The following article is based on research by Marshall Gittler, Head of Investment Research for FXPRIMUS.

FXPRIMUS Week in Focus for the week beginning 16 Jan: May speech on Brexit, Trump inauguration, Bank of Canada & ECB meetings

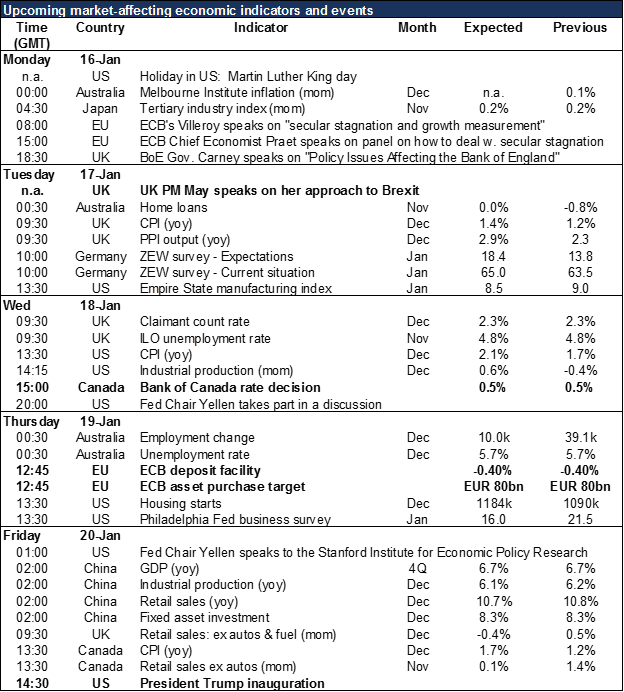

Expectations of fiscal stimulus by the incoming Trump administration gave rise to “Trump Trades” that pushed US rates, US stocks and the dollar higher. This Friday, expectations meet reality as President-Elect Trump takes office. We could see the dollar relatively soft this week, at least until the Inauguration.

Before Christmas, UK PM May promised that she would make a speech on Brexit in the new year. She makes that speech on Tuesday. The Sunday Times reported that she would outline a “Hard Brexit” approach, severing most of the country’s special relationship with the EU in order to regain control over immigration. This caused the pound to fall in Asian trading Monday. We could see the pound fall a bit more after her speech, but now the news is pretty much in the market; the big surprise would be if she is less rigid than expect.

Together with Bank of England Gov. Carney’s speech today, UK inflation data on Tuesday, employment data on Wednesday, and retail sales on Friday, the pound is likely to be a major focus of trading throughout the week.

There’s not likely to be any change in policy at the ECB meeting on Thursday. However, the hawks dug in their heels (talons?) at the December meeting, according to the minutes. The acceleration in Eurozone inflation in December suggests there could be even more resistance to further easing at this meeting and therefore a more hawkish tone following the meeting. That could support EUR.

The Bank of Canada meeting on Wednesday is widely expected to leave rates unchanged. The Canadian economy appears to be stronger than the BoC had expected it would be at this point, but on the other hand, inflation is well below their target range. I therefore expect them to maintain their current stance but to emphasize the problems of below-target inflation and uncertainty due to the new administration in the US. CAD could weaken somewhat after the meeting as a result.

There are several Fed speakers this week, including two speeches by Fed Chair Yellen. The market will hope for some clarification of the debate that showed up in the FOMC minutes over the impact of the new administration’s fiscal policy on monetary policy this year.

Monday is a holiday in the US. There are a large number of US indicators coming out during the rest of the week, but I expect politics to dominate the USD outlook this week, rather than economics.

The euro could gain some support this week from Germany’s ZEW index on Tuesday, which is expected to rise further.

Finally, China announces its Q4 GDP on Friday and the usual economic indicators that accompany it — industrial production, retail sales and fixed asset investment. The rate of growth is expected to be roughly the same as in the previous period.