The following article is based on research by Marshall Gittler, Head of Investment Research for FXPRIMUS.

FXPRIMUS Week in Focus for the week beginning 9 Jan: China inflation, Trump press conference, US retail sales

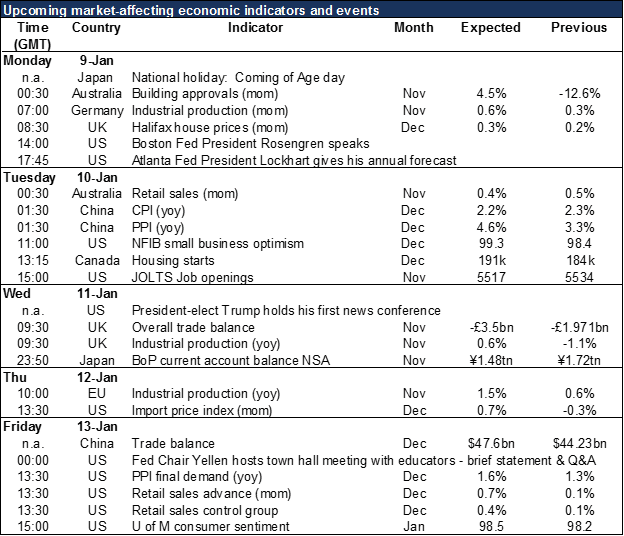

Last week was extremely volatile. The second week of the month though is usually quiet. US retail sales and consumer sentiment, Chinese inflation and trade, and UK production & trade are the main indicators coming out.

The chief point of interest though will be the first press conference by US President-Elect Donald Trump, who will meet with the press in New York on Wednesday. Although the main topic is what he intends to do with his businesses, his plans for trade and other policy measures will certainly come up This is a major risk for US bonds and therefore the dollar too. Other currencies likely to be affected are MXN, CAD and CNH in particular.

Among the large number of Fed speakers, Fed Chair Yellen will host a town hall meeting Friday. Recent comments by Fed officials have generally been hawkish and while Yellen tries to be more neutral, her colleagues feel no such obligation. Comments from Fed officials boosted the dollar on Friday and may continue to do so this week.

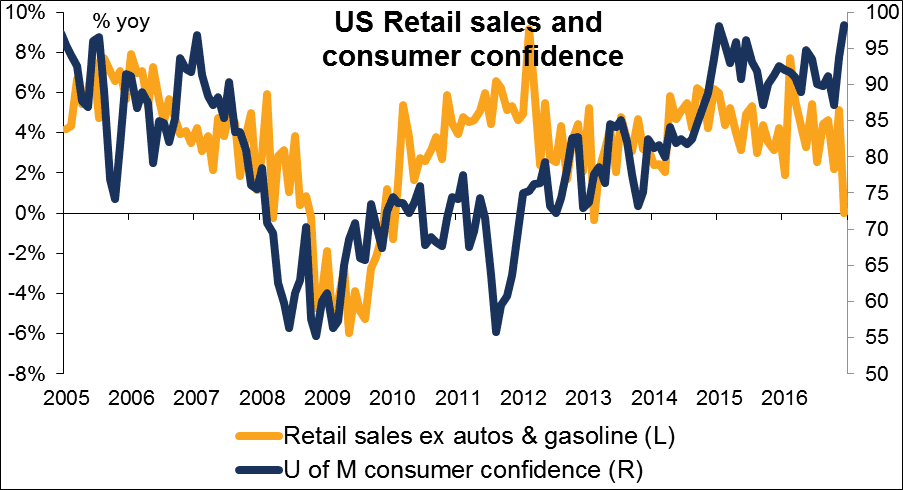

The big day for US data is Friday, when PPI, retail sales and the U of M consumer sentiment survey are released. Retail sales are expected to grow and consumer sentiment to improve. These two encouraging trends should help the dollar. Also the PPI is expected to accelerate further, which is also dollar-positive.

