The following article is based on research by Marshall Gittler, Head of Investment Research for FXPRIMUS.

FXPRIMUS Week in Focus for week beginning Nov. 14th

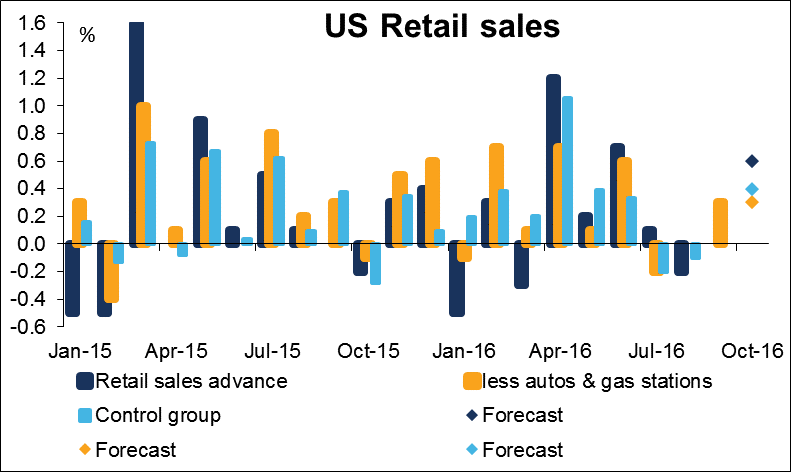

There’s no escaping US politics. US politics was the driving force behind the markets last week and it will continue to be so this week. The House of Representatives will vote on its leadership this week and President-elect Trump will meet with Japan’s PM Abe. Furthermore, there will be constant leaks about who might get what Cabinet post.

There are also a number of important central bank officials speaking. Many ECB officials will appear at Euro Finance Week in Frankfurt this week, including ECB President Draghi on Friday. Bank of England Gov. Carney testifies in Parliament on Tuesday and Fed Chair Yellen testifies in Congress on Thursday. The indicators might not matter that much. There will be more data on the real economy, including industrial production, GDP and retail sales figures from several countries, and particularly some important data from the UK.

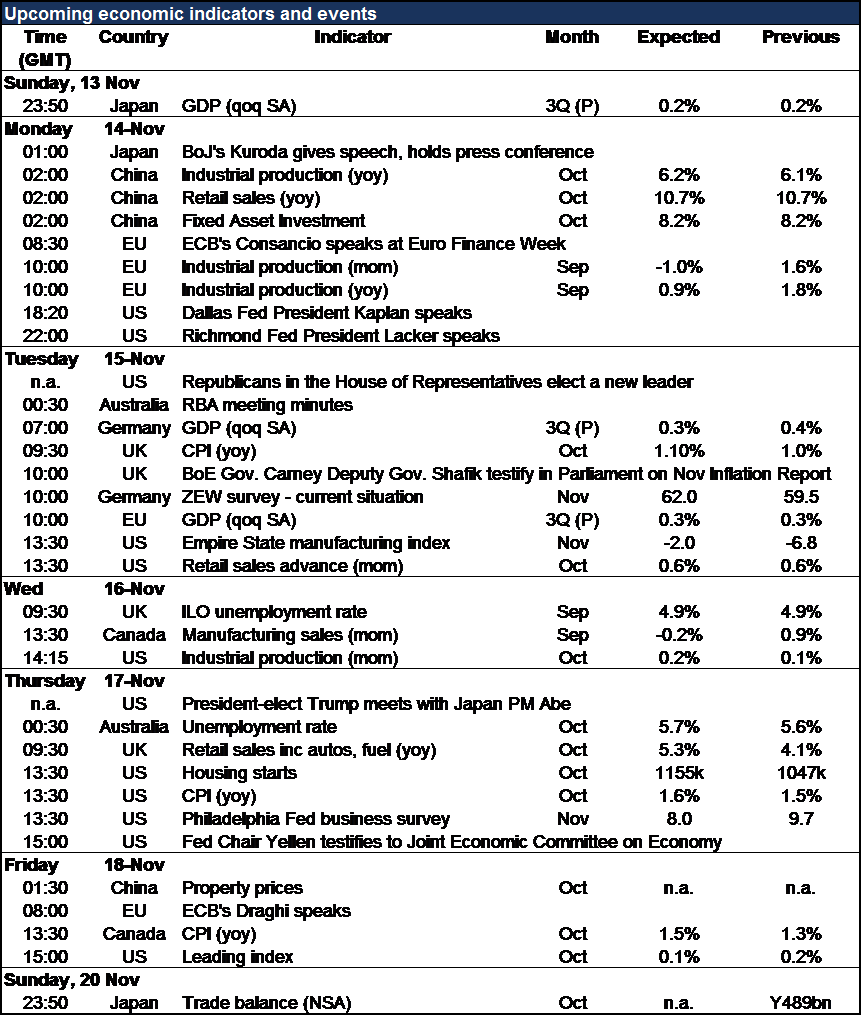

The major data out from the EU includes today’s industrial production and Tuesday’s ZEW survey and Q3 EU GDP. Today’s IP figure is expected to be lower, which could add to the euro’s recent gloom.

