The following article is based on research by Marshall Gittler, Head of Investment Research for FXPRIMUS.

FXPRIMUS Week in Focus for week beginning Nov. 7th: US Presidential Election, RBNZ rate decision

Obviously, the US Presidential Election will dominate the markets this week. The US Senate election will also be important, as there’s a chance that the Democrats take control. The House of Representatives though seems likely to remain in the hands of the Republican Party, so less chance of any change there.

Market participants should understand how the US elects its president. In brief, the voting system is organized by state. Each state is allocated a certain number of “electors” according to their representation in Congress, so largely by population. The voters do not vote directly for the President; they vote for these electors, who then meet later to vote on their behalf for the President.

The key point is that it’s a “winner take all” system: whoever wins a state, wins all that state’s electors. Therefore, a candidate who wins a majority in the states with the most electors wins the election regardless of his or her standing in the popular vote. That’s how candidates can – and do – win the election despite losing the popular vote. (It’s happened four times so far.)

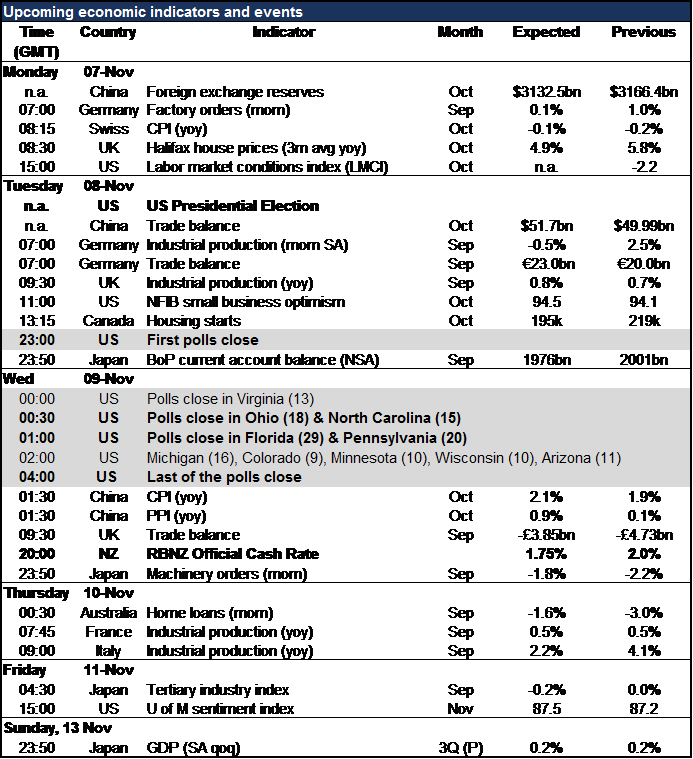

Most states vote consistently for one party or the other. There are only a few states that have a record of changing their party allegiance over time. These are called the “swing” states. In the table above, we give the closing times for the polls in the largest “swing” states, with each state’s number of electoral votes in parenthesis. Ohio, North Carolina and Florida are probably the key ones. If Trump loses any of those three, then he probably will not be able to amass 270 electoral votes and is likely to lose the election.

What would be the likely result of each candidate’s victory? As we’ve seen over the last week, when the possibility of a Trump victory increased, the markets went into risk-off mode: gold, JPY and CHF gained, while stocks and several EM currencies – particularly MXN and BRL – came off, as Trump is against free trade. The dollar fell overall, while the high-beta AUD also did poorly. But as we can see this morning (Monday), when a Clinton victory seems more likely (following the news that the FBI has cleared her of any wrongdoing in the latest episode of her email scandal), then stocks rally, the dollar rallies, MXN soars, CAD does well, while safe-haven assets like gold and JPY fall.

The implications for interest rates is mixed. If Trump wins, his economic plans involve a huge increase in the government budget deficit, which would push up yields on long-dated bond. But if Clinton wins, then normalcy is restored and the Fed probably raises short-term interest rates – essentially the same result of higher interest rates but at the short end of the yield curve.

My biggest fear though is that the election might not settle things politically in the US either way. The political circus that’s engulfed the US may well continue indefinitely, eroding confidence in the US political system. That would weaken the dollar. But with Brexit negotiations starting next year and elections in Italy in December and France and Germany next year, neither the pound nor the euro is positioned to take leadership of the currency markets. We could be in for a very, very confusing time of volatile, trendless markets in FX.

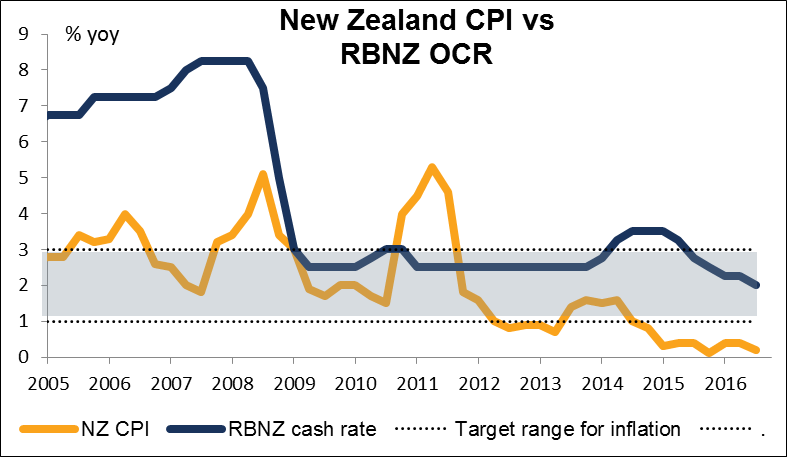

Away from the US, the main event this week will be the Reserve Bank of New Zealand (RBNZ) meeting. Analysts unanimously expect a cut in the Official Cash Rate (OCR) to 1.75%. At their last meeting in September, the RBNZ said “Our current projections and assumptions indicate that further policy easing will be required to ensure that future inflation settles near the middle of the target range.” Since then, inflation has fallen further, making a cut in rates almost inevitable. The question then becomes whether they will signal further loosening or move to a neutral stance. I expect them to retain their easing bias and therefore I expect NZD to weaken after the meeting.