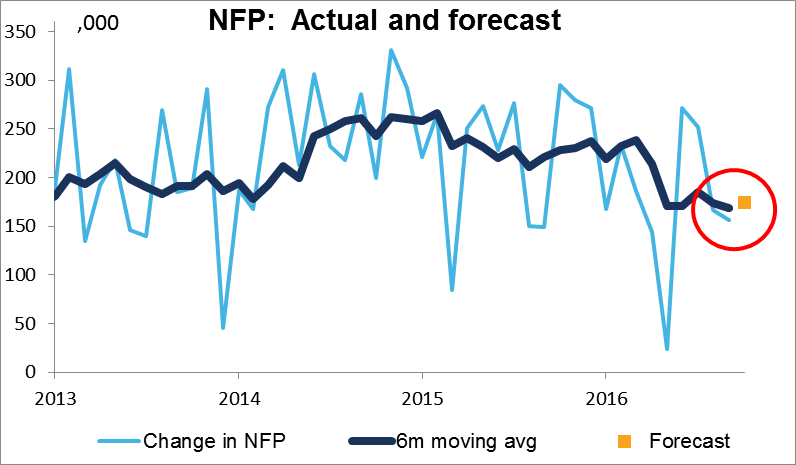

This week’s US employment data — the ADP report on Wednesday and the nonfarm payrolls on Friday — should also play their part in setting up a rate hike in December. After the surprisingly low 156k number in September, payrolls are expected to bounce back to 175k. Given that Fed Chair Yellen has said the year-to-date average monthly job growth of around 180k a month is not sustainable, yet another gain of nearly that level would probably solidify their resolve to hike in December and be positive for the dollar.

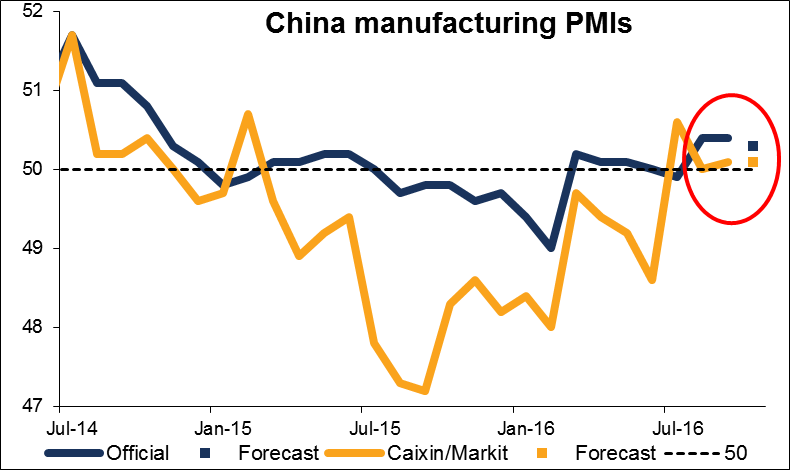

As if that weren’t enough, we have the final PMIs out this week as well. The market will be watching the UK manufacturing and service-sector PMIs coming out this week. They are expected to slow somewhat, which could be mildly negative. China’s PMIs are expected to be barely changed at right around the boom-or-bust line. That would show little change either way in activity, and therefore might not get the market so excited unless they deviate significantly from expectations.