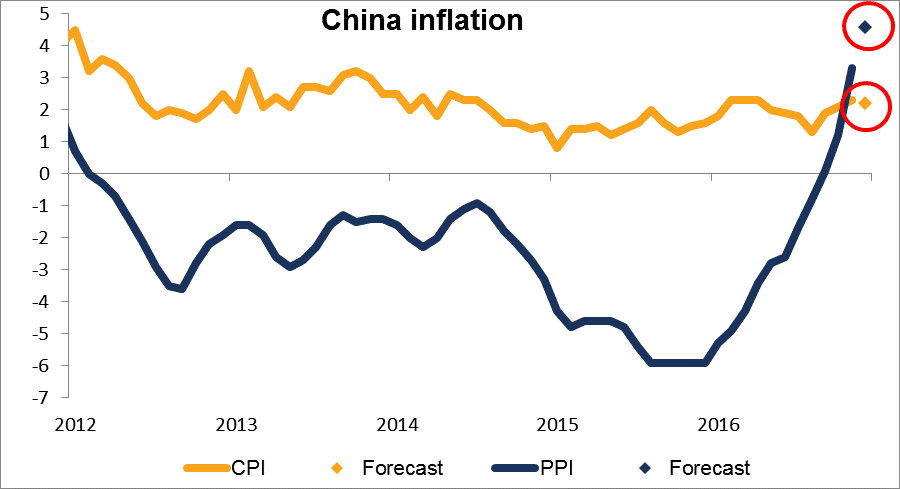

China’s CPI is forecast to slow somewhat, but producer prices are soaring! That should be encouraging for inflation globally. Since the US is the only G10 country that is currently in a tightening cycle, rising Chinese inflation would probably have the biggest implications for the US. China will also announce its trade data. Imports are expected to rise, which may help AUD and NZD.

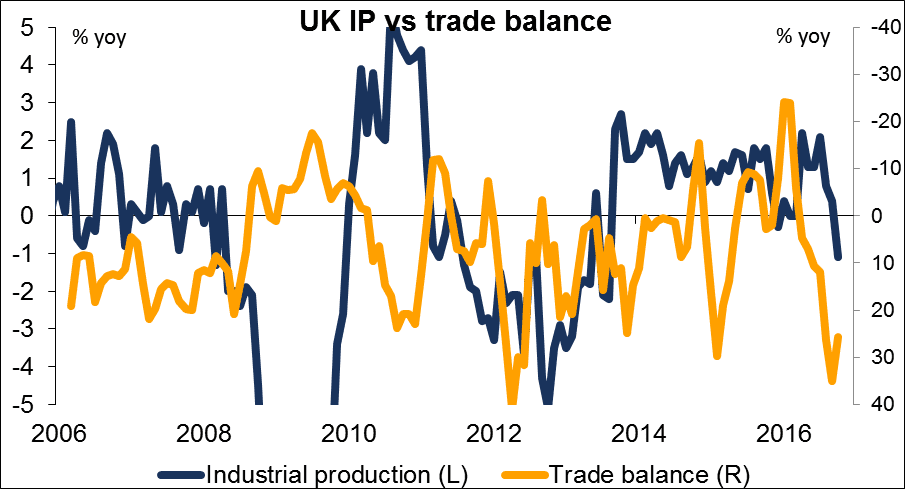

From this month, the UK Office of National Statistics (ONS) is releasing the country’s economic indicators in “theme days.” Related indicators will be grouped together and released simultaneously. Wednesday is “short-term indicators” day: construction, production and trade data will be released. These indicators used to be released on different days. Releasing them simultaneously will make it difficult to estimate the net impact on the market. Production is forecast to be up but the trade deficit is expected to have widened considerably. That makes it difficult to estimate what the overall impact on the exchange rate will be.

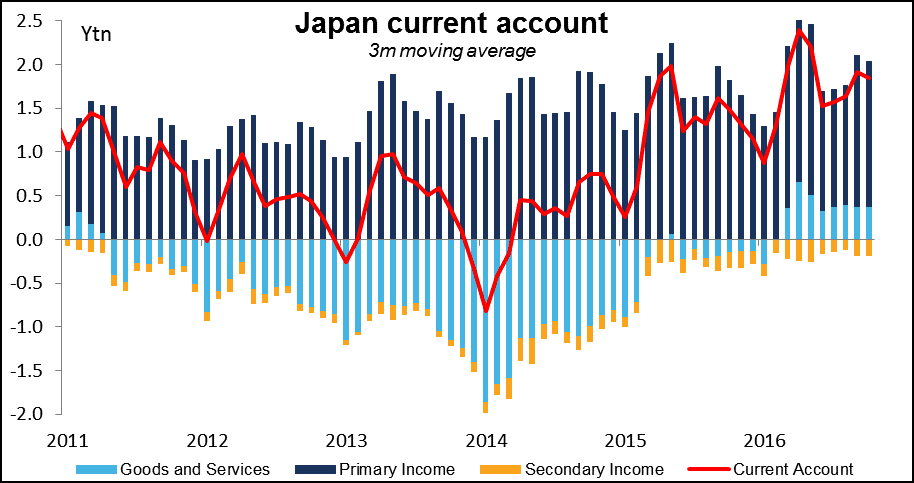

Japan releases its current account data on Thursday morning in Japan. The surplus is forecast to have fallen somewhat. That could pressure JPY, but I expect the political environment after Trump’s press conference will be more important for USD/JPY.