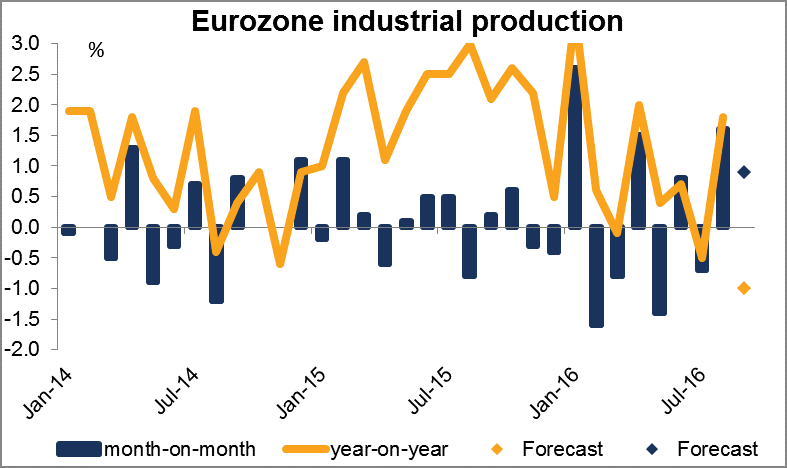

The ZEW survey on the other hand is expected to be higher, which could be EUR-supportive, but I next month’s survey will be much more important as investors try to gauge how Trump’s election affected sentiment in Europe, if at all. The pace of growth in Q3 meanwhile is forecast to have been the same as in Q2, which suggests the GDP data might not have a major impact.

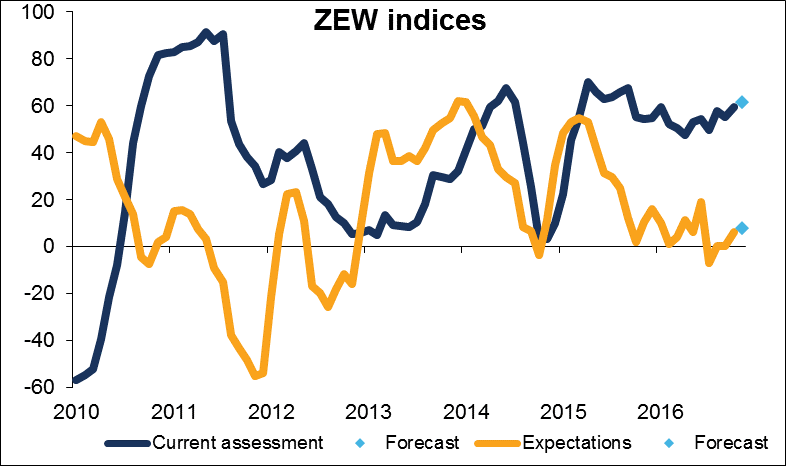

For the US, the key data is retail sales on Tuesday. The month-on-month rate of change in headline retail sales is expected to be unchanged, but the retail sales control group – the figure that feeds into the GDP calculation – is expected to be higher, which could boost the currency. Industrial production (Wednesday) is also expected to accelerate, as is CPI inflation (Thursday). If all the data come in as forecast, it could boost the dollar.

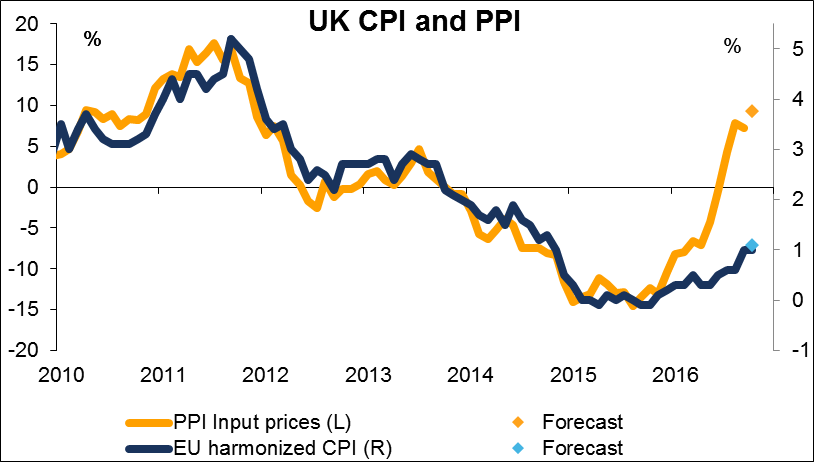

The UK announces its CPI on Tuesday, employment data on Wednesday and retail sales on Thursday. The data are generally expected to be positive for the pound. Inflation is forecast to rise further ,particularly at the wholesale level; unemployment should be steady; and retail sales are forecast to increase.

This good news for sterling comes on top of a change in the market’s assessment of the outlook for the pound. Many investors now reason that the UK has already had its shock, while Trump’s Presidency may embolden the anti-euro right on the Continent, where several countries go to the polls in the next few months (Italy, Netherlands, Germany). Some investors have taken into selling EUR/GBP to express this view.

In any event, US politics are likely to determine sentiment more than the data this week. The US House of Representatives will vote on a new Speaker Tuesday. The current House Majority Leader, Paul Ryan, is expected to win re-election, but of course the phrase “is expected to” doesn’t mean much anymore. A change in the House leadership would be crucial for US fiscal policy, since Congress has to pass any budgets.

President-elect Trump will also meet with Japanese PM Abe. That should give us some idea of what he has in mind for the country’s major international alliances.

Finally, investors will be listening for rumors about who is getting what Cabinet post in the new administration. The market currently believes that “President Trump” will govern differently than “Candidate Trump,” but if chooses appointees for their ideology rather than competency, sentiment could change quite quickly.