The following article is based on research by Marshall Gittler, Head of Investment Research for FXPRIMUS.

FXPRIMUS Week in Focus for the week beginning Oct. 24th: PMIs, Q3 GDP, Germany & Japan CPIs

We’ve got a busy week of indicators this week. We will get more data on the real economy as the October PMIs and the Q3 GDP figures start to come out. Also, a number of G10 countries release their CPI figures, which will give us more insight into whether inflation in the industrial world has actually started to turn up. That’s quite important for monetary policy, and therefore currency rates.

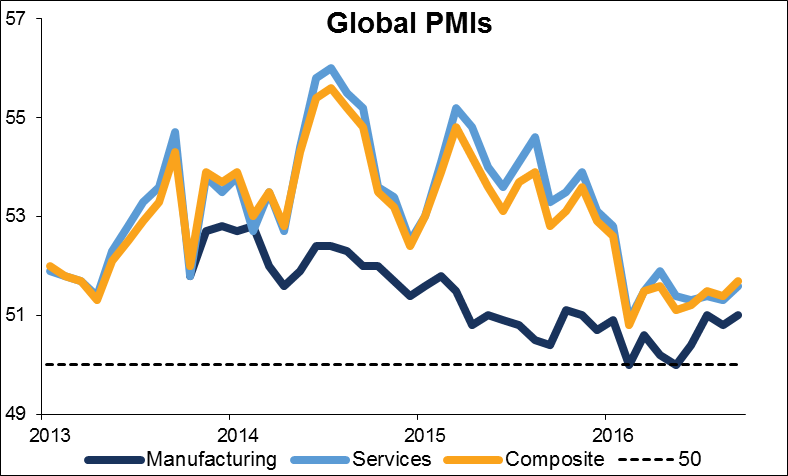

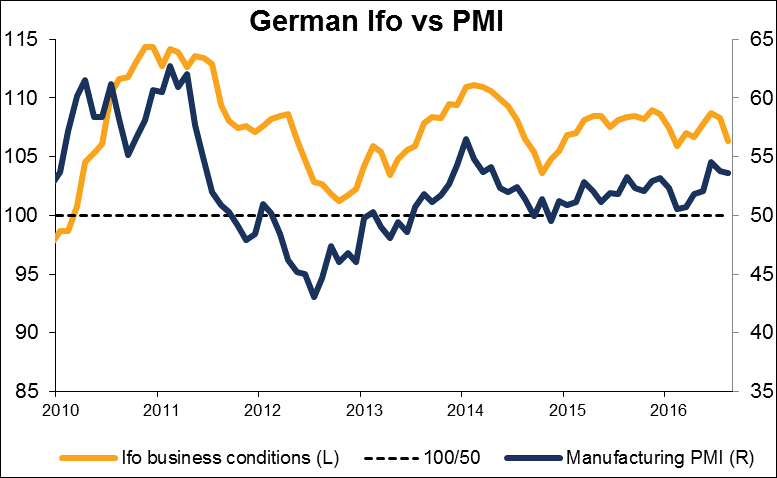

We started off the week today with the first of the preliminary Markit purchasing managers indices (PMIs) for the major economies. The figures for the Eurozone showed that growth is much stronger than expected. That should be good for the euro this week. Tonight’s preliminary US manufacturing PMI is forecast to be unchanged, which would give no impetus either way to USD.

