The following article is based on research by Marshall Gittler, Head of Investment Research for FXPRIMUS.

FXPRIMUS Week in Focus for the week beginning 27 December

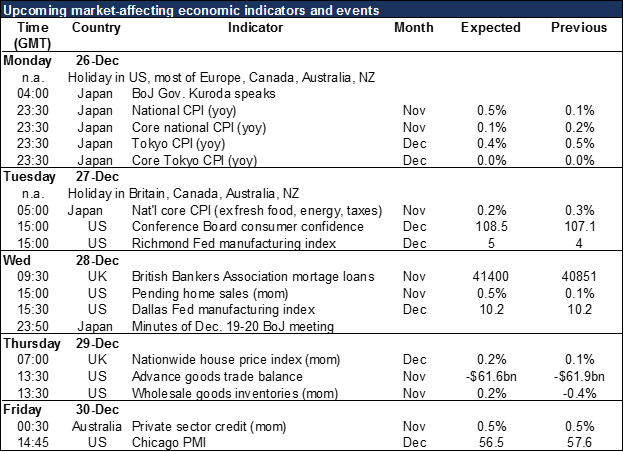

It’ll probably be quiet this week, as the Christmas holiday continues Tuesday in the UK and several of the former Commonwealth countries. For the rest of the week there are no major indicators out, only second-tier ones, and no scheduled speeches by central bank officials. This should be a good week to take care of all those small tasks you’ve been putting off all year, if you’re in the office at all.

The only major indicator out this week was Japan’s CPI data, which came out on the 26th when only Japan among the G10 countries was open for business. The data were as expected or worse, with inflation rates generally decelerating. The report puts additional pressure on the Bank of Japan to keep its policy accommodative, which is negative for the yen.

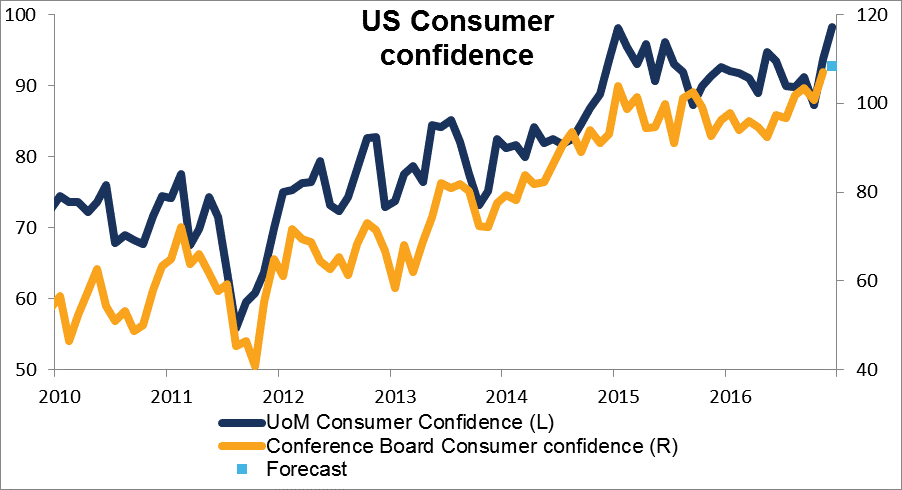

US indicators dominate the rest of the week. Most are expected to be favorable. The Conference Board consumer confidence index is already at the highest level since before the 2008 financial crisis and is expected to rise further when the December figure is announced on Tuesday. That would suggest Donald Trump’s election had a positive effect on consumer sentiment.

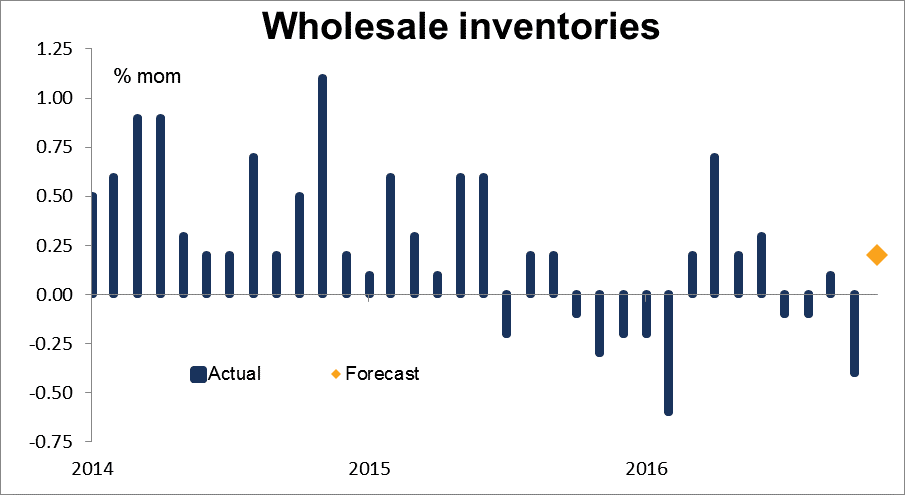

Wholesale inventories are expected rise, which would help to boost growth after several months of destocking. That would add to the positive outlook for the dollar.

There aren’t any major EU indicators out during the week. The only notable indicator is EU money supply on Thursday, but the money supply is not directly affecting policy recently and so is not market-affecting.

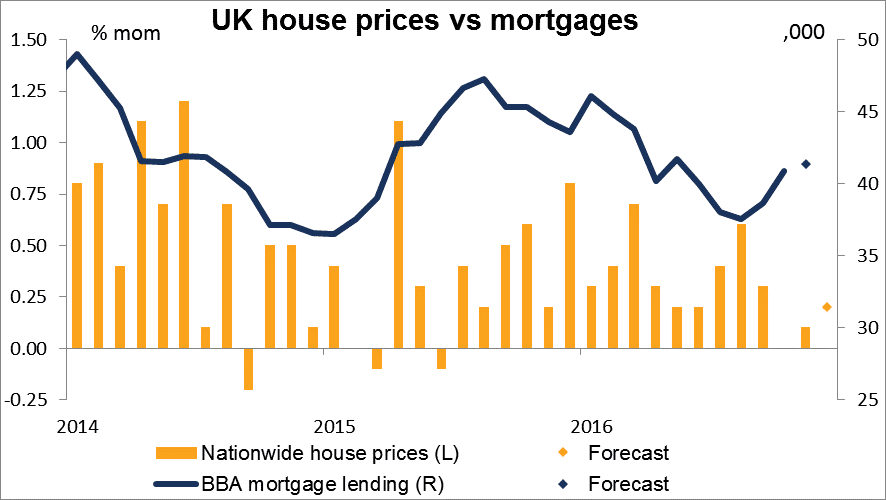

UK housing market data out this week includes the British Bankers’ Association mortgage lending data on Wednesday and the Nationwide Building Society house price index on Thursday. The forecasts are for some improvement: more mortgages were taken out and house prices rose after several months of little or no growth. The news could be good for GBP.

Finally, Australian private sector credit is expected to continue to grow at the same pace as in the previous month, which could help to support the beleaguered AUD temporarily. Over the longer term though a slowdown in Chinese growth is likely to be more important than domestic factors for swaying AUD.