The following article is based on research by Marshall Gittler, Head of Investment Research for FXPRIMUS.

FXPRIMUS Week in Focus for week beginning 28 Nov: US nonfarm payrolls, OPEC meeting, Italy & Austria votes, final PMIs

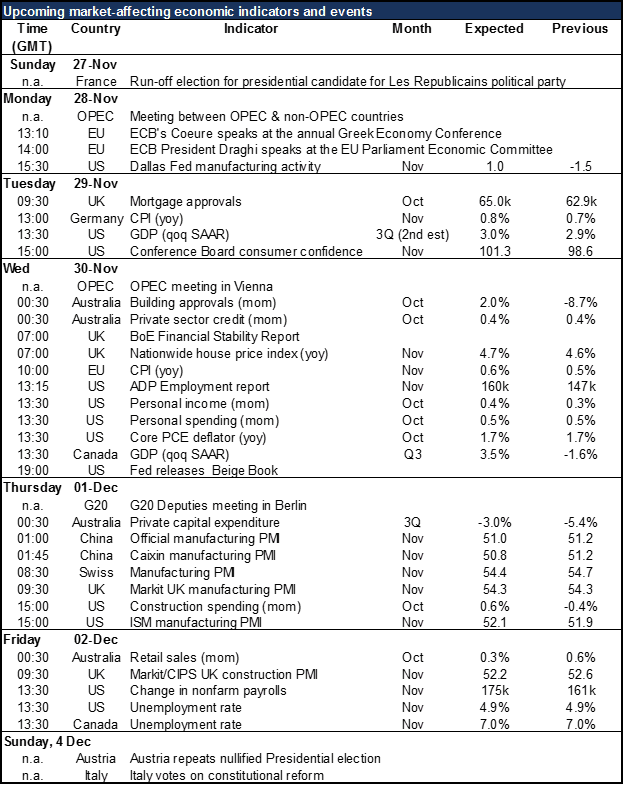

There’s lots of excitement this week: the US labor market data, an OPEC meeting, the final PMIs, and finally next weekend, the long-awaited Italian referendum, one of the key risk points on the European calendar.

The main indicators will be Wednesday’s ADP report followed by Friday’s nonfarm payrolls. The market is looking for yet another strong rise in the number of jobs, which should be supportive for the dollar. It may get the market thinking that the FOMC’s prediction of two hikes during 2017 may well be possible.

Everyone will be watching the OPEC meeting Wednesday. The group agreed in Algiers on 29 Sep to cut output, but now needs to decide how to distribute those cuts. A failure to agree on the cuts would mean lower oil prices, lower CAD, RUB and MXN, as well as lower stock markets.

Sunday’s votes in Italy and Austria are key risk factors for the EUR. Italy will hold a referendum on a constitutional reform. If the country votes it down, then PM Renzi is likely to resign. That would begin a period of political instability in the Eurozone’s third largest economy. Following Brexit and Trump’s victory, Italy’s voters might be the next to vote in a Euro-skeptic party. A “no” vote would therefore raise the risk level in one of the key members of the Eurozone, which would be EUR-negative.

Austria is re-running its Presidential election after the one held in May was nullified. The pro-European candidate narrowly won that election, but the Euro-skeptic far right candidate has a good chance of winning this time around. It would be the first national victory in Europe by a Euro-skeptic right-wing party, making such votes in other countries more likely. EUR-negative.

For the US, aside from the employment data, the main points will be the 2nd estimate of GDP, personal income & spending, the Beige Book, and ISM index. They are all expected to be positive, which would be good news for the US economy and the dollar.

The main EU statistics will be Tuesday’s German CPI followed by Wednesday’s EU CPI. They’re expected to show inflation rising slightly, but not enough to dissuade the ECB from extending its QE program next week (8 Dec). ECB President Draghi’s speeches on Monday and Wednesday may offer further insights. I expect though that ahead of Sunday’s votes, EUR/USD may remain weak and be moved more by sentiment towards USD than any news about the Eurozone economy.

There’s an important British indicator out every day after today: mortgage approvals Tuesday, Nationwide house price index Wednesday, manufacturing PMI Thursday and construction PMI Friday. Most are expected to show activity unchanged to higher. That should help to keep GBP underpinned.

The final PMIs on Thursday include the manufacturing PMIs for China. These are expected to be lower, which could hurt risk sentiment somewhat.

Finally, Australia announces building approvals and private sector credit on Wednesday, private capital expenditure on Thursday, and retail sales on Friday. Most are expected to be weak. Together lower China PMIs, AUD could be relatively weak.