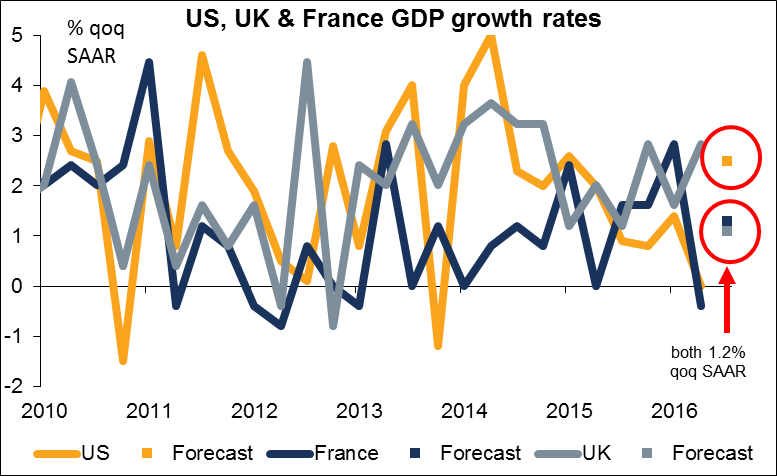

Adding to our information on global growth will be the Q3 GDP figures for the UK on Thursday and France and the US on Friday. Growth in the UK is expected to decelerate sharply, but remember that Q3 saw the aftermath of the Brexit vote, so the fact that it escaped recession is an achievement in itself. US growth, forecast at 2.5% qoq SAAR, could be seen as sufficient to increase the odds of the Fed raising rates in December and therefore be positive for the dollar.

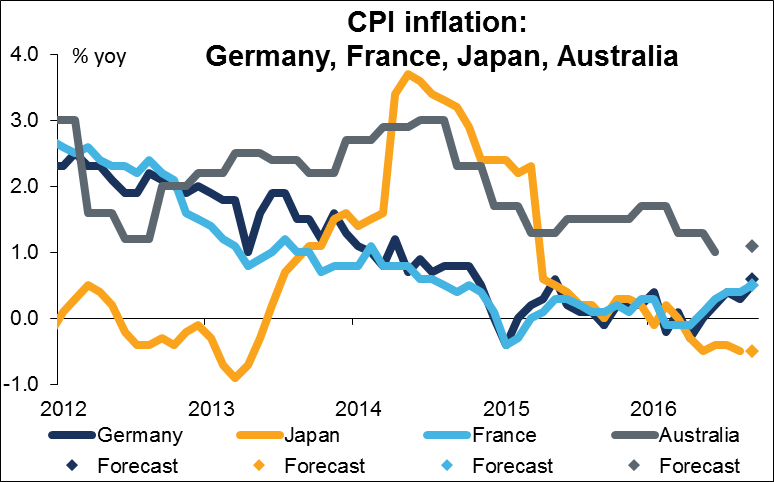

We’ll also get news about inflation as Australia, Japan, France and Germany release their CPIs. Japan’s inflation is expected to be unchanged to lower, showing the nation’s continued struggle to escape from deflation. This could raise hopes of more BoJ easing and be JPY-negative. The others are forecast to show a further step-by-step rise in their inflation rates, indicating that global inflation may indeed have bottomed out. That could be modestly EUR-positive.

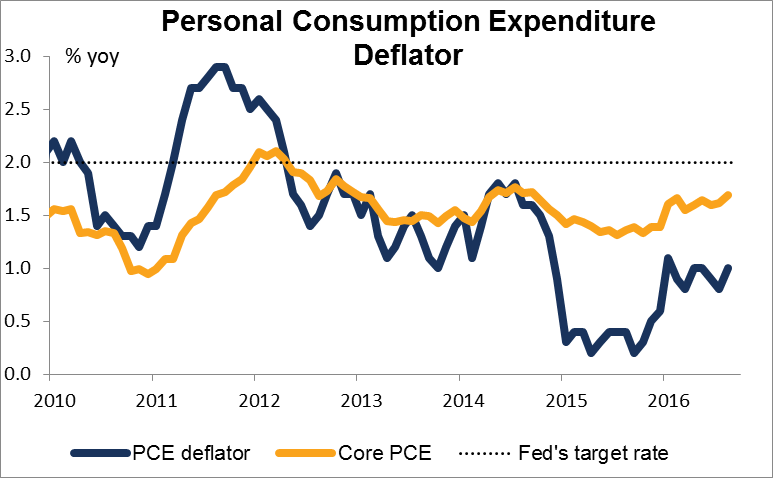

The US also releases the Q3 core personal consumption expenditure (PCE) deflator, the Fed’s preferred inflation gauge, as part of the GDP data on Friday. This is expected to show some slowdown in core PCE inflation, in line with the monthly figure. That could dampen the dollar, although I expect the market will pay more attention to the GDP figure released at the same time.

The other important US data we get this week is forecast to show a continued improvement in the US economy, which, coupled with the rise in GDP, could prove positive for the dollar.

For the EU, a forecast small rise in the Ifo index on Tuesday may corroborate Monday’s PMIs.