The following article is based on research by Marshall Gittler, Head of Investment Research for FXPRIMUS.

FXPRIMUS Week in Focus for the week beginning 6 Feb: RBA, RBNZ meetings; Trump/Abe meeting

The data calendar is rather light this week, as is usual in the second week of the month. The focus then will be on the two antipodean central bank meetings. Neither is expected to result in a change in rates, so the emphasis will be on the nuance of policy.

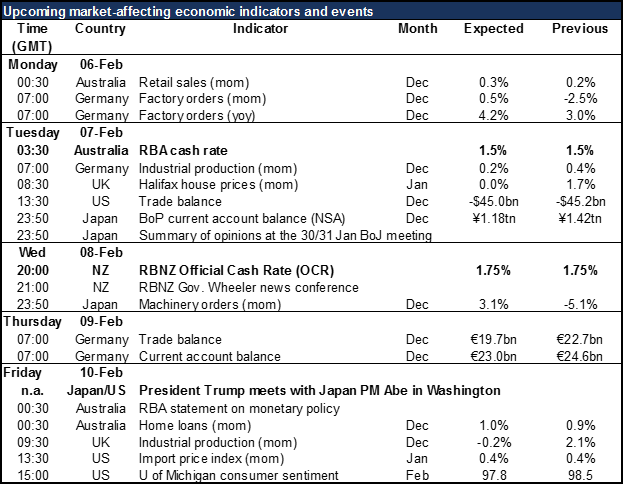

The Reserve Bank of Australia (RBA) meets tomorrow and is expected to keep rates steady. In fact, it’s expected to keep rates steady for the whole year. Boring! So the market will be looking for any change in tone in the statement. I would expect to see only a little change in the statement, which might not give much impetus to trading. If anything though, I think the emphasis will be on the low level of inflation after the drop in December and also the risk that the strong currency poses to the recovery. That could result in some profit-taking on AUD, which has been the best-performing G10 currency so far this year.

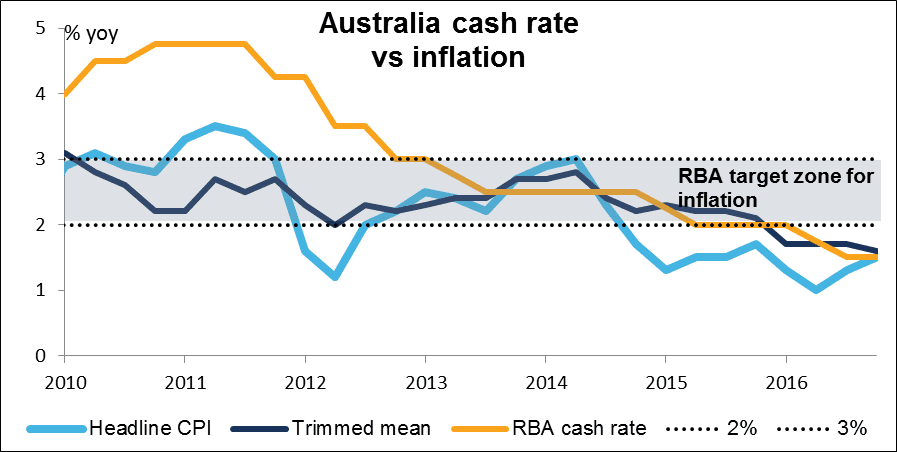

Then on Wednesday morning, the Reserve Bank of New Zealand (RBNZ) meets. It’s expected to hike rates at some point this year, but the market puts zero probability on it happening this week. I think this time around they’re likely to take a more cautious tone, because of the recent rise in the unemployment rate. That could depress NZD for now.

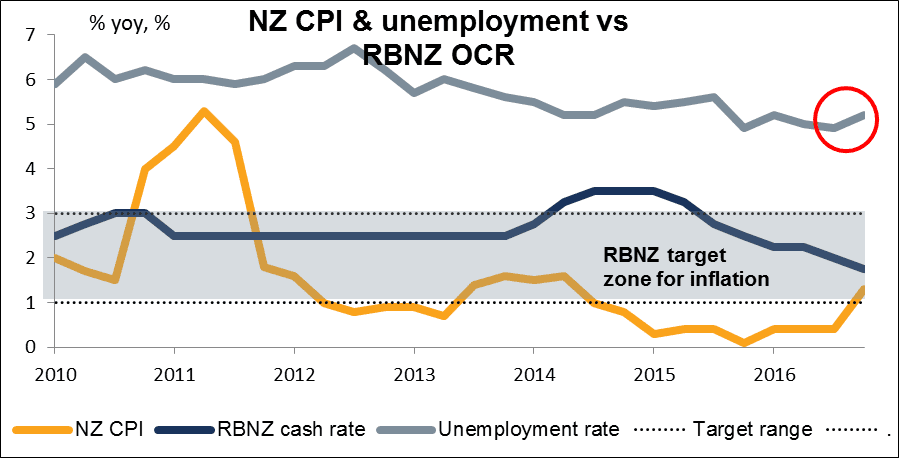

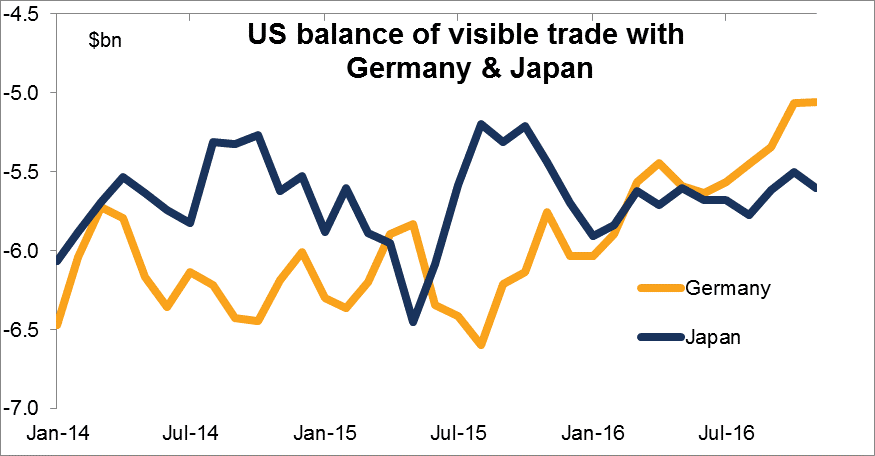

As for the other data, the US releases its trade data and Germany and Japan announce their current accounts. Normally trade figures aren’t so important for the FX market, but I expect that as the new US administration focuses more on trade issues, these data will become more important too. Japan and Germany’s current account surpluses are forecast to fall. That could reduce the political pressure on them and therefore be negative for JPY and EUR, positive for USD.

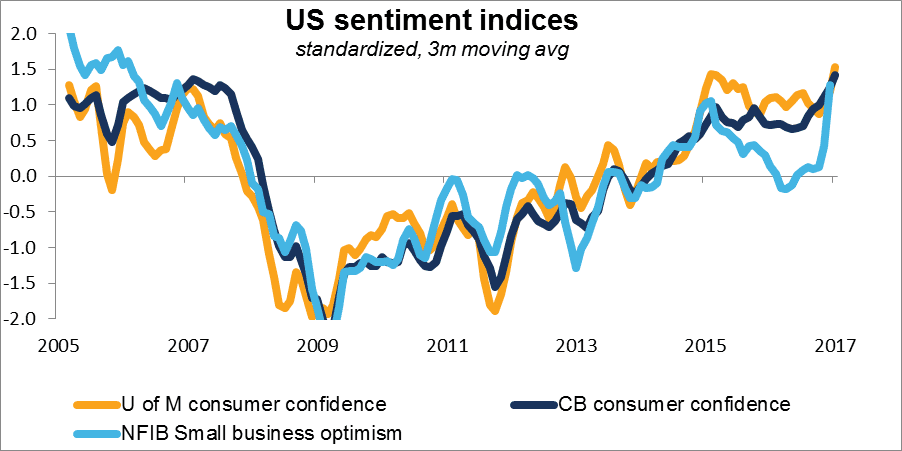

The U of Michigan consumer sentiment index for February is expected to fall. In January it hit the highest level since early 2004, but apparently the enthusiasm is starting to wane. The size of the drop will be closely watched and could prove negative for the dollar.

Meanwhile, markets will remain riveted on Washington as the policy debate there continues. Rising friction with Iran could push oil prices higher, while this Friday’s meeting between President Trump and PM Abe will show us whether Trump’s comments on currencies are serious or just a negotiating tactic. I expect the meeting to result in friendly comments that may take some pressure off JPY and allow USD/JPY to move